Depreciation rate finder (by tool name) About this calculator This calculator will find the depreciation rate(s) for all depreciable assets acquired after 1 April 1993.

Use of this tool does not result in data being submitted to us. Depreciation claim - calculate your tax deduction (by keyword) About this calculator This calculator is used to calculate depreciation on a business asset.

You will need to know the depreciation rate that applies to the asset – you can get this from our depreciation rate finder. Use of this tool does not result in data being submitted to us. When to use this calculator Use this calculator when assets are purchased in earlier income years: If you've already claimed depreciation in earlier years - enter the first day of this income year as the purchase date. Note: The depreciation rate for buildings with a life of 50 years is 0%. Do not use this calculator for petroleum mining assets as different depreciation rules apply to them.

Note: Assets costing $500 or less (including loose tools) may not need to be depreciated. This calculator will take about five minutes to complete. What you will need Your balance date The cost of the asset (if you are GST registered, use GST-exclusive cost, if not GST registered, use GST-inclusive cost). Www.ird.govt.nz/resources/5/5/55b4f6004ec257549574f7b6c72de7d5/ir340-2014.pdf. Inland Revenue - Te Tari Taake. Using your home for the business (Claiming business expenses) Claiming business expenses: Using your home for the business Many people who run a small business use an area set aside in the family home for work purposes.

If you are doing this, you can make a claim for the area set aside so long as: it is used principally for business use (such as an office or storage area), and you keep a full record of all expenses you wish to claim. The responsibility for keeping invoices and records for a home office is the same as for any other business expenses you are claiming. You can claim a portion of the household expenses, such as the rates, insurance, power and mortgage interest. You can only claim the expenses that relate to the area set aside for business.

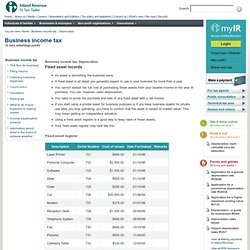

Accounting for depreciation (Business income tax) Business income tax: Depreciation In your income tax return, you must claim depreciation - or "wear and tear" - on most fixed assets (unless you elect not to depreciate - see "Depreciation methods for fixed assets").

A fixed asset is something that your business owns and that you expect to use for business purposes for more than a year. There are some assets that do not depreciate, for example, land or trading stock. You cannot claim the cost of an asset as a business expense against your income. Use our Depreciation rate finder to look up the depreciation rate for any asset. Fixed asset records (Business income tax)

Business income tax: Depreciation An asset is something the business owns.

A fixed asset is an asset you generally expect to use in your business for more than a year. You cannot deduct the full cost of purchasing these assets from your taxable income in the year of purchase. You can, however, claim depreciation. Depreciation calculator. General Depreciation Determination DEP80: Residential Rental Property Chattels (Determinations) Determinations: Depreciation determinations Note to Determination DEP 80 Following the issue of Interpretation Statement 10/01: Residential Rental Properties - depreciation of items of depreciable property ("IS 10/01") in Tax Information Bulletin Vol 22 No 4 (May 2010) the Commissioner has issued a general depreciation determination to provide a new list for the "Residential Rental Property Chattels" industry category.

The list is consistent with the Commissioner’s position set out in IS 10/01 and includes items of depreciable property that are commonly found in residential properties. Note: Some of these items cost less than $500.00 and under section EE 38 of the Income Tax Act 2007 low cost items (not part of any other property) may be treated as an expense item rather than separate depreciable property. Other items not common to residential rental properties have been removed but taxpayers may use a depreciation rate for a similar item in another industry or asset category. 1. 2. 3.