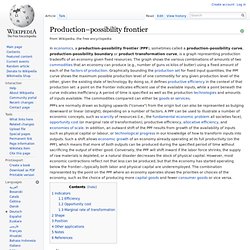

Economics A-Z terms beginning with A. Production–possibility frontier. Indicators[edit] Efficiency[edit] An example PPF with illustrative points marked The PPC shows left to right downward position.

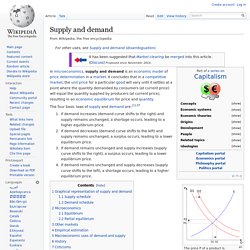

A PPF(production possibility frontier) or PPC typically takes the form of the curve on the right. Supply and Demand. The price P of a product is determined by a balance between production at each price (supply S) and the desires of those with purchasing power at each price (demand D).

The diagram shows a positive shift in demand from D1 to D2, resulting in an increase in price (P) and quantity sold (Q) of the product. If demand increases (demand curve shifts to the right) and supply remains unchanged, a shortage occurs, leading to a higher equilibrium price.If demand decreases (demand curve shifts to the left) and supply remains unchanged, a surplus occurs, leading to a lower equilibrium price.If demand remains unchanged and supply increases (supply curve shifts to the right), a surplus occurs, leading to a lower equilibrium price.If demand remains unchanged and supply decreases (supply curve shifts to the left), a shortage occurs, leading to a higher equilibrium price. Price elasticity of demand. Author: Geoff Riley Last updated: Sunday 23 September, 2012 Price elasticity of demand measures the responsiveness of demand after a change in price The formula for calculating the co-efficient of elasticity of demand is: Percentage change in quantity demanded divided by the percentage change in price Since changes in price and quantity usually move in opposite directions, usually we do not bother to put in the minus sign.

Explicit cookie consent. EARLIER this year it all looked so rosy.

In April, just two years after Greece imposed the biggest sovereign-debt restructuring in history on its private creditors, it raised €3 billion ($4.2 billion at the time) in five-year bonds at a yield of less than 5%. In July its ten-year bonds were yielding less than 6% and their Spanish and Italian equivalents less than 3%, not far off Germany’s. The troubled economies of Europe’s “periphery” were beginning to turn around, it seemed, and the European Central Bank (ECB) would do whatever it took to keep the euro zone together. That all went out the window in the global market sell-off of October 15th-16th. Economics Online provides analysis, comment, and data on economics, economic theories and issues.

Move over America: China overtakes US as world's biggest economy (kind of) - Business News - Business - The Independent. According to the International Monetary Fund the combined purchasing power of China's citizens now outstrips that of America's.

And by the end of the year will China should make up 16.48 per cent of the world's purchasing-power adjusted GDP for a total of $17.632 trillion (£11 trillion). The US, by contrast, will make up 16.28 per cent, or $17.416 trillion. Purchasing power parity seeks to address the fact that while wages tend to be lower in “developing” countries than in mature economies like the US, the price of goods and servicing is also typically much lower. The Economist's Big Mac Index, for example, quotes the price of the McDonalds staple in July at $4.80 in the US, but just $2.73 in China. CBI warns export demand is slowing in latest sign of faltering UK recovery. Falling demand for British goods abroad weighed on manufacturers in October, in the latest sign that the UK recovery is losing steam.

A sluggish eurozone economy and a stronger pound pulled exports lower for the first time in 18 months, according to the CBI, frustrating government ambitions for a big push in UK exports. Rain Newton-Smith, director of economics at the business lobby group, said: “It’s disappointing that a sluggish exports market has taken some of the steam out of manufacturing growth, which was going from strength to strength throughout most of this year. “The manufacturing sector is clearly facing headwinds. Global political instability, mounting concerns about weakness in the eurozone, and recent rises in sterling are all weighing on export demand.”

Ebola crisis: The economic impact. 20 August 2014Last updated at 19:03 ET By Richard Hamilton BBC News Military road blocks are preventing the movement of goods and workers With more than 1,300 reported deaths from Ebola in West Africa, the virus continues to be an urgent health crisis, but it is also having a devastating impact on the economies of Guinea, Liberia and Sierra Leone.

"The economy has been deflated by 30% because of Ebola," Sierra Leone's Agriculture Minister Joseph Sam Sesay told the BBC. BP and GDF Suez discover new North Sea oil field. 23 October 2014Last updated at 05:47 ET Oil firms BP and GDF Suez have announced the discovery of a new field in the UK Central North Sea.

The find, which spans adjacent blocks operated separately by the two companies, has been flow-tested at a maximum rate of 5,350 barrels per day. UK housing market is cooling, says BBA. 23 October 2014Last updated at 07:04 ET The mortgage market has slowed since the summer, banks say Mortgage activity dropped in September compared with a year ago signalling a UK housing market that is "continuing to cool", banks have said.

UK retail sales fall in September on weak clothes demand. 23 October 2014Last updated at 05:58 ET UK retail sales fell in September, adding to signs that the economic recovery may be losing steam.

The Office for National Statistics said sales volumes fell 0.3% on the month, more than expected and the weakest figure since January. Mild weather in September put shoppers off buying winter clothes, but sales were weaker in other sectors too. Slow wage growth, falling house prices, and global economic worries have raised concerns about the UK recovery.

NHS needs extra cash and overhaul, say health bosses. Definition of Fiscal Policy. Tesco shares rally on upgrade from leading City analyst. However, thanks to the cautiously upbeat assessment issued by Mr McCarthy on Wednesday, the stock rose for a third straight trading session, the first time the troubled supermarket group has managed such a run since mid-August. “A rights issue would improve the underlying strength of Tesco and would simultaneously create problems for Sainsbury at a corporate level,” the analyst said. Indeed, a fund-raising may be “positively” received by Tesco investors “as it would help resolve balance sheet concerns, while buying time to undertake asset disposals without a fire sale.” Many of the market’s worries about the company are now reflected in Tesco’s bombed-out share price, he added.

“We expect further bad news on accounting, pensions and a re-basing of profits, but believe much of this is now in the price.” Oh boy! There was nothing wrong with fiscal policy under Labour, says top economics prof. Simon Wren-Lewis, professor of economics at Merton College, Oxford, blogs to the effect that there was no real problem of overspending under the last government; the idea that there was is largely a media lie propagated by people such as yours truly, he suggests, though obviously he doesn't get down, dirty and quite as directly personal as that.

There's quite a bit of this sort of revisionism around at the moment – which is odd, given that the Labour leadership has just gone the other way and come over all fiscally responsible. Normally I wouldn't bother with it; this is now basically just one for the history books. Yet if misguided analysis such as this gains traction, failure to control the public finances will happen again, and Britain will for ever be stuck on a treadmill of repeated fiscal crisis. Labour has been attempting to reposition itself of late as a party that can be trusted on spending. Carl Icahn: Apple's share price is half what it should be. In April, Apple said it would return $130bn of cash to shareholders, marking one of the biggest shareholder windfalls in history. It did not credit Mr Icahn directly, but the billionaire investor was quick to claim the victory. Taking account for a share split, Apple’s share price has risen more than 50pc since he started his campaign, making the April share repurchase look like a bargain.

Apple shares were up 1pc at $101.78 in premarket trading on Thursday. In Thursday’s letter, entitled 'Sale: Apple shares at half the price', Mr Icahn said that Apple was at another “watershed” moment, and that he believed it was poised to take market share from Google, its “only real competitor”. Mr Icahn said the larger screen size made Apple's iPhone6 directly comparable with Samsung's Galaxy S5 and Note 4, making the choice between the two "analagous to the choice between a Volkswagen over a Mercedes at the same price".

Has the London house price bubble burst? “A growing sense of caution seems to have taken a particular toll on the London market where buyer demand contracted more significantly than elsewhere in September, falling for the fifth consecutive month,” the report read. For the rest of the UK, the price balance fell from 39 to 30 on the sentiment index this month - the lowest reading since June 2013 as the combination of strict new mortgage rules, nervousness ahead of rising interest rates forecast for the spring, and high prices have dampened demand. Buoyed by cash buyers and a lack of supply, London is now expected to slow as over-inflated prices force workers to buy in the home counties or remain in rental accommodation. Number of UK High Street shops falls sharply. 8 October 2014Last updated at 19:39 ET The number of shops on the High Street declined dramatically in the first nine months of this year, a survey suggests.

Town centres saw 964 net closures between January and September, two-and-a-half times the net reduction for the whole of 2013, according to the study by PwC and the Local Data Company. The collapse of businesses such as Phones 4U and lingerie chain La Senza accelerated the decline, PwC said. Shoppers lose appetite for big supermarkets. Ebola outbreak: Britain sending 750 soldiers and medics to Western Africa - Health News - Health & Families - The Independent.

Economy tracker: Unemployment. Momentum slows in housing market, says Rics. IMF warns of low interest rates 'risk' to economy. General Economics.