Summary statement of financial position - Annual Review 2011 - Rio Tinto. Statement of Financial Performance financial definition of Statement of Financial Performance. Statement of Financial Performance finance term by the Free Online Dictionary. Income statement (statement of operations) A statement showing the revenues, expenses, and income (the difference between revenues and expenses) of a corporation over some period of time.

Copyright © 2012, Campbell R. Balance sheet B/S Statement of financial position defined example. Business Encyclopedia ISBN 978-1-929500-10-9.

Revised 2014-04-03. On the balance sheet Assets always equal the sum of Liabilities plus Owners Equities. Www.ifrs.org/NR/rdonlyres/579AE116-2B0D-4A84-90A0-F4D872F4AF5C/0/Module04_version2010_1_SOFP.pdf. IFRS for SMEs - U.S. GAAP Comparison Wiki : Statement of Financial Position. Balance sheet. A standard company balance sheet has three parts: assets, liabilities and ownership equity.

The main categories of assets are usually listed first, and typically in order of liquidity.[2] Assets are followed by the liabilities. The difference between the assets and the liabilities is known as equity or the net assets or the net worth or capital of the company and according to the accounting equation, net worth must equal assets minus liabilities.[3] Another way to look at the balance sheet equation is that total assets equals liabilities plus owner's equity.

Looking at the equation in this way shows how assets were financed: either by borrowing money (liability) or by using the owner's money (owner's or shareholders' equity). Beginners' Guide to Financial Statements. The Basics If you can read a nutrition label or a baseball box score, you can learn to read basic financial statements.

If you can follow a recipe or apply for a loan, you can learn basic accounting. Income Statement (Profit and Loss Statement) Introduction to Income Statement The income statement is one of the major financial statements used by accountants and business owners.

(The other major financial statements are the balance sheet, statement of cash flows, and the statement of stockholders' equity.) The income statement is sometimes referred to as the profit and loss statement (P&L), statement of operations, or statement of income. Understanding The Income Statement. Income Statement Definition.

The income statement is the one of the three major financial statements.

The other two are the balance sheet and the statement of cash flows. The income statement is divided into two parts: the operating and non-operating sections. The portion of the income statement that deals with operating items is interesting to investors and analysts alike because this section discloses information about revenues and expenses that are a direct result of the regular business operations. Income statement. An income statement (US English) or profit and loss account (UK English)[1] (also referred to as a profit and loss statement (P&L), revenue statement, statement of financial performance, earnings statement, operating statement, or statement of operations)[2] is one of the financial statements of a company and shows the company’s revenues and expenses during a particular period.[1] It indicates how the revenues (money received from the sale of products and services before expenses are taken out, also known as the “top line”) are transformed into the net income (the result after all revenues and expenses have been accounted for, also known as “net profit” or the “bottom line”).

One important thing to remember about an income statement is that it represents a period of time like the cash flow statement. This contrasts with the balance sheet, which represents a single moment in time. Www.google.co.uk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=14&ved=0CI4BEBYwDQ&url=http%3A%2F%2Farchive.sba.gov%2Fidc%2Fgroups%2Fpublic%2Fdocuments%2Fsba_homepage%2Fform_finasst_incomestmt.xlt&ei=67qgT4SsM9HE8QPd5vieCA&usg=AFQjCNHxFzTi2rBjJnRbS08sfrFZzP6vAg&s. Www.londoninternational.ac.uk/current_students/programme_resources/lse/lse_pdf/further_units/fin_reporting/91_fin_reporting_3chs.pdf. Www.bis.gov.uk/files/file20417.pdf. Financial Regulatory Framework. Skip to main content Linked in Google+ Twitter Facebook RSS Register / Login Home » Any Answers » Financial Regulatory Framework Financial Regulatory Framework More social links Twitter Facebook Linkedin Google+ I have an assignment to complete for ACCA - Accounting and Audit Practice on the above subject.

Help!!! 0inShare Login or Register to comment Comments. Regulatory accounting framework (RAF) The Definition, Purpose, and the Regulatory Framework of Accounting. Financial Reporting and Regulatory Framework - ACC3003. Www.egs.ie/accountancy/pub/theory.pdf. RATIO ANALYSIS DEFINITION. RATIO ANALYSIS involves conversion of financial numbers for a firm into ratios.

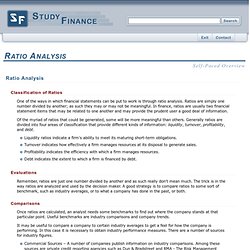

Ratio analysis allows comparison of one firm to another. Since ratios look at relationships inside the firm, a firm of one size can be directly compared to a second firm (or a collection of firms) which may be larger or smaller or even in a different business. Financial Ratio Analysis is a method of comparison not dependent on the size of either firm. Financial Ratios provide a broader basis for comparison than do raw numbers. In the VentureLine database the comparison is conducted against the industry (SIC Code) in which each particular listing is associated. PURE RESEARCH is motivated exclusively by the search for knowledge for its own sake. StudyFinance.com. Classification of Ratios One of the ways in which financial statements can be put to work is through ratio analysis.

Ratios are simply one number divided by another; as such they may or may not be meaningful. In finance, ratios are usually two financial statement items that may be related to one another and may provide the prudent user a good deal of information. Of the myriad of ratios that could be generated, some will be more meaningful than others. Generally ratios are divided into four areas of classification that provide different kinds of information: liquidity, turnover, profitability, and debt. Liquidity ratios indicate a firm's ability to meet its maturing short-term obligations.Turnover indicates how effectively a firm manages resources at its disposal to generate sales.Profitability indicates the efficiency with which a firm manages resources.Debt indicates the extent to which a firm is financed by debt. Ratio Analysis: Financial Ratio Calculator. Accounting Principles II: Ratio Analysis. Ratio Analysis. Ratio Analysis is a form of Financial Statement Analysis that is used to obtain a quick indication of a firm's financial performance in several key areas.

The ratios are categorized as Short-term Solvency Ratios, Debt Management Ratios, Asset Management Ratios, Profitability Ratios, and Market Value Ratios. Ratio Analysis as a tool possesses several important features. The data, which are provided by financial statements, are readily available. Financial Ratio Analysis - Index. Financial Ratio Tutorial. When it comes to investing, analyzing financial statement information (also known as quantitative analysis), is one of, if not the most important element in the fundamental analysis process.

At the same time, the massive amount of numbers in a company's financial statements can be bewildering and intimidating to many investors. However, through financial ratio analysis, you will be able to work with these numbers in an organized fashion. The objective of this tutorial is to provide you with a guide to sources of financial statement data, to highlight and define the most relevant ratios, to show you how to compute them and to explain their meaning as investment evaluators. In this regard, we draw your attention to the complete set of financials for Zimmer Holdings, Inc. (ZMH), a publicly listed company on the NYSE that designs, manufactures and markets orthopedic and related surgical products, and fracture-management devices worldwide. Ratio Analysis Definition. Main ratios (introduction) Author: Jim Riley Last updated: Sunday 23 September, 2012. Balancing Accounts and the Trial Balance.

Aims: This worksheet deals with: Balancing-off accounts Preparing trial balances Balancing - off accounts Look at the following 'cash' account: Drawing-up a trial balance. Trial Balance Definition. Trial Balance Preparation and Purpose. Trial balance. A trial balance is a list of all the General ledger accounts (both revenue and capital) contained in the ledger of a business.

This list will contain the name of the nominal ledger account and the value of that nominal ledger account. Trial Balance. Equity (finance) A Strong Focus On The Concept Of Currency Value - Forbes.com. Currency Stability. Currency Definition. Anale.steconomiceuoradea.ro/volume/2010/n2/107.pdf. Money measurement concept. The money measurement concept underlines the fact that in accounting, every recorded event or transaction is measured in terms of money.

Using this principle, a fact or a happening which cannot be expressed in terms of money is not recorded in the accounting books. Thus, it is not acceptable to record such non-quantifiable items as employee skill levels or the quality of customer service.[1] Www.cipfa.org.uk/students/studylounge/download/model_answers/jun06/fa_model_answers.pdf. List out the accounting concepts and explain the accural concept. SEPARATE DETERMINATION CONCEPT DEFINITION. Accounting Terms - Glossary of Accounting Terms and Definitions. While studying accountancy, you may come across several accounting terms that you may not be familiar with. Most glossaries may help you with it, but some accounting definitions may be too elaborately worded for most people to understand and hence end up confusing them rather than helping them. So I will try to make this glossary of accounting terms and definitions as simple and easy to understand as I can.

I hope that this glossary covers up most of the doubts which accounting students may have. The Accounting Review, Vol. 39, No. 3 (Jul., 1964), pp. 563-573. Accounting Ratios Analysis, Accounts Ratios, Ratios In Formulas-Accounting Issue. Accounting ratios are used as an indication as to how a business is performing. They should not be used in isolation, but as a comparison to the previous years' trading figures to show up any problems, or to compare to a similar company.

To complete a thorough examination of your company's effectiveness, however, you need to look at more than just easily attainable numbers like sales, profits, and total assets. Basic Accounting Concepts. Learn Basic Financial Principles Lesson. Financial accountancy.