The Box S-1, Delayed IPO, and the Genius of Tien Zuo. While I did my own post on the Box S-1, I also noticed that fellow CEO blogger, Tien Zuo of Zuora, had done a post of his own with the catchy title These Numbers Show That Box CEO Aaron Levie is a Genius.

I saw the post, clipped it to Evernote, and I decided to read it on my next flight. That trip was a few days ago and at 35,000 feet I decided that Tien Zuo was also a genius. Not because he did a nice post on Box, but because he is devising an new accounting for SaaS companies which reflects them more accurately than current GAAP, and – rather amazingly– I’m guessing he came up with this more than 5 years ago. You see, being a natural cynic, I had tended to dismiss Zuora’s “subscription economy” mantra as part Silicon Valley narcissism (lots of businesses have been selling subscriptions for a long time — just because it’s new to us doesn’t mean it’s new to the world) and part marketing pitch.

The Challenges SaaS Businesses Face Communicating their Financial Health. Tien Tzuo, the founder and CEO of Zuora* and former CSO/CMO at Salesforce, knows SaaS businesses better than most.

Here's Why Box's Aaron Levie Is A Genius. Burn Baby Burn: A Look at the Box S-1. I’m pretty busy this week so I was hoping not to dive into the Box S-1, but David Cummings’ excellent summary served only to whet, as opposed to satiate, my appetite.

Perhaps it was the $168M FY14 operating loss. Maybe it was the $380M in financing raised during the last three years. Or the average quarterly burn rate of $23M. But somehow, I got sucked in. I just had to know their CAC ratio. Billings as a Sales Metric While many SaaS companies don’t disclose “billings,” Box does — but on an annual basis only — in their S-1. [Click on the images to see full size.] Billings is an attempt to triangulate on new sales (or bookings) in a SaaS company. Notes from the Box S-1 IPO Filing. Box S-1. Business Models for 2014. Perhaps the greatest continuing disconnect between technologists and normals is the value ascribed to software.

As Marc Andreesen famously declared, “Software is eating the world,” and while that is absolutely true, software, especially in the consumer space, is not eating value, at least not directly. In fact, if 2013 taught us anything, it’s that the value consumers place on software is lower than ever. This phenomenon was seen most clearly in the app store economy, where paid downloads plummeted in popularity. Multiple developers have written about how increasingly difficult it is to make money on the store, and despair about the relentless march to free (with in-app purchase). I myself have joined in, excoriating Apple for not doing more to help developers create sustainable business models in the app store. It’s telling that software and music share a common heritage: round, shiny pieces of plastic in a shrink-wrapped case.

Physical goods. Advertising. Box has secretly filed for an IPO. Box, the online storage company, has secretly filed paperwork for an initial public offering, according to a source.

That means Box could start trading as a public company before its chief rival, Dropbox. Both are among the most anticipated tech IPOs of this year. A new law allows companies with less than $1 billion in annual revenue to confidentially file drafts of their IPO prospectus with the US Securities and Exchange Commission. Twitter is the most prominent company to have taken advantage of this provision of the JOBS Act. We’ve already declared 2014 to be “the year of the secret IPO.” “We don’t have anything to share at this time.

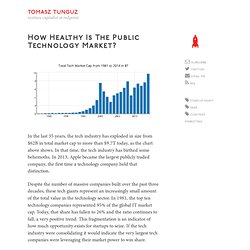

Box has already tapped banks, including Morgan Stanley, Credit Suisse, and JP Morgan Chase, to help underwrite it stock offering. Enterprise software is a $300B market based on tools built for the industrial era. Dropbox recently raised $250 million in a funding round led by a BlackRock investment fund; its valuation was $10 billion. How Healthy is the Public Technology Market? In the last 35 years, the tech industry has exploded in size from $62B in total market cap to more than $9.7T today, as the chart above shows.

In that time, the tech industry has birthed some behemoths. In 2013, Apple became the largest publicly traded company, the first time a technology company held that distinction. Despite the number of massive companies built over the past three decades, these tech giants represent an increasingly small amount of the total value in the technology sector. In 1981, the top ten technology companies represented 95% of the global IT market cap. Today, that share has fallen to 26% and the ratio continues to fall, a very positive trend.

Benchmarking Box's S-1: How 7 Key SaaS Metrics Stack Up. Yesterday, Box filed for its IPO and released its S-1.

I enjoy going through S-1s because quite a bit about a private company is revealed and though only a subset of information is released, the S-1 discloses some very important details about the business operations. Over the past several months, I've analyzed the basket of the roughly 40 public SaaS companies many different ways. With the Box S-1 in hand, I can now benchmark Box's business against other publics, and in particular, SaaS companies nine years after founding. Box is also nine years old. Below are seven key comparisons between Box and the average public SaaS business. Microsoft's Mobile Muddle. Saying “Microsoft missed mobile” is a bit unfair; Windows Mobile came out way back in 2000, and the whole reason Google bought Android was the fear that Microsoft would dominate mobile the way they dominated the PC era.

It turned out, though, that mobile devices, with their focus on touch, simplified interfaces, and ARM foundation, were nothing like PCs. Everyone had to start from scratch, and if starting from scratch, by definition Microsoft didn’t have any sort of built-in advantage. They were simply out-executed. Not that that should make Satya Nadella sleep any better at night. The power of mobile is that it is always with you; it is impossible for your mobile device to not dominate your computing time.