Startup Tools. Startup Tools 1.

Startup Tools Click Here 2. Lean LaunchPad Videos Click Here 3. 4. 5. 6. Private Limited Company Registration. Frrole Discloses Everything From Founders Equity to Revenue. Brings Transparency To The Startup Ecosystem - The Startup Journal - Indian Startup Stories, Startup News, Startup Resources, Interviews. Amarpreet Kalkat If you are following the startup ecosystem closely then you might know that there have been long discussions about the founder’s salary, equity division, and revenue in startups.

No individual or startup has ever disclosed these to the public. But Frrole, a Bangalore based startup which helps brands to discover and analyze their social media presence have gone beyond this trend and has publicly disclosed everything that none ever done. The details were posted by Amarpreet Kalkat, the founder of Frrole. Founders Equity The founder equity before the seed round raise was divided as 60:20:20 between the three cofounders – Amarpreet, Nishith and Abhishek (Amarpreet had started, Nishith and Abhishek joined in later). 2.5% of it was issued to Rishab Malik, our lone advisor + part-time team member, before the seed round raise.

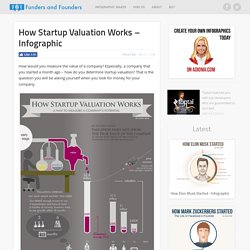

Seed Round In the seed round, we raised $245K at a post money valuation of $1.065 million. How Startup Valuation Works - Illustrated. How would you measure the value of a company?

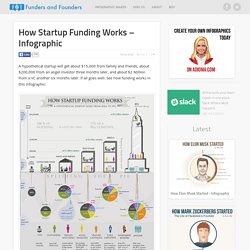

Especially, a company that you started a month ago – how do you determine startup valuation? That is the question you will be asking yourself when you look for money for your company. Create an infographic timeline like this on Adioma Let’s lay down the basics. Valuation is simply the value of a company. How Funding Works - Splitting The Equity With Investors - Infographic. A hypothetical startup will get about $15,000 from family and friends, about $200,000 from an angel investor three months later, and about $2 Million from a VC another six months later.

If all goes well. I have a job offer at a startup, am I getting a good deal? Part 1: The offer. We’ve been answering this question a lot lately: “I have a job offer at a startup, am I getting a good deal?”

This isn’t a comprehensive answer—just some questions we would ask if we had an offer. If you don’t understand your offer, get a lawyer. But—right or wrong—most people don’t hire lawyers to review their offer letter. Table of Contents. Negotiating Your Startup Job Offer - Robby Grossman. Over the last three years I’ve been on both ends of job offers at startups.

One thing that’s struck me is how little most applicants know about what to expect in a job offer, and in many cases, what the written offer they’ve received actually means. I was extremely fortunate that the first startup job offer I received was written by a pair of founders who had the utmost integrity and explained things very clearly. How I negotiated my startup compensation - Michelle Wetzler of Keen IO. Hi, I’m Michelle.

I recently left my job as a technical consulting manager and joined my best friends and my fiancé, Kyle, at Keen.io (I wrote about that here). This is the story of how I negotiated my compensation. When I started thinking about joining Keen, I quickly realized there is a lot I don’t know about startups. I’ve picked up quite a bit just by being around our CEO, Kyle, for the past few years – he’s been in and out and up and down in startups, and has shared some of the hard lessons he learned along the way. Joining an Early Stage Startup? Negotiate Your Equity and Salary with Stock Option Counsel TipsSTOCK OPTION COUNSEL. Be aware that many early-stage startups will ignore Convertible Notes when they give you the Fully Diluted Capital number to calculate your ownership percentage.

Convertible Notes are issued to angel or seed investors before a full VC financing. The seed stage investors give the company money a year or so before the VC financing is expected, and the company "converts" the Convertible Notes into preferred stock during the VC financing at a discount from the price per share paid by VCs. Since the Convertible Notes are a promise to issue stock, you'll want to ask the company to include some estimate for conversion of Convertible Notes in the Fully Diluted Capital to help you more accurately estimate your Percentage Ownership. Q: Is 1% the standard equity offer? 1% may make sense for an employee joining after a Series A financing, but do not make the mistake of thinking that an early-stage employee is the same as a post-Series A employee. Yes. Q: What is fair for vesting? 1. 1. 3. 4. 5. What Is The Best Way To Structure Independent Contractor Equity Compensation For A Bootstrapping Startup?

Pre-Startup Founder Agreements. Getting Paid in Equity: A What to Do Guide. Equity-based pay is often used by the founders of young startups who want to grow their businesses but cannot offer big salaries to qualified professionals.

Typical arrangements seek to either partially or fully compensate service providers with stock in the company in exchange for hard work. Depending on where you are at (career- and age-wise), as well as where the company is at –and where it is going– this offer could either be an amazing opportunity, or it could be a total waste of your time and potential. Below are some helpful tips and suggestions to keep in mind when contemplating whether or not to take an equity-based position.

Gauge The Company’s Ability To Sell Equity compensation can be a lucrative investment of your time if you work for the right business. In business, the most common type of risk analysis one can perform on a company is known as the SWOT analysis. Free Startup Docs: How Much Equity Should Advisors Get? It’s an age-old scenario: You’re building a company, you have a product idea, and you’ve got the framework laid out in your head, but you want some expert advice and guidance on how to take the next steps.

So, you go out to find a veteran entrepreneur, ask her to be an advisor in your fledgling company … and then what? This is where a lot of founders get stuck. Entrepreneurs want to compensate their mentors and advisors for the time they dedicate to helping their businesses grow, but they have no idea how much equity to offer. Not to mention, once the founder and advisor have nominally agreed to a relationship, law firms enter the mix and seed the new advisor with a mountain of paperwork — legal agreements, options agreements — documents stuffed with legalese and binding statements. Just this hassle alone is sometimes enough to scare an advisor away from the relationship, at which point both sides lose. So what do you think? For more, see the FAST document below: