Le retour en grâce du charbon. LE MONDE GEO ET POLITIQUE | • Mis à jour le | Par Gilles Paris Le XXIe siècle sera-t-il celui de la renaissance du charbon ?

L'étude du cabinet Wood MacKenzie qui pronostique que la houille, devenue bon marché, occupera la première place des énergies primaires à la fin de la décennie présente un mérite. Celui de rappeler, notamment en Occident, où des débats énergétiques se concentrent sur la place future des énergies renouvelables ou sur l'exploitation controversée du gaz de schiste, que la part du charbon n'a cessé de progresser dans le monde au cours des quarante dernières années. Chinese coal: key to a global climate solution. Author: Kevin Jianjun Tu, Carnegie Endowment.

EU still subsidising coal industry despite climate change. Climate change is killing nearly 400,000 people worldwide each year and it is already costing the global economy €930bn annually – warns think-tank The European Investment Bank is greener than it used to be. It now lends half its annual energy pot to energy efficiency and renewables. The future of energy? Coal. Grim news for environmentalists: Coal is on pace to match oil as the world's leading energy source within 10 years.

A report by the International Energy Agency notes that abundant supplies from places like Indonesia, India and Australia, combined with "insatiable demand" from China and emerging markets will drive coal's surge unless international energy practices shift. "Coal's share of the global energy mix continues to grow each year, and if no changes are made to current policies, coal will catch oil within a decade," IEA executive director Maria van der Hoeven said in a press release, noting that the trend would assure continued growth in CO2 emissions and their climate change implications. Van der Hoeven was announcing IEA's annual Medium Term Coal Market Report, which forecasts that coal will nearly catch oil by 2017, when global coal consumption will hit 4.32 billion tons of oil equivalent (btoe), compared to 4.4 billion tons for oil. THE BIG PICTURE: The Coal Pile. DIW says three strikes against coal in Germany. Coal power Germany's premier economics institute takes a look at the future of power from lignite in terms of profitability, suitability for the country's future energy supply, and the environment.

On all three counts, the researchers say brown coal has no future, and the last units will probably be closed "around 2040/45. " Increasingly, international onlookers concerned about climate change – and sometimes not completely familiar with the debate in Germany, perhaps for an inability to speak the language – charge that Germany is switching from nuclear to coal. Renewables International has repeatedly discussed the matter, most recently with reference to data from Germany's Energy Agency (Dena). Other data, however, can seem to suggest the opposite. Diwkompakt_2012-069.pdf (Objet application/pdf) New Global Assessment Reveals Nearly 1,200 Proposed Coal-Fired Power Plants. Coal-fired power plants are a major source of greenhouse gas emissions—one that could be increasing significantly globally, according to new analysis from the World Resources Institute.

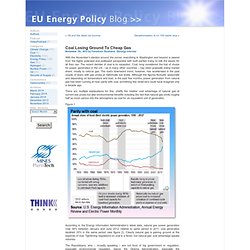

Untitled. November 19, 2012 Source: U.S.

Energy Information Administration Power Plant Operations Report (EIA-923) and U.S. Surface Transportation Board's Confidential Waybill Sample. The average cost of shipping coal by railroad to power plants increased almost 50% in the United States from 2001 to 2010. Railroad transport accounts for more than 70% of U.S. coal destined to the electric power sector, so changes in rail rates can have an important impact on the cost of coal delivered to power plants.

On average, nominal U.S. rail rates for shipping coal grew from $11.83 to $17.25 per short ton from 2001 to 2010. National numbers can be misleading, however, as regional dynamics tend to vary considerably among the six major coal basins. The wide range in minemouth coal prices and transportation distances across the United States create significant variation in the impact of transportation rates on overall coal costs, with different basins affected to significantly differing degrees. Coal reserves in the United States: Geology explains why we have so much coal. Photograph by Saul Loeb/AFP/Getty Images.

When you think of the vast expanse of wet prairies in Florida’s Everglades, the peat-filled wetlands of Georgia’s Okefenokee Swamp, or the Amazon River Delta, coal isn’t the first thing that comes to mind. But these landscapes are modern-day examples of the enormous, ancient inland seas and dense tropical swamps that turned into today’s coal beds. Les entreprises énergétiques polonaises veulent plus de charbon. Coal Losing Ground To Cheap Gas by EU Energy Policy Blog. With the November’s election around the corner, everything in Washington and beyond is viewed from the highly polarized and politicized perspective with both parties trying to milk the issues for all they can.

The recent demise of coal is no exception. Coal, long considered the fuel of choice for power generation in the US – as in many other countries – has been gradually losing market share, mostly to natural gas. Coal exports on record pace in 2012, fueled by steam coal growth - Today in Energy. October 23, 2012 Source: U.S.

Energy Information Administration, Short-Term Energy Outlook, U.S. Predicting U.S. Coal Plant Retirements. The question concerning coal plant retirements forced by looming regulatory rules, low gas prices, and moribund load growth has changed from “Why?”

To “How many plants?” Many highly detailed analyses and reports have been written on the subject by superbly qualified analysts. This approach to estimating potential plant closures is much more qualitative, and much easier to understand. However, the results closely align: About 50 GW are threatened. Few subjects elicit such a visceral response from members of the U.S. power industry as the forced retirement of coal-fired power plants.

Since the formation of the Environmental Protection Agency (EPA) in late 1970, polluting discharges have steadily decreased to the point that today’s air and water cleanliness is unmatched since before the start of the industrial revolution. Today, the question has evolved into “How much regulation is enough?” Added Regulatory Hurdles Will Accelerate Coal Plant Retirements. The U.S. Environmental Protection Agency is developing a number of new regulations for the power sector governing air emissions, cooling water intake structures, and coal combustion waste disposal methods. Combined, these regulations have the potential to drive as much as 40% of existing coal-fired generating units to retire in the next 10 years, representing about 51 GW.

Over the past two-plus years, we have heard the regulatory drumbeat for the coal-fired power sector quicken and increase in volume.