All India Services - Wikipedia, the free encyclopedia. List of paradoxes. This is a list of paradoxes, grouped thematically.

The grouping is approximate, as paradoxes may fit into more than one category. Because of varying definitions of the term paradox, some of the following are not considered to be paradoxes by everyone. This list collects only scenarios that have been called a paradox by at least one source and have their own article. Although considered paradoxes, some of these are based on fallacious reasoning, or incomplete/faulty analysis.

Informally, the term is often used to describe a counter-intuitive result. Logic[edit] Self-reference[edit] These paradoxes have in common a contradiction arising from self-reference. List of companies of India. From Wikipedia, the free encyclopedia This is a list of notable companies based in India.

For further information on the types of business entities in this country and their abbreviations, see "Business entities in India". A[edit] Political families of India. List of superhuman features and abilities in fiction. Origins Examples of ways in which a character has gained the ability to generate an effect.

Methods Examples of methods by which a character generates an effect. Powers Superpower interaction This section refers to the ability to manipulate or otherwise interact with superpowers themselves, not "power" such as electrical power or gravitational power. Personal physical powers Powers which affect an individual's body. Mentality-based abilities The abilities of extra-sensory perception (ESP) and communication. Physical or mental domination Physics or reality manipulation These powers may be manifested by various methods, including: by some method of molecular control; by access to, or partially or fully shifting to another dimension; by manipulating the geometric dimensions of time or space; or by some other unnamed method.

Elemental and environmental powers Ability to control or manipulate the elements of nature. Energy manipulation These powers deal with energy generation, conversion and manipulation. Fortune Global 500. Until 1989 it listed only non-US industrial corporations under the title "International 500", while the Fortune 500 contained and still contains exclusively US corporations.

In 1990, US companies were added to compile a truly global list of top industrial corporations as ranked by sales. Since 1995, the list has had its current form, listing also top financial corporations and service providers by revenue. From 2001 to 2012, there has been significant change in the geographical distribution of the companies in the Global 500 rankings. The number of North American–based companies have reduced from 215 in 2001 to 144 in 2011, whereas the contribution of Asian-based companies have increased rapidly from 116 in 2001 to 188 in 2012.

The share of European-based companies have increased marginally from 158 to 160 over the decade.[1] Controversy[edit] Www.google.co.in/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&ved=0CGwQFjAA&url=http%3A%2F%2Fen.wikipedia.org%2Fwiki%2FValue_added_tax&ei=UzvgT7r5GszprQeh-Z2ADQ&usg=AFQjCNEWs3ok_hJomfRy07M7_4PxY4kmDg&sig2=ht62fzFDrVaIEkTIZTjrWA. A value-added tax (VAT) or also goods and services tax (GST) is a form of consumption tax.

From the perspective of the buyer, it is a tax on the purchase price. From that of the seller, it is a tax only on the value added to a product, material, or service, from an accounting point of view, by this stage of its manufacture or distribution. The manufacturer remits to the government the difference between these two amounts, and retains the rest for themselves to offset the taxes they had previously paid on the inputs. The purpose of VAT is to generate tax revenues to the government similar to the corporate income tax or the personal income tax.

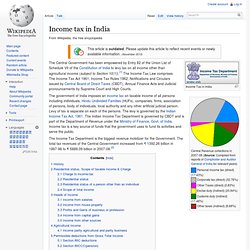

The value added to a product by or with a business is the sale price charged to its customer, minus the cost of materials and other taxable inputs. Overview[edit] Maurice Lauré, Joint Director of the France Tax Authority, the Direction Générale des Impôts, was first to introduce VAT on 10 April 1954, although German industrialist Dr. Income tax in India. Income Tax in India Central Revenue collections in 2007-08 (Source: Compiled from reports of Comptroller and Auditor General of India for relevant years) Personal income tax (direct) (17.43%) Corporate tax (direct) (32.76%) Other Taxes (direct) (2.83%) Excise duty (indirect) (20.84%) Customs duty (indirect) (17.46%)

Indian cuisine. India cuisine or Indian food encompasses a wide variety of regional cuisines native to India.

Given the range of diversity in soil type, climate and occupations, these cuisines vary significantly from each other and use locally available spices, herbs, vegetables and fruits. Indian food is also heavily influenced by religious and cultural choices and traditions. The development of these cuisines have been shaped by Dharmic beliefs, and in particular by vegetarianism, which is a growing dietary trend in Indian society.[1] There has also been Central Asian influence on North Indian cuisine from the years of Mughal rule.[2] Indian cuisine has been and is still evolving, as a result of the nation's cultural interactions with other societies.[3][4] Historical incidents such as foreign invasions, trade relations and colonialism have also played a role in introducing certain foods to the country.

Institutes of National Importance.