Commercial classification of chemicals. Commercial classification of chemicals.

Following the commercial classification of chemicals, chemicals produced by chemical industry can be divided essentially into three broad categories: GBD Compare. Industry 4.0 and the chemicals industry. Industry 4.0, which combines digital and physical advanced technologies, can potentially transform the chemicals industry, itself the backbone of many end-market industries.

Through the dual areas of business operations and growth, these technologies enable “smart” supply chains and factories, as well as create new business models. Introduction In one way or another, the chemicals industry contributes to almost every manufactured product. The industry converts petroleum and natural gas into intermediate materials, which are ultimately converted into products we use daily. With more than 20 million people employed and annual sales of $5 trillion, the global chemicals industry serves as the backbone of many end-market industries such as agriculture, automotive, construction, and pharmaceuticals.1 Changes in the chemicals industry are thus likely to have a ripple effect on a number of other industries.

Chemical Logistics Vision 2020 190911 final. Marketing Strategies for Specialty Chemical Distributors. Chemical Industry Vision 2030: A European Perspective - Chemicals Featured Article - A.T. Kearney. Vision 2030 outlines emerging challenges, analyzes the current positioning, and highlights imperatives for the European chemical industry in positioning itself to stay ahead in the game.

The European chemical industry is facing major challenges as value chains increasingly move eastward, drawn by economic growth and market opportunities in Asia. A new, more competitive environment is taking shape, giving rise to state-controlled players and emerging chemical giants. Fragile economic conditions require managing volatility on a playing field where trade flows gradually change direction. Valspar : Our Company. 035. Methanex 100610 RC Value 3. January.2016.Monthly Cefic Chemicals Trend Report. Paint and Coatings Industry Overview - Chemical Economics Handbook (CEH) Published March 2015 The major change that has taken place in the coatings industry during the last 40 years has been the adoption of new coating technologies.

Until the early 1970s, most of the coatings were conventional low-solids, solvent-based formulations; waterborne (latex) paints, used in architectural applications, accounted for 30–35% of the total. In the late 1970s, however, impending government regulations on air pollution control focusing on industrial coating operations stimulated the development of low-solvent and solventless coatings that could reduce the emission of volatile organic compounds (VOCs). Energy conservation and rising solvent costs were also contributing factors. Dow Chemical may sell businesses exposed to commodity swings. ZA PricingintheChemicalIndustry 230215. How to add value when buyers think you sell a commodity. These days, products and services can quickly lose their competitive edge, thanks to the breakneck speed of change and intense global competition.

One problem sales professionals face that cuts across nearly every industry: How to build perceived value and set yourself apart, when buyers (rightly or wrongly) treat you like a commodity – with little real difference between you and the other guy? Of course, you aren’t selling exactly what your competitor does. You know your product or service is not identical, but your customer might think so, and there is the rub. From their point of view, what is the real difference between Hertz and Avis? The challenge you face is getting past the buyer’s perception that you are selling a “me too” product or service. A Smarter Way to Sell Commodities. The mere word “commodity” strikes terror in the heart of most marketers.

Forbes Welcome. How to Sell a Product that Seems Like a Commodity. Selling Commodities ~ A Free Sales Training Article by Dave Kahle. Other Articles || Sales Training Resources || About Dave Copyright 2011, by Dave Kahle.

"How do you create a perceived value to differentiate yourself from the competition, when you are both selling a commodity? " That's a question I'm often asked in my seminars. It uncovers a problem that is spreading to almost every industry. The rapid pace of technological development and our ultra-competitive global economy means that no one can keep a competitive edge in their product for very long. This complicates life for the salesperson. Celanese Corporation. - Expects adjusted earnings range of $8.00 to $8.50 per share by 2018 - - On track to generate $2.5 billion in free cash flow from 2016 to 2018 - - Announces capacity expansions at Clear Lake to drive growth - - Announces addition of ultra-high performance polymer to further enhance earnings power - DALLAS--(BUSINESS WIRE)-- Celanese Corporation (NYSE: CE), a global technology and specialty materials company, will host an Investor Day at 8:00 a.m.

Eastern time today in New York City. “Celanese has taken significant strategic action over the past several years to position itself as an integrated, global leader with the unique ability to deliver value to shareholders across all macroeconomic conditions through its balanced portfolio,” said Rohr. During the event, the company will discuss the strategies and initiatives that are expected to grow adjusted earnings and cash flow through 2018 at a compound annual growth rate of 10 percent and 15 percent, respectively. Polymer Emulsion Market by Type, by Application - Trends & Forecasts to 2020 - MarketWatch. LONDON, Sept. 24, 2015 /PRNewswire/ -- Monomers dissolved in water are known as polymer emulsion.

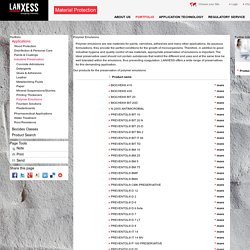

Global demand for emulsion polymers to reach 12.6 million metric tons / Raw materials market / Markets & companies - European-coatings.com. Polymer Emulsions - LANXESS Material Protection. Portfolio Page Tools Note Noted pages Print Send All Share this page.

CELANESE : to Increase Prices of Emulsion Polymers in EMEA. Celanese Corporation (NYSE: CE), a global technology and specialty materials company and global leader in emulsion polymers, announced today it will increase the price of all emulsions sold in Europe, the Middle East and Africa by 150 €/tonne effective April 1, 2011, or as contracts allow. This price increase includes all emulsions and affects applications including, but not limited to, adhesives, paint and coatings, building and construction, nonwovens, glass fiber, carpet and textiles.

Customers should contact their Celanese sales representative for more details. Gx pricing in the chemical industry. Avoid Price Discounts by Selling Value Not Benefits.