AA - Retail Marijuana Tax - Results: Elections: The Denver Post. Justice Department Declines to Endorse Pot Taxes (Except by Implication) USDOJYesterday Rob Corry, head of the campaign against Colorado's proposed marijuana taxes, got a response from U.S.

Attorney John Walsh to his October 9 letter asking about the Justice Department's position on the issue. "The U.S. Colorado Proposition AA, Taxes on the Sale of Marijuana (2013. Beginning on January 1, 2014, it will impose two different taxes on the sale of recreational marijuana: Lawmakers in the state estimated that Proposition AA would result in approximately $70 million a year in additional revenue to the state government with $40 million of that going into a fund for public school capital construction.

Colorado marijuana sales tax, Proposition AA, is excessive. Posted: 09/25/2013 05:10:30 PM MDT Colorado NORML thinks marijuana consumers in Colorado will be paying excessive taxes under Proposition AA.

(Anthony Souffle, Chicago Tribune/MCT) (Anthony Souffle, Chicago Tribune/MCT) Washington and Colorado Marijuana Laws Set Course for Legal Pot. Correction appended, Oct. 21 Nearly a year after Colorado and Washington State voted to become the first states to legalize recreational marijuana, the detailed rules governing how pot will be grown, sold and taxed are finally complete.

And as the two states implement their different approaches to getting high, the whole world is watching. This week, the American Civil Liberties Union (ACLU) announced a new panel, headed by California Lieut. Substantial taxes on marijuana cruise to victory. Brian Vicente, chairman of the Yes on Prop AA campaign, right, and campaign staffer Christie Nima look at vote returns on a laptop during an election party Tuesday in Denver.

DENVER – A dime bag is going to cost a few cents more. Colorado voters, who made history in 2012 by legalizing marijuana for recreational use, voted Tuesday to impose heavy taxes on sales of the psychoactive plant in order to fund inspections and public-health efforts related to pot. With nearly 1 million votes counted Tuesday night, Proposition AA was winning 65 percent to 35 percent. The measure imposes a 15 percent wholesale excise tax and a 10 percent retail sales tax on recreational marijuana.

The Legislature has the authority to raise the sales tax to 15 percent, and it is in addition to Colorado's existing 2.9 percent sales tax on regular items. Joe Megyesy, spokesman for the AA campaign, said the seeds of the measure's victory were sown last year when Colorado voters decided to end marijuana prohibition. Marijuana taxes over 30 percent to start and other highlights from (almost) final pot bills. The THC-driving-limits bill, which could have a devastating impact on medical marijuana patients like William Breathes, our pot critic, was only one of several huge cannabis-related bills that passed yesterday.

The measures still must go through a procedure or two today, the last of the legislative session, but they're thought to be more or less in their final versions. 30 percent pot tax is reasonable and voters will pass it, activist says. Earlier today, we shared the thoughts of Sensible Colorado head Brian Vicente about the federal government's continued silence on Amendment 64, the marijuana measure he co-authored.

But we also asked Vicente's views about the newly passed but not yet signed marijuana laws spurred by A64, as well as the fear among lawmakers that Colorado voters will reject taxes on pot -- so great a concern that the legislature almost approved a measure that might have repealed much of it. Let's tackle the tax question first. As we've reported, the Taxpayers Bill of Rights, shorthanded as TABOR, requires a vote to approve tax increases. Will Colorado's Pot Taxes Preserve the Black Market? Taxing Marijuana: Four Questions. Marijuana legalization brings tax questions: Whether to tax, how much, for whose benefit, and by what measure.

None of the answers is obvious. Whether to tax Some think marijuana should bear no special taxes. Their theory will face voters next month in Colorado, where proposals to tax legalized marijuana 15 percent at wholesale and 10 percent at retail -- along with various local taxes -- are on the ballot. Those proposals face strong opposition. It's hard to answer the "Whether" question without first looking at the other questions about taxation. How much? To start with, taxes need to pay for the expenses of implementing and enforcing legalization. Colorado's Crazy Marijuana Tax.

Vertical integration?

Here's an example: A wine company owns land, vines and a winery, and sells to consumers only at its own outlet store. Substitute "marijuana grow area" for land and vines, "marijuana production facility" for winery and "marijuana retailer" for outlet store, and you understand the Colorado model. Colorado law will require that at least 70 percent of marijuana sales follow that model, with the supply chain integrated vertically (from top to bottom) -- and with no wholesaler.

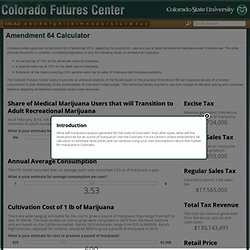

So how do you apply a wholesale level tax when no wholesaler exists? With great difficulty. Basing a tax on a fictitious price means no one will ever know the correct tax. Calculator Dev ‐ Colorado Futures Center - Colorado State University. Colorado voters approved Amendment 64 in November 2012, legalizing the production, sale and use of adult recreational marijuana under Colorado law.

The state General Assembly is currently considering legislation to levy the following taxes on recreational marijuana: An excise tax of 15% of the wholesale value of marijuana. A special sales tax of 15% on the retail sale of marijuana. Extension of the state’s existing 2.9% general sales tax to sales of marijuana and marijuana products. The Colorado Futures Center seeks to provide an unbiased analysis of the fiscal impact of the proposed Amendment 64 tax measures as part of a broader commitment to look holistically at the sustainability of Colorado’s state budget. How pot taxes stack up to other sin taxes. Amendment 66 and Proposition AA by the numbers. A map of how statewide ballot measures fared in each Colorado county adds a bit of color to the numbers. Amendment 66, a $1 billion tax increase for education, was approved by a majority of voters in only two counties — Denver (53 percent) and Boulder (54 percent).

Its worst showing was in eastern Cheyenne County, in which it was rejected by 86 percent of voters. Statewide, nearly 65 percent of voters rejected it. In most Denver metro-area counties, it failed with 60-70 percent voting against it. Voters in Douglas County disliked the measure a bit more, with only 28 percent voting for it. Colorado Voters Approve Hefty Marijuana Taxes by Big Margins. Marijuana tax supporters vastly out-raise and out-spend tax opponents.

An anti-tax rally over retail marijuana in September gave away free pot and also tried to rally people against Proposition AA, a taxation ballot issue. (Joe Amon, The Denver Post) The campaign backing a measure to impose new taxes on recreational marijuana has out-raised tax opponents by more than 17-to-1 and outspent opponents by 22-to-1, a Denver Post analysis of campaign finance reports shows. The Committee for Responsible Regulation, the campaign group formed to support Proposition AA on this year’s ballot, has raised about $67,000 in monetary and in-kind contributions as of its most recent finance filing earlier this week. The group opposed to the tax, simply named No Over Taxation, has raised about $3,800 in monetary and in-kind contributions, according to its filings. Tax proponents have also vastly out-spent opponents, but the large majority of the proponent’s expenditures have gone toward paying consultants and fund-raising expenses.

60% of cigarettes sold in New York are smuggled: report - Jan. 10, 2013. NEW YORK (CNNMoney) The Tax Foundation said that 60.9% of cigarettes sold in New York State are smuggled in from other states. This makes New York the biggest importer of black market cigarettes, along with the state's highest tax rate of $4.35 per pack. That's compared to Missouri, the state with the lowest rate, of 17 cents per pack. In New York City the tax rate is even higher, adding another $1.50 per pack to the state rate. It's not uncommon for smokers to pay $12 for a pack. The report said that tobacco smuggling and the tax rate have risen practically in tandem since 2006. This bears out a report issued last month by the New York Association of Convenience Stores, estimating that "chronic cigarette-tax evasion" deprives the state of at least $1.7 billion in tax revenue and 6,700 jobs.

Joe Henchman of the Tax Foundation, who co-authored the report with scholars from the Michigan-based Mackinac Center for Public Policy, said the smuggling takes place in various forms. "R.J. High Marijuana Taxes Could Derail Legalization Plans. Grover Norquist Says Taxing Pot Is Not a Tax Hike. Gage SkidmoreGrover Norquist, who last month spoke in favor of legislation that would allow state-licensed cannabusinesses to deduct expenses on their federal tax returns, tells National Journal that politicians who vote for taxes on newly legal marijuana need not worry that they are violating the pledge promoted by Norquist's group, Americans for Tax Reform. The ATR pledge says, "I will oppose and vote against any and all efforts to increase taxes.

" But according to Norquist, marijuana taxes don't count: "That's not a tax increase. It's legalizing an activity and having the traditional tax applied to it," he says.He compares legalization to changes in alcohol regulation, as when a state legalizes the sale of liquor on Sundays or allows grocery stores to sell beer and wine where they previously couldn't. "When you legalize something and more people do more of it and the government gets more revenue because there's more of it...that's not a tax increase," he explains.

Pot Goes Legit. While today's medical marijuana centers give you a sense of what fully legal cannabis will look like in Colorado, they operate under restrictions that make little or no sense for businesses serving the recreational market. To begin with, there's that requirement that customers have "a debilitating medical condition. " To qualify, a condition must either be listed in Amendment 20, the 2000 initiative that legalized medical use of marijuana, or approved by the Colorado Department of Public Health and Environment, which is charged with maintaining the state's registry of approved patients.

Colorado voters approve new taxes on recreational marijuana. By John IngoldThe Denver Post Posted: 11/05/2013 09:12:34 PM MST|Updated: 6 months ago. Colorado Marijuana Taxes Prop. AA Passes: Legal Weed Will Be Taxed.