B N Corporates. is a Delhi based Accounts & Tax Consultant firm in Rohini, well known for its Gst registration in India as well as financing, taxation and accounting Services.

Gst Registration Consultant - B n Corporates. B n Corporates - Gst Registration. Gst Consultant in Rohini. Gst Registration Consultant in Rohini. GST consultant in Rohini: So, when You are Seeking an Accountant you need a Tax consultant in Rohini.

When your Business Going Very Smoothly, But You Can’t Even Imagine How Much You are Earning from Your Business or Profession Then you Need Tax Consultant in Pitampura. A Tax Consultant Will Help You in Income Tax Return Filings, GST Return Filing Services, Accounting Services, Tax Preparation Services, & All financial Services Related to Your Business. We are here to help as GST registration consultant in Rohini. With Top GST Consultant in Rohini. You will Get to Know Profit During the Financial Year. & able to see How your Business running & Profit Earning. AADHAAR NO IS MANADATORY. GST Updates. E Way Bill. What is E- Way Bill. What is E-Way bill As per the GST act E-Way bill is the way of material transfer from one state to other states which is called interstate sale and within the state is an intrastate sale, it is a form containing detail of material is being moved and vehicle detail in part B used by transporter during movement.

E-Way bill is filled by consignor or by transporter who are carrying goods by road, rail and air. Tds Return Due Dates. GSTR 3B DUE DATE. What is Gst Registration. What is GST Registration. GST REGISTRATION is a process by which a Individual Person, Partnership firm and Private Limited Company registered himself with the government for dealing in goods and servicesNow the question arise who will be liable for get registered under GST act.

First the company who is sale their good and services to other state is liable to registered And the annual turnover of a previous year exceeding 40,00,000/- lakh will be liable for registration? The benefits of registration under gst is we can avail input tax claim under gst. We can deal with so many registered person so that we can grow our business also registered company under gst will get loan approval from bank fast than other. Note :- Documents Required for Gst Registration Regular scheme under this we can avail benefit of input tax credit Composition scheme under this we have to pay GST on all our sale of goods and services.

Not registration panel charges and interest Penality of Rs. 10,000/- or Tax Due – Whichever if High. TDS on Contractor Section 194 C. What is TDS on Contractor. TDS on Payment to contractor is deducted under section 194C of Income Tax actAccording to this act every person is responsible for making payment to resident contractor in connection with work done by them shall deduct tds @ 2% in case payment to individual and HUF rate will be 1% tds will be deducted. if the payment or bill amount exceeding 30,000/- for single transaction and exceeding 100000/- during the financial year.

The person who is making payment to any contractor for work will deduct tds according to the Income Tax act section 194C. Every person who has Tax Assessment No(TAN) & making payment to contractor for any work shall be liable to deduct tds on payment for the work provided amount paid or payable to any Resident Person.

Note :- TDS on Rent Section 194 I TDS deduction liability arise on payer (Who have TAN no) when the actual payment of work done under contract is done to payee on accrual basis or paid basis.TDS will be deducted on amount before gst charged. TDS on Section 194 I. What is Gstr 9. Annual Return Filing. What’s is GSTR 9 GSTR 9 is associate annual come to be filed yearly by taxpayers registered under GST.

Points to note: It consists of details relating to the outward and inward supplies made/received throughout the relevant previous year under completely different tax heads i.e. CGST, SGST & IGST and HSN codes. It is a consolidation of all the monthly/quarterly returns (GSTR-1, GSTR-2A, GSTR-3B) filed therein year. though advanced, this return helps in in depth reconciliation of knowledge for 100% clear disclosures. Who should file GSTR-9, the annual return? All taxpayers/taxable persons registered under GST should file their GSTR nine. Taxpayers opting composition scheme (They should file GSTR-9A) 1. 2. 3. 4. GSTR-9 filing for businesses with turnover up to Rs 2 large integer created optional for FY 17-18 and FY 18-19.

Due Date, late fee and penalty The day of the month to file GSTR-9 is additional extended to Gregorian calendar month thirty, 2019. 1. 2. 3. TDS on Rent Under Section 194 I as Income Tax Act. What is the Difference Between OPC & Sole Proprietorship. In India the thought of “ONE MAN ARMY” in the form of outdated Sole Proprietorship form of Business Structure is the most common amongst any other forms of business.

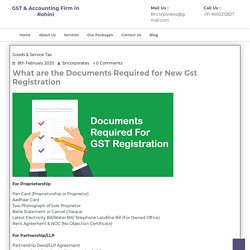

The reason being it is very simple to form and close and is also free from making additional mandatory submissions. Many Shopkeepers, Professionals including Chartered Accountants, Company Secretaries, Doctors, Advocates, Architects, Consultants, etc are running their business or profession as a Sole Proprietor. If you as an existing or ambitious businessperson would like to decide whether to switch to “OPC” structure or not then this article will surely guide you the path. The resolved of the government is to bring the outmoded small proprietors who are presently working in un-organized areas in an organized form of business to enhance Business governance and inculcate a habit of formal business structure. How to do TDS on Salary Calculation as Income Tax. What are the Documents Required for New Gst Registration. For Proprietorship Pan Card (Proprietorship or Proprietor)Aadhaar CardTwo Photograph of Sole ProprietorBank Statement or Cancel ChequeLatest Electricity Bill/Water Bill/ Telephone Landline Bill (For Owned Office)Rent Agreement & NOC (No Objection Certificate) For Partnership/LLP Partnership Deed/LLP AgreementAadhaar Card, Pan Card & Photograph of All PartnerCopy of Electricity Bill/Water Bill/Landline bill (For Owned office)Rent Agreement & NOC (For Rented Office)Registration Certificate & Copy of Board Resolution (In Case of LLP)Appointment Proof of authorized signatory-Letter of Authorization For Private Limited/Public limited/One Person Company.

Accouting Service in Rohini. Trademark Registration. Accounting Services. Gst Return Filing. Gst Return Filing. Gst Registration.