Home - MetaIntegral. A platform is a business model that creates value by facilitating exchanges between two or more interdependent groups, usually consumers and producers.

In order to make these exchanges happen, platforms harness and create large, scalable networks of users and resources that can be accessed on demand. Platforms create communities and markets with network effects that allow users to interact and transact. PLATFORM BUSINESS MODEL DEFINITION: a business model that creates value by facilitating exchanges between two or more interdependent groups, usually consumers and producers. Like Facebook, Uber, or Alibaba, these businesses don’t directly create and control inventory via a supply chain the way linear businesses do. Updated Reading List : SecurityAnalysis. Real Economy Lab. Business portal for executives created by a busy executive. Data-Driven Architecture — re:form. A few years ago, a group of UCLA anthropologists and archeologists conducted one of the most thorough studies of how people live in the United States.

The study took 32 middle-class Los Angeles families and observed them as they went about their days, going beyond superficial notions of how people live and into the real nuts and bolts of daily home life. Out of this study came the book, “Life at Home in the 21st Century,” an unflinching look at the often harried state of the modern American family. One particularly interesting part of the book tracked the families’ movements every 10 minutes over two weekday afternoons and evenings, observing how they use their homes. The above map shows what one family’s movements looked like—a map that Jeanne Arnold, who oversaw the study, said is very representative of all the families. Almost all activity is centered around the family room and kitchen.

When it comes to building a startup, entrepreneurs put a multitude of things at risk.

As an entrepreneur, how can one know whether it is worth the gamble to grow their idea into a company? Though there is no guaranteed way to found a successful startup, there are various ways entrepreneurs can identify and minimize many of the risks that face their potential company. One of the first steps an entrepreneur can take is to identify the 9 basic building blocks of their business model. In answering the first 9 questions, entrepreneurs can better gauge whether their startup will be headed towards the path of success. In our infographic below, we have simplified the 9 crucial questions entrepreneurs should answer before embarking on building a startup: Everyone knows that particular feeling of dread that accompanies a lull in conversation at a party, networking event, or even a job interview.

You’ve already covered the usual small talk and then, oof, you hit a dead end. What now? Even the most extroverted among us know that being a good conversationalist doesn’t always come easy—but there are some experts who have had more practice than the rest of us. Writers, journalists and others who interview sources regularly have developed tried and true techniques that help them connect deeply with people. Not only can interviews with thought leaders in your field provide a great source of content for your blog or website, the skills honed while interviewing are useful in many types of communication. The intersection of design thinking, strategic consulting and customer centricity Design thinking, a set of intuitive principles bound to bring simplicity in an otherwise complex business situation, has been a topic of consultants, marketers, designers and other industry (and academic) leaders and thinkers for quite some time.

Design thinking is often perceived as a tool that leads to disruptions and success, its main premise being better understanding of customers’ wants and needs. That’s achieved by observing them in their natural surroundings, listening rather than asking (think of traditional focus groups) and testing and iterating multiple solutions. Why do the best price metrics and price models fail?

You use a price structure that does not align with your brand When building your price structure, you should evaluate whether the intended price structure aligns with the firm’s brand positioning. The crowdfunding model continues to evolve.

Besides the four basic crowdfunding platform models described in our earlier CF 101 – Part Two article, there has recently emerged a new breed of hybrid models which deviate from these standard platform types. These include co-investment and investor-led type of models, as well as more niche platforms focused on a particular sector. Extracted from our Democratising Finance, Alternative Finance Demystified Report, today’s post will provide a brief overview of these “mixed” platforms that have branched out from the original models.

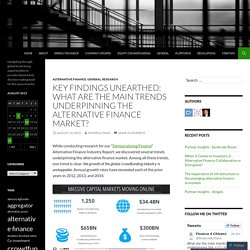

Co-Investment Models Pioneered by OurCrowd and VentureFounders, recent hybrid, co-investment models focused on early stage issuers have emerged. While conducting research for our “Democratising Finance” Alternative Finance Industry Report, we discovered several trends underpinning the alternative finance market.

Among all these trends, one trend is clear: the growth of the global crowdfunding industry is unstoppable. Annual growth rates have exceeded each of the prior years in 2012, 2013, and 2014. To give you an indication of the sheer size of this rapidly growing sector, according to the latest Massolution Crowdfunding Industry Report, total funding volume of the crowdfunding sector in 2013 reached a whopping $6.1 trillion. This represents a 125% annual growth over 2012. In fact, if the Alternative Finance sector does reach its forecasted $34.4 billion in funding in 2015, it will have surpassed the venture capital industry’s $30 billion of annual funding volume. So what other interesting key findings did we unearth while researching this rapidly growing market? Last time I emphasized getting specific on your revenue streams – down to the customer segment, pricing model, and customer lifetime assumptions.

In this post, I’m going to show you how to use these simple inputs to ballpark your business model and test whether it’s worth pursuing. If you don’t have a “big enough” problem worth solving (that’s not even plausible on paper), then why expend any effort on it. The traditional top-down approach for doing this is attaching your business model to a “large enough” customer segment. When Mark Zuckerburg started Facebook in 2004, he wasn’t the first building a social networking platform.

There were dozens of other social networking platforms before his – many with millions of dollars in funding and millions of users. Yet, he still managed to build the largest social networking platform on the planet. How did Facebook manage to win against bigger and better funded competitors who had a huge head-start over them? The answer: Facebook won on strategy – not on an original founding vision or an inherent unfair advantage. This week I am participating in Crowdsourcing Week Europe 2015 in Brussels. The conference has an amazing range of speakers from both the public and private sector sharing their ideas about, and experiences from, the Crowd Economy. My session focused on the critical role of Communities in the Crowd / Collaborative Economy, and covered: 20th century businesses aren’t adapting to 21st century realities;Why we need a fundamentally new and more expansive approach to building online communities in our evolving global economy;Emerging opportunities for businesses to create and exchange new forms of value with their communities and in the process, become more sustainable. 1.

Networked Companies Thrive In a recent article from Harvard Business Review, a study between Deloitte and a team of independent researchers examined 40 years of S&P 500 data to examine how business models have evolved with emerging technologies. Network Orchestrators. 100 Personal Development Tips to Improve Your Life and Be Happier.

The quiet financial services revolution begins. James Currier is a cofounder and partner of NFX Guild, an early-stage fund with a three-month program for marketplace and network businesses. How to join the network. Canaan Partners, one of the Sandhill Road posse in Silicon Valley, is a VC firm that has moved big into the alternative finance space. With over $4.2 billion under management they have the fire power, and the tool kit, to move quickly into promising, early stage companies. Etsy's IPO Is a Direct Challenge to Wall Street's Beliefs. SaaS Metrics 2.0 - Detailed Definitions. Collaboration Business Plan Template. Launch your own online school, create your online courses in minutes, and it is FREE!

What’s A Startup? First Principles. Purpose At Work by Imperative. Quora Responses. Original One-Page Strategic Plan. How to Make Wealth. Kcs_taxonomy.pdf. Accredited Investor Markets.