Why The Hermès Birkin Bag is a Better Investment Than Gold. Economy Of Fashion: How Different Trends Reflect The Financial State. It's common knowledge fashion is cyclical in nature.

The concept of “newness” in fashion doesn't refer to the premiere of a trend, but rather its revival. Why fashion cycles in this manner, however, is less obvious. There are lots of factors at play: cultural trends, politics, celebrity influence. One one of the most surprising factors to influence the cycle of fashion, though, is the state of the global economy. If you think about it, it makes sense. During tougher times, if you need new clothes, the focus is less on passing fads and more on classic, quality pieces worth the expenditure because they’ll last (which also aids in cutting down cost per wear). As FIT professor John Mincarelli tells ABC News, “In rough economic times, people shop for replacement clothes,” adding “basics” prevail during an economic downturn. Economist George Taylor was the first to notice the correlation between fashion and the economy; he developed the “Hemline Theory” to describe his findings.

Pinterest How? The Potential of Pilgrim Retail. LONDON, United Kingdom — Each year, millions of pilgrims descend on Mecca in Saudi Arabia, Islam’s most holy city, for the Hajj pilgrimage.

This year’s Hajj took place from 10 to 15 September, during which time authorities expected an influx of up to two million people. In recent years, Saudi Arabia’s government has placed limits on the numbers of Hajj pilgrims, while major renovation and expansion projects are carried out to accommodate increasing numbers of religious visitors. On top of the pilgrim flows during Hajj, about 12 million pilgrims from abroad are expected to visit Mecca this year for Umrah (the pilgrimage to Mecca which can be undertaken at any time of year), a number the government plans to increase to 15 million by 2020.

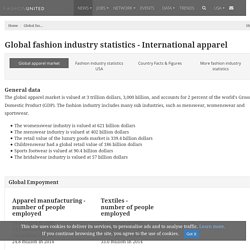

This year, tourists in Saudi Arabia are expected to spend 33.6 billion Saudi Arabian Riyals (SAR) (about $9 billion). The Hajj period remains one of the most successful retail months of the year. Global fashion industry statistics - International apparel. Total trade of clothing and textiles: 726 billion dollars The most traded apparel and textile products are non-knit women’s suits, knit sweaters, knit T-shirts and non-knit men’s suits.

Non-knit women’s suits: 54.6 billion dollars, 7.5 percent Knit sweaters: 52.8 billion dollars, 7.3 percent Non-knit men’s suits: 43.4 billion dollars, 6 percent Knit T-shirts: 36.9 billion dollars, 5.1 percent Knit Women’s suits: Knit women’s suits: 28.2 billion dollars, 3.9 percent Light rubberized knitted fabric: 23.9 billion dollars, 3.3 percent Synthetic filament yarn woven fabric: 20.9 billion dollars, 2.9 percent Raw cotton: 18.9 billion dollars, 2.6 percent Non-retail synthetic yarn: 18.8 billion dollars, 2.6 percent. Six countries at G20 keen on UK trade talks, says Theresa May. China is among six countries at the G20 summit that are interested in trade talks with the UK, British officials have said, despite the US and Japan issuing warnings about the negative consequences of Brexit.

Theresa May initially named India, Mexico, South Korea, Singapore and Australia as countries that would welcome initial discussions about enhancing free trade with the UK. A UK official source later said China had also been keen to explore direct trading relations with the UK after Brexit. “They specifically said China would be open to a bilateral trade arrangement. That is interesting to us as we leave the European Union,” the official said.

May omitted the names of the majority of other countries at the summit in Hangzhou, China – including the US, Japan, Brazil, South Africa, Turkey and Indonesia, which appear to have given no such assurances. However, the UK prime minister has also had to endure some difficult discussions about the consequences of Brexit. Luxury footwear brand Jimmy Choo boosted by weaker pound. Celebrity-favourite footwear brand Jimmy Choo has posted rising profits and said it expects a weaker pound in the wake of Brexit to further boost revenues and profits.

The luxury shoes and accessories firm, popular with the likes of Jennifer Lopez and Sandra Bullock, said that because only 9.5 per cent of its global revenues are in pounds compared to a larger 28 per cent of operating costs, a weaker sterling ‘will lead to a reported upside in business performance at a revenue and profit level’. The comment came as Jimmy Choo posted a 43 per cent rise in operating profits for the six months to the end of June to £25.3million boosted by a weak pound, as well as growth in China and in its men's coillection. Luxury appetite: Jimmy Choo said it saw ‘impressive’ growth in China, which has been a tough market for its competitors recently While being well-known for its skyscraper heels, Jimmy Choo's men’s line and handbags have also been doing well.