Understand What is Mutual Funds & Know the Benefits of Mutual Funds at Karvy Online. A professionally managed investment fund collected from many investors for the purpose of investing in securities such as stocks, bonds, money market instruments and similar assets.

Mutual funds have become popular investment vehicles offerings various kinds of schemes with different investment objectives. Mutual fund investment is one of the safest, easiest and convenient ways of making successful investments. We provide a platform to invest in mutual funds in a hassle-free, simple and convenient manner through our website www.karvyonline.com and through all our branches. Learn the Difference Between FD vs Mutual Funds at Karvy Online. Why should one trade in commodities?

Not only shares can be traded; various commodities like oil, wheat, soybean, gold, silver, etc. are traded in the commodity market mainly for the purpose of hedging. For example, think of a farmer who is worried about the price fluctuations and feels he would face loss after some time. He enters into a commodity futures contract wherein he agrees to sell his commodity at a specific price at a specific time.

By doing so, the farmer tries to reduce his loss. Commodity trading is not meant only for farmers as anybody can trade and make profit. Know IPO Meaning & Basics at Karvy Online. Investing is very much essential these days as savings alone is not adequate to fulfill all our financial goals and also to beat inflation.

There are several investment options available and you can choose them as per your needs and convenience. You have to start your investments right from a young age so as to get good returns. Investment habit brings a sense of financial discipline in a person’s life as it makes you allocate a certain amount of money periodically for the purpose of investment. Based on your risk appetite and time horizon to achieve your financial goals, you can select the appropriate investment option. There are some financial assets that help you achieve your short term goals and other assets that help you achieve your long term goals. Understand SIP Meaning & Features at Karvy Online.

Everyone of us aspire to fulfill our dreams and have many ways to achieve it.

But the important thing is to find the best means. Share market investing can be done other than just investing in banks or land. Interest rate from banks are not attractive due to rising inflation rates and buying or selling land has become a cumbersome process due to the legalities and processes involved. The liquidity factor is high in case of share market investments. Mutual funds, equity, bonds, commodity, currency, etc. are among the various financial products offered by the stock market. SIP (Systematic Investment Plan) is a mutual fund tool and is one of the easiest ways through which any common man can enter the stock market. Financial discipline i.e. investing should become a major and inevitable part of your everyday life. Rupee Cost AveragingCompounding EffectFlexibility. Stay updated with Share Market Live at Karvy Online.

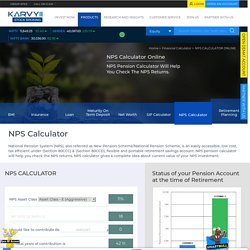

Calculate Current Value of NPS Investment with NPS Calculator - Karvy Online. Tax Benefit: EET model -> Exempt – Exempt – Tax ( The invested amount is taxable, the pension you receive is taxable) Individual’s Contribution: Investment in NPS made by an individual is eligible for tax exemption under Section 80CCD (1a) read with Section 80CCE of the Income Tax Act, 1961 which has an overall limit of Rs. 1.50 lakh.

Budget proposal on Employee/Individual(s) contribution towards NPS is exempted u/s 80CCD (1b ) up to 50,000/- extra is subject to approval of Finance bill. Employer’s Contribution: Employer’s contributions to NPS will NOT be included in the Rs1.50 lakh limit exemptions that employee avail of under Section 80C and thereby al low to SAVE EXTRA TAX on this amount under sec 80CCD(2) of the Income Tax Act, 1961 Market based Returns: NPS offers the investor an option to decide an asset allocation between Equity Instruments, Corporate Bonds and Government Securities, with up to 50% exposure to Equity instruments. Get a List of Highest Dividend Paying Stocks in India - Karvy Online. Investments are very essential to have a secured future in this volatile world.

You may be aware that if you invest in a company for a long term, you will get high yields. But other than that how else you profit from investing in a company? Dividends, bonus, rights issue, etc. are the other benefits you can avail. You may buy a company’s share and may sell it after many years when you feel it’s the right time and also depending on your needs and lifetime goals. Before you begin to invest in a company, do a complete study of the company.

Know the Highest Dividend Paying Stocks in India - Karvy Online. Learn How to Invest in Stock Market at Karvy Online. There are few things that you should know before you invest in share market.

Investing in stocks provide high returns due to the power of compounding effect. A trading and demat account is a must to start trading in the stocks. Don’t worry! It’s not a cumbersome process and it can be opened very easily online and quickly with no hassle. Understand How to Invest in Stock Market at Karvy Online. Understand What is Share Market at Karvy Online. New to stock market?

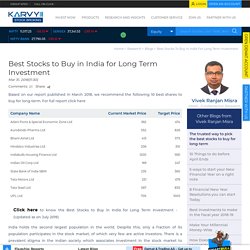

I will take you through the world of share market in this article. Firstly, let us learn what is share market? Share market is where buying and selling of share happens. Share represents a unit of ownership of the company from where you bought it. For example, you bought 10 shares of Rs. 200 each of ABC company, then you become a shareholder of ABC. Learn What is Share Market at Karvy Online. Get a List of Best Shares to Buy in India for Long Term Investment - Karvy Online. Based on our report published in March 2018, we recommend the following 10 best shares to buy for long-term.

For full report click here India holds the second largest population in the world. Despite this, only a fraction of its population participates in the stock market, of which very few are active investors. There is a prevalent stigma in the Indian society which associates investment in the stock market to betting. However, it holds no truth, as investment in stock market is more of calculated decisions of investment. On entering the stock market, most investors are unsure about selecting stocks and go by word of mouth or biases towards renowned company names. For best long-term investments, an investor is required to perform a basic research on the stock, evaluate certain indicators, focus on the overall investment strategies, consider the long-term goals and be patient.

Here's a quick look at the long-term returns generated by different tools: Know the Best Shares to Buy in India for Long Term Investment - Karvy Online. Know the List of Best Shares to Buy Today at Karvy Online. Learn about the Online Trading App by Karvy Online. Know about Mutual Fund App - Karvy Nivesh App by Karvy Online. Open Demat Account at Karvy Online. 1)Best Demat Account For Beginners In India Our life goals can be achieved only with proper financial planning.

Now don’t get too worried about financial planning. It’s just the right allocation of funds according to your needs so that you can use that money at the right time to fulfill your goal. Earning money is not a big deal but the money earned has to be utilized in the best way. Savings are not adequate to beat inflation and that’s why investment comes into picture. Learn What is Demat Account & its Benefits - Karvy Online. Know What is Demat Account & its Benefits at Karvy Online. Understand What is Online Trading & Advantages of it at Karvy Online. Know What is Online Trading & its Advantages - Karvy Online.

Know the Various Types of Demat Account at Karvy Online. Prevent Unauthorized Transactions in your Trading/Demat account --> Update your Mobile Number and Email ID with your Stock Broker/Depository Participant.

Know about Trading in Equity & Shares at Karvy Online. Know Which is the Best Demat Account for Beginners in India - Karvy Online. Our life goals can be achieved only with proper financial planning. Now don’t get too worried about financial planning. Its just the right allocation of funds according to your needs so that you can use that money at the right time to fulfill your goal. Earning money is not a big deal but the money earned has to be utilized in the best way. Savings are not adequate to beat inflation and that’s why investment comes into picture.

Got the point? Financial assets can be anything right from equity, mutual funds, IPO, bonds, debentures, NCD, currency, commodity, derivatives, etc. Understand How to Close Demat Account & Types of Demat Account Closure - Karvy Online. Investors can hold up to 5 demat accounts and many investors avail this option to open demat accounts with different depository participants.

However, Holding demat accounts attract annual maintenance changes and over a period, investors realize the need to close these demat accounts and either hold all securities in one account or close all demat accounts rematerialize the shares. Opening a demat account is now a completely online process. However, closing a demat account is not as simple and involves visiting broker office and submitting forms and documents. Account Closure If the demat account has no holdings and all payments have been settled, the investor can easily raise the closure request with the depository participant. Avail the closure form Submit duly filled and sighed form to the nearest branch Alternatively, Send duly filled and sighed form to the HO Transfer and Account Closure Once all the required documents are submitted, the account will be closed within 5 working days. Demat Account Opening Charges at Karvy Online. Enjoy lowest demat account charges from Karvy Stock Broking Ltd! Rs. 650/- Minimum or as decided by KSBL from time to time or as applicable to any scheme.

Other Charges: Exchange Transaction charges, SEBI Turnover Fees, Handling Charges, Stamp duty, Service Tax, Securities Transaction Tax, Clearing Member charges, any other Statutory charges/levies as applicable. Handling Charges, over and above brokerage would be levied, where the brokerage generated per contract per Exchange segment is less than Rs. 25, to make sum of brokerage plus handling charges equal to Rs. 25. An Administrative Charge of Rs. 10/- would be levied per each offline executed order (orders executed through our service desk / Branch Office) with a maximum of Rs. 50/- per day. Note: Above charges are exclusive of service tax, securities transaction tax and other levies by Government Bodies / Statutory Authority as applicable from time to time, unless otherwise specified.

Read about NCD & Bonds - Karvy Online. Read the Advantages & Disadvantages of IPO - Karvy Online. An IPO is the first sale of stock by which a company can go public. The stock is offered for sale to the general public by the company seeking to raise capital for expansion. Companies come out with public issue wherein they invite public to contribute towards the equity and issue shares to meet their fund requirements by sharing ownership with investors. When one buys shares in the company, he/she becomes shareholders and for that matter owner in the company by the size of share value. Advantages: IPO allows companies to raise capital by selling shares. Disadvantages: Companies need to disclose critical information including financial information on a regular basis.