Capital & Success, Satellite Offices, How to Sell, When to Sell and the Top Idea in Your Mind. Why France can clearly have at least 10 Criteo created in the next decade. Criteo is in the last decade the only French VC funded startup which clearly crushed the billion mark both in valuation and business size, while establishing a global leadership.

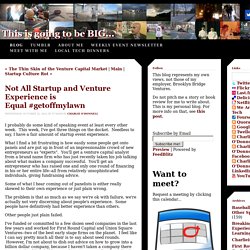

The merits of the founders are really above everything, as they played against all odds. The question is currently to know if Criteo is more a shooting star not to be seen two times in a decade, or if it is a pioneer announcing more to come. Capital And Success. In a post early last week I asserted this: Access to capital and raising a boatload of it is rarely the thing that wins the market.

And then later in the week I saw this tweet And then this one These tweets are about the competition between our portfolio company DuckDuckGo and another search engine called Blekko. Not All Startup and Venture Experience is Equal #getoffmylawn. I probably do some kind of speaking event at least every other week.

This week, I've got three things on the docket. Needless to say, I have a fair amount of startup event experience. What I find a bit frustrating is how easily some people get onto panels and are put up in front of an impressionable crowd of new entrepreneurs as "experts". You'll get a venture capital analyst from a brand name firm who has just recently taken his job talking about what makes a company successful. You'll get an entrepreneur who has raised one and only one round of financing in his or her entire life--all from relatively unsophisticated individuals, giving fundraising advice. Some of what I hear coming out of panelists is either really skewed to their own experience or just plain wrong. The problem is that as much as we say we're ok with failure, we're actually not very discerning about people's experience.

Other people just plain failed. Dear Analysts: No offense intended, btw. Question everyone. The Founder’s Guide To Selling Your Company. For most founders, selling a company is a life changing event that they have had no training for.

At Y Combinator, one big thing we help our startups with is navigating questions around the acquisition process. Originally, I wrote this guide for YC startups outlining what I’ve learned in my last ten years as an entrepreneur about selling startups. If you are going through an acquisition, hopefully this will be useful to you. When to Sell Similar to raising money, the best time to sell your startup is when you don’t need to or want to. The best time to sell your startup is when you have many options. The following is a brief overview of the steps that go into valuing your company, garnering interest in it and navigating through the acquisition process.

Starting Acquisition Talks Do not enter acquisition talks unless you are ready to sell your company. How Your Startup Will be Valued Investors value companies based on either their financial value or their strategic value. Getting Offers. The right way to go from a single office to multiple offices. Pop quiz: Name a billion dollar company (in any industry) that only has one office.

Impossible, right? I got this nugget courtesy of Christoph Janz at Point Nine Capital. He’s right. Hard as I try, I can’t think of one market-leading company that has got by on one office. If you aspire to build your own market leader, at some point, you too will have to plan for a World where your team members are in multiple locations. I see this happening earlier and earlier. At FreshBooks, we are trying to do things a little different (as always….). However, we’re under no illusions. Let’s start with how not to do office expansion. Next, don’t have an exec team in one place and the “troops” somewhere else. The best satellite office implementations have the following attributes: Exec commitment and presence: Ideally one or more of the senior management team members is permanently based in the new office.

Same hiring, onboarding, culture, vibe: Startups are all about people. Should You Sell Your Company? Sittin’ up drunk shuffling thoughtsGot paper but I’m lostLosing focus what a n#%$a still hustin’ for?

My seed is straight the family’s settledIdle time get the man in trouble—Nas, Suicide Bounce One of the most difficult decisions that a CEO ever makes is whether or not to sell her company. Logically, determining whether selling a company will be better in the long term than continuing to run it stand-alone involves a huge number of factors, most of which are speculative or unknown. And if you are the founder, the logical part is the easy part. Indeed, the task would be far simpler if there were no emotion involved.

Types of Acquisitions. The Top Idea in Your Mind. July 2010 I realized recently that what one thinks about in the shower in the morning is more important than I'd thought.

I knew it was a good time to have ideas.