Money We Have

I’m Barry Choi, a Toronto-based personal finance and travel expert.As a completely self-taught, do-it-yourself investor with no formal training, I make money easy to understand for all Canadians. I combine my knowledge of finance with my passion for travel and encourage people to see the world.

BMO World Elite Mastercard Review. **This post may contain affiliate links.

I may be compensated if you use them. The BMO World Elite Mastercard was easily one of the best BMO credit cards. It’s their flagship travel rewards credit cards and comes with great benefits including lounge access, travel insurance, concierge service, extended warranty and more. What people love is that the sign up bonus is typically generous and it has a strong earn rate. But is that enough for you to sign up? BMO World Elite Mastercard benefits $150 Annual fee – Fee waived in the first yearGet up to 40,000 BMO Rewards points as a welcome bonus ($285 value) Earn 3 BMO Rewards points per $1 spent on dining, entertainment, and travel purchasesEarn 2 BMO Rewards points per $1 spent on all other purchasesMastercard Airport Experiences membership provided by LoungeKey, plus 4 annual complimentary passesComprehensive travel insurance package includedFree global WiFi Since lounge membership normally costs $99 USD a year and $32 per visit.

Final thoughts. Best budget apps. American Express Platinum Canada Review. Normally, my American Express Platinum Canada review is positive since you get so much value out of the card, but due to the world pandemic, American Express has devalued the card.

The current sign up bonus for the American Express Platinum Card is 25,000 Membership Rewards points when you spend $2,000 in the the first three months of card membership. Admittedly, this offer is quite low compared to previous welcome bonus, but it seems to be a reaction to COVID-19. For the time being, the American Express Gold Rewards Card is a better offer as you can earn up to 30,000 points as a sign up bonus when you use a referral link. Best cashback credit cards in Canada. Figuring out what the best cash back credit cards in Canada should be an easy process right?

You take a look at what’s the earn rate for each card and then you apply for it right? Well, that’s one of the factors that would help you pick a card, but you also need to think about the additional benefits such as insurance or experiences that are offered before you put in an application. Best air miles credit cards.

Scotiabank Passport Visa Infinite. Over the years, many credit cards have introduced no foreign transaction fees as a standard benefit, but the Scotiabank Passport Visa Infinite was one of the first out of the gate.

What’s interesting is that even though this credit card was introduced a few years ago, it’s still one of the best travel credit cards in Canada. What really makes this card stand out is the six free annual lounge passes that you get. Again, this was one of the first cards to introduce no forex fees and lounge access, yet no other credit card has similar benefits in my opinion. When you look at all of the features the card has to offer, it’s not hard to see why it’s one of the best Scotiabank cards in Canada. So what exactly do you get? Scotiabank Passport Visa Infinite Card benefits The Scotiabank Passport Visa Infinite Card (referral link) comes with quite a few benefits and it seems like it was clearly built with the modern traveller in mind. Best credit cards. Credit Cards with no Annual Fee. The best travel credit cards and best cash back credit cards in Canada are extremely popular, but most of them come with an annual fee.

This isn’t a big deal if you believe the benefits are worth it, but what about credit cards with no annual fee, are they any good? The short answer is yes, but your options are much more limited. The good thing is that some of the best no fee credit cards come packed with benefits and are usually the ideal card for specific situations. Read my guide on the best no fee credit cards now to find out which ones you should apply for. PC Financial World Elite Mastercard Earn 45 PC Optimum Points per $1 dollar spent at Shoppers Drug MartEarn 30 PC Optimum Points per $1 spent where PC Products are soldEarn 30 PC Optimum Points per $1 spent at PC TravelEarn 30 PC Optimum Points per litre at Esso/Mobil locationsEarn 10 PC Optimum Points per $1 spent on all other purchases The PC Financial World Elite Mastercard is ideal for people who collect PC Optimum points.

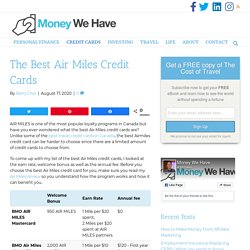

BMO Air Miles World Elite Mastercard Review. Best air miles credit cards. AIR MILES is one of the most popular loyalty programs in Canada but have you ever wondered what the best Air Miles credit cards are?

Unlike some of the best travel credit cards in Canada, the best Airmiles credit card can be harder to choose since there are a limited amount of credit cards to choose from. To come up with my list of the best Air Miles credit cards, I looked at the earn rate, welcome bonus as well as the annual fee. Before you choose the best Air Miles credit card for you, make sure you read my Air Miles review so you understand how the program works and how it can benefit you. BMO Air Miles Mastercard No annual fee950 AIR MILES welcome bonus*Earn 1 AIR MILE per $20 spent on all purchasesEarn 2 AIR MILES per $20 spent at participating AIR MILES partners (see list of partners here)Get 5x the Miles at Shell until December 31, 2020.1.99% interest rate on balance transfers for 9 months (1% fee applies)Purchase protectionExtended warranty.

Credit Cards With Lounge Access. Best airline credit cards in Canada. Scotiabank Passport Visa Infinite Card Review. The best credit card offers in Canada. **This post contains affiliate links Determining what the best credit card deals in Canada are purely subjective.

Unlike the best travel credit cards in Canada where you can actually measure things based on the signup bonus and earn rates, the best deals can be open to interpretation. With this in mind, my selections are based on actual promotions as well as benefits that you get right away without much work. Since credit card offers often change, I’ll update this article on a regular basis. The best credit card offers in Canada.

The Best Cash Back Credit Cards in Canada - Money We Have. Best Airline credit cards in Canada. Westjet Rewards Review. If you fly WestJet on a regular basis or even if you fly them once a year, you’ll want to learn more about their loyalty program known as WestJet Rewards.

What many people don’t realize is that it’s a cash back type of rewards program so it’s easy to understand. There are no blackout dates or redemption schedules to worry about, you just claim your WestJet dollars on whatever you want which is why WestJet Rewards is one of the best travel rewards programs in Canada. Redemptions start at just $15 WestJet dollars so it’s easy to use your dollars right away. What’s even more impressive is that WestJet has consistently made improvements to their rewards program. This is a huge deal since most loyalty programs devalue what’s already available. How to earn WestJet dollars When travellers spend money on WestJet flights, WestJet vacation packages, or cars and hotels booked on westjet.com, they’ll earn 0.5% – 8% cash-back in WestJet dollars depending on their tier.

Additional Silver tier benefits. Amex Gold Rewards Card Review. Best budget apps. Best Budget Apps. Creating a budget is a smart financial decision since it can help you track your spending and help you save.

But, as helpful as this can, creating a budget can be painful. At least if you do it traditionally with spreadsheets or pen and paper. However, thanks to technology today there are many easier ways to track your money. Here’s what you need to know about the best budget apps available in Canada. Why Consider Using a Budget App To start with, using a budget app is much easier and less time consuming than having to worry about tracking it on your own. What to Look for When Choosing a Budget App There are plenty of budget apps available in Canada, but you do need to be a bit selective in choosing the best one for your needs. Some budget apps will allow you to do all of the above, but a few of these apps are more tailored towards specific needs. Scotiabank Momentum Visa Infinite Review. Amex Gold Rewards Card Review. **This post contains affiliate links The American Express Gold Rewards Card is one of the best travel rewards credits in Canada and is currently one of my favourite cards on the market.

Some people complain that Amex isn’t widely accepted, but in recent years, more and more merchants now allow you to pay with American Express. Although this is an inconvenience when your card isn’t accepted, American Express Membership Rewards is the best bank travel rewards program in Canada. Membership Rewards points are highly flexible thanks to their transfer partners. For context, you can transfer your Membership Rewards points to Aeroplan on a 1:1 basis or to Marriott Bonvoy at a 1:1.2 ratio. Architectural Photography Miami. Scotiabank Momentum Visa Infinite.

Talk to any person with knowledge about Canadian credit cards and they’ll tell you that the Scotia Momentum Visa Infinite card is the best cash back credit cards in Canada. What makes this card so popular is the fact that the rewards are simple, easy to earn, and even easier to redeem which makes it an appealing card for families and big spenders. You’ll earn a cash back rate of 4% on groceries & recurring bill payments, 2% on gas and transit, and 1% on all other purchases Plus, the annual fee of $120 is usually waived for the first year so you can try this card out for free.

Scotiabank Momentum Visa Infinite. Best low-interest credit cards in Canada. Best High Interest Savings Accounts in Canada. **This post contains affiliate links With Canada having some of its lowest interest rates in the last decade the thought of a high-interest savings accounts in Canada may seem absurd. To complicate things, there are so many different banks in Canada and they all have various accounts that come with different features.

If you’re not aware of what to look for or why a high-interest savings account matters to you, you may end up just signing up for the first account offered to you. The key thing to understand is that the best high-interest savings accounts in Canada won’t make you rich. Heck, the rate you get may not even beat inflation, but the idea is that the money deposited will be safe and earn you some interest. With so many different accounts available, you may not be sure where to look, but don’t worry, I’ve rounded up the ones with the best rates for you to compare. Cashback Credit Cards. Best Travel Credit Cards. **This post contains affiliate links If you’ve checked out some the best travel credit cards in Canada lists out there, you’ve probably noticed that most of them focus on categories.

You’ll find recommendations for the best airline, hotel, travel insurance, no foreign transaction fees, etc. While this is very useful, I think that the sign up bonus is arguably the most important thing as it can be worth hundreds of dollars. My list below of the best travel rewards credit cards in Canada is focused on that big welcome bonus and what it takes to get all those points/miles. As you’ll quickly learn, some of the bonuses only require a minimal amount of effort to get hundreds of dollars in travel rewards. I do NOT recommend applying for all of the below cards (there’s more than a dozen cards on the list). Credit Cards With Lounge Access. **This post contains affiliate links One of the worst things about travelling is the airport experience before a flight or during a layover.

Think about the uncomfortable seating (when available), crowded bathrooms, overprice food and noisy/busy areas. To escape this chaotic environment, you can head into airport lounges which are private, offer food, and comfortable seating. Each lounge is different and offers different amenities, but there’s no denying how comfortable they are. The problem is, normally you need to pay a yearly membership fee of $99 USD and then $32 USD for each visit which is not exactly cheap. Best Cashback Credit Cards In Canada.