Creating an Art Exhibition. Would you like to present an art exhibition at Brandeis?

Here are some suggestions for a successful show. Show Me … Why and When? Six to eight weeks before you open the exhibit, take the following first steps. Develop your purpose. Why you are interested in presenting this exhibition to the Brandeis community? See Creating an Audience for many more suggestions on publicity and communications. Finding Your Space There are some wonderful exhibition spaces on the Brandeis campus, but they are not plentiful.

Complete the Space Request Form (PDF) and send it to the contact person for the space for which you are applying. The Dreitzer Gallery in the Spingold Theater Center is used several times a year by the Department of Fine Arts for student exhibitions, particularly during the spring semester. Creating an Audience See Creating an Audience for ideas. Preparing Your Exhibition Curators spend a lot of time preparing and hanging exhibits to make them look clean, professional and inviting. 0300004. File 1099 Online & File W2 Online: eFile 1099 & W2 Forms. eFile1099NOW. Filing your 1099 tax forms shouldn't be costly, frustrating or time-consuming.

Yet, the myriad services and offerings out there have made it so. With efile1099NOW.com, we've made it our mission to take that burden off your shoulders. It's our simple, intuitive, cloud-based software solution that offers comprehensive processing of your 1099 and W-2 forms, including printing, mailing and optional electronic delivery to your recipients, and electronic filing with the IRS and SSA. And as an IRS-approved e-file provider, we're committed to ensuring the security of your data. From the moment you sign up, your data is secured safely with best-in-class encryption. For instant, comprehensive answers to your questions on any topic, including our services, filing deadlines, technical support, account issues and more, visit our Support Site.

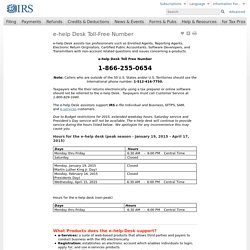

You can search our knowledgebase 24/7. For fast answers to the most common questions about our service, see Frequently Asked Questions. IRS FIRE Logon. E-help Desk Toll-Free Number. E-help Desk assists tax professionals such as Enrolled Agents, Reporting Agents, Electronic Return Originators, Certified Public Accountants, Software Developers, and Transmitters with non-account related questions and issues concerning e-products. e-help Desk Toll Free Number Note: Callers who are outside of the 50 U.S.

States and/or U.S. Territories should use the International phone number: 1-512-416-7750. Taxpayers who file their returns electronically using a tax preparer or online software should not be referred to the e-help Desk. The e-help Desk assistors support IRS e-file Individual and Business, EFTPS, SAM, and e-services customers. Due to Budget restrictions for 2015, extended weekday hours, Saturday service and President’s Day service will not be available. f1096_14.pdf. IRS help for Real Estate investors - Michael Plaks. Beginning of the year is a perfect opportunity to get even with all those contractors who worked for you during 2014: report them to the almighty IRS and make them pay taxes on the money they received from you.

In fact, it applies not only to contractors but to everyone who did some kind of work for you last year: property managers, wholesalers, mentors, attorneys, and even – yes! – accountants. Should you even bother? Your first question might be – why should I? Well, three top reasons come to mind: It will allow you to deduct their earnings on your own tax return.It is required by law for any person to whom you paid at least $600 in 2014, total. When, where, and how? The next question is – how do I do it? Unlike most other forms, 1099s cannot be simply downloaded and printed at home. Who should receive 1099-MISC? The only other critical question is – whom do I need to send these 1099s to?

Contractors of all kindwholesalers and birddogs (but not Realtors!) Fw9.pdf. f1096_14.pdf. f1099msc_14.pdf.

IRS help for Real Estate investors - Michael Plaks.