The UK's External Balance Sheet.pdf. Lack of secondary market liquidity exacerbates sell-off /Euromoney magazine. Amid the market turbulence this week as investors panicked about slowing growth in Europe and around the world, equity markets sold off sharply and panic-buyers drove down 10-year US treasury yields, market sources reported surprisingly thin liquidity, even in benchmark US government bonds.

With dealers unwilling to position risk ahead of Fed stress tests and amid heightened regulatory reporting requirements on Volcker rule compliance, even in the supposedly most liquid bond markets prices gapped around. Harvey Schwartz, chief financial officer of Goldman Sachs, reviewing the impact of Volcker rules and increased capital charges on liquidity provision as US regulators now require more detailed reports from US banks, says: "I'm talking about [in] normal market functioning times, not in stress market functioning times, definitely balance sheet has felt scarce. Daily chart: Taking the king's coin. RBA: Bulletin February 2001-Statement on Monetary Policy.

Reserve Bank Bulletin – February 2001 Download the complete Statement [PDF 771K] Go To International economic conditions have weakened in recent months and are likely to provide a less favourable environment for the Australian economy in the coming year.

The United States in particular is now in a period of considerably slower growth, and this has prompted a broader reassessment of international economic prospects, with most observers in recent months revising downward their expectations for global growth. Mohamed El-Erian offers six reasons why business investment has stalled, de. NEWPORT BEACH, CALIFORNIA – Some economists, like Larry Summers, call it “secular stagnation.”

Others refer to it as “Japanization.” But all agree that after too many years of inadequate growth in advanced economies, substantial longer-term risks have emerged, not only for the wellbeing of these countries’ citizens but also for the health and stability of the global economy. Those looking for ways to reduce the risks of inadequate growth agree that, of all possible solutions, increased business investment can make the biggest difference. And many medium-size and large companies, having recovered impressively from the huge shock of the 2008 global financial crisis and subsequent recession, now have the wherewithal to invest in new plants, equipment, and hiring. However one looks at it, the corporate sector in advanced economies in general, and in the US in particular, is as strong as it has been in many years.

First, companies are concerned about future demand for their products. Währungsfonds in der Kritik: „Man muss den IWF abschaffen“ - Deutschland. Blinded by Pro-European Bias? The IMF and the Doyle Debacle. The Bank Of International Settlements Warns The Monetary Kool-Aid Party Is Over.

QE3 Coming Soon? TIPS Say No- Macro Story. Are Ever Larger Global Booms and Busts Really Inevitable? — jaredbernsteinb. I’ve been meaning to respond to this piece by Eduardo Porter from a few days ago on both recent and historical stirrings in global financial markets.

ViewsWire. GMO LLC - Home. GMO is a global investment management firm committed to providing sophisticated clients with superior asset management solutions and services.

We offer a broad range of investment products, including equity and fixed income strategies across global developed and emerging markets, as well as absolute return strategies. Our client base includes endowments, pension funds, public funds, foundations and cultural institutions. Big ups and downs give daytraders a way to thrive. Australia learns, as Dutch did in 1960s, that resource boom has downside. BEWARE Dutch disease.

No, this is not a travel warning for tourists visiting the seedier parts of Amsterdam. It's a history lesson about how commodities booms can become double-edged swords for resource-rich countries, a lesson that Australia is now learning as a strong Australian dollar becomes an unbearable burden for much of its economy. Coined after a surging Dutch guilder eviscerated Holland’s manufacturing industry in the aftermath a giant natural gas discovery in 1959, 'Dutch Disease' refers to the loss of competitiveness that labor-intensive industries suffer when a currency appreciates on the back of rapid growth in a capital-intensive resource sector. Companies that extract and market the commodity do well, but the rising currency also causes downstream manufacturing exporters to lose market share to foreign competitors while foreign investment inflows associated with the boom push local asset and consumer prices ever higher.

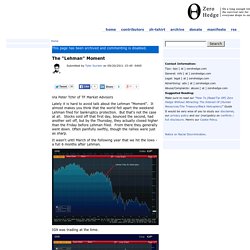

The "Lehman" Moment. Via Peter Tchir of TF Market Advisors Lately it is hard to avoid talk about the Lehman "Moment".

It almost makes you think that the world fell apart the weekend Lehman filed for bankruptcy protection. George Dorgan sur Twitter : "thanks to @Macronomics1 another chart documenting that #NeoKeynesian rules are collapsing. Here #OkunsLaw. 2011 Greatest Hits: Presenting The Most Popular Posts Of The Past Year. Capital instruments. You declare that you will not engage in any activities related to content of the Website that are contrary to applicable law or regulation or the terms of any agreements between you and UBS AG and/or any branch, group, subsidiary or affiliate of UBS AG (UBS).

Publication of the information and materials on the Website is only made pursuant to the requirements of sections 23 and 23.1 of Circular 2008/22 issued by the Swiss Financial Market Supervisory Authority (FINMA).