Rachel Taylor

What Is Group Health Insurance. A Basic Guide to Selling Long-Term Care Insurance. A Second Chance to Switch Medicare Advantage Plans. Life Insurance for Pregnant Women. Why Life Insurance Is Not an Investment. Mental Health and the Holidays : Tips to Keep You Healthy. Why Medicare surveys are good for your health. What are the parts of Medicare? ABCD’s Explained. Types of Life Insurance. How Much Life Insurance Do I Need? How Medicare Covers Mental Health. Steps to Prepare for Medicare. What documentation can I submit for proof of income? – Stride Health. The most common documentation for proof of income includes: Pay stubBank Statements (personal & business)Copy of last year's federal tax returnWages and tax statement (W-2 and/ or 1099) If you cannot provide a copy of one of the common documents listed above, please see below for a full list of approved documents: Income Copy of last year's federal tax return along with federal schedule E that accurately reflects current income (can be Federal or state).Wages and tax statement (W-2 and/ or 1099, including 1099 MISC, 1099G, 1099R, 1099SSA, 1099DIV, 1099SS, 1099INT).Pay stubSelf-employment ledger documentationSocial Security Benefits LetterUnemployment Benefits Letter Self-employment Unearned income You can use your proof of income documentation to help enroll in Health, Life, Accident, and Disability Insurance.

Travel Medical Coverage. Medicare usually doesn’t cover health care while you’re traveling outside the U.S.

Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, and the Northern Mariana Islands are considered part of the U.S. There are some exceptions, including some cases where Medicare Part B (Medical Insurance) may pay for services that you get on board a ship within the territorial waters adjoining the land areas of the U.S. Medicare may pay for inpatient hospital, doctor, ambulance services, or dialysis you get in a foreign country in these rare cases: You're in the U.S. when a medical emergency occurs that requires immediate medical attention to prevent a disability or death, and the foreign hospital is closer than the nearest U.S. hospital that can treat your medical condition.

Guide to the SilverSneakers Program. Unfortunately, Original Medicare plans (basic parts A and B coverage) don’t cover a SilverSneakers membership.

SilverSneakers is considered a “gym membership or fitness program,” and the Medicare website explicitly says it won’t cover those. However, there is the chance that a Medicare Advantage plan will cover it. A supplemental (also known as a Medigap) plan could also cover the SneakerSilvers program. The SilverSneakers website says the program is covered by “one in four” Medicare programs, though the organization doesn’t specify if this is 25 percent of Medicare Advantage plans or 25 percent of all Medicare plans. Harvard Pilgrim Health Care. Featured Member Discounts & Savings EyeMed affiliated providers Purchase a complete pair of glasses and get 35% off frames.

Save 20% on any frame or lens options purchased separately, or on any optical accessory.* Discount is available at: In Style Optical JC Penney Optical LensCrafters Pearle Vision Target Optical View details *Participating eyewear providers offer special savings on items such as eyeglasses and contact lenses. Fitness Reimbursement If you belong to a qualified health and fitness club for four months in a calendar year, we’ll reimburse you up to $150 for you or the dependents covered under your plan Learn more about the fitness reimbursement * $150 maximum reimbursement per Harvard Pilgrim policy in a calendar year (individual or family contract).

Complementary and Alternative Medicine Take a balanced approach to well-being and save up to 30% on a wide range of services offered through our partnership with WholeHealth Living Choices. View details 1. 2. InsideTracker View details. Disease Prevention and Health Guidelines. Choosing a Health Insurance Plan. Ways to Choose a Health Insurance Policy.

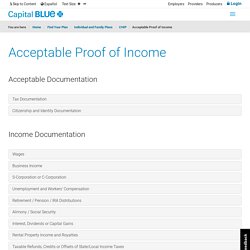

How to Use Your Health Insurance. Understanding The Difference Between Medicaid and CHIP. Policy For Care During a Disaster. Required Documentation for SEP. CHIP - Acceptable Proof of Income. Business Income Business income any business income not being reported for tax filing purposes requires a year-to-date profit and loss statement.

Sole Proprietorship 1040 federal tax form with all schedules from the previous calendar year – Mid April is the cutoff for determining which years return is acceptable (tax filing deadline). Line 31 of Schedule C should match Line 12 of the 1040 form if there is only one Schedule C. A year-to-date Profit and Loss– Only acceptable for new self employment businesses or a drastic change from previous year. If extension was filed for previous year’s taxes, proof of the extension must be received. The profit and loss must include: Business name Time period covered (example – Today is 8/25 – profit and loss should be from 1/1 through 7/31) Gross income earned in that period Line item list of expenses for the period (insurance, gas, utilities, etc) Net profit figure for the period.

Partnership. Why Choose Capital Blue Cross. Provider Finder Guide.