Public Provident Fund Calculator on PPF Investment. What is PPF?

Public Provident Fund (PPF) is a scheme of the Central Government, framed under the PPF Act of 1968. Briefly, PPF is a Government backed, long-term small savings scheme which was initially started by the Government in order to provide retirement security to self-employed individuals and workers in the unorganized sector. Today, PPF is every Indian citizens’ darling investment avenue. So, if you are keen on a safe corpus, earning a decent tax-free rate of return, enjoying tax benefit; then PPF is for you. The contributions (i.e. investments) made to the PPF account, will earn a tax-free interest and the maturity proceeds are exempt from income-tax. Keep in mind, you need to be disciplined to make the most of the PPF investments, and also meet your liquidity needs elsewhere; because under this investment avenue your money is blocked for good 15 years. 10 Basics of a PPF account The main features of the PPF account scheme are: Retirement Calculator for Retirement Planning - PeronalFN.

Retirement Calculator Retirement Calculator is an online tool which will help you to calculate your retirement corpus.

Further, you can use this Retirement Calculator to find out the future value of your current expenses. PersonalFN – Get Unbiased Mutual Fund Research and Financial Planning Services for Investing in India. Personalized Financial Planning, Weath Planning Services Online - PersonalFN. All of us have some dreams in life – be it buying a dream home, a car, children’s education, their marriage, travelling abroad for leisure, retirement, amongst host of others.

In parlance to personal finance, all these are financial goals; because after all, along with emotions they carry a monetary value. You see, for your dreams to convert into reality there’s no other alternative to effective planning. Our experience narrates that many people often have infinite financial goals with limited income.

Understanding Mutual Funds. Your Guide To Build An All-Season Mutual Fund Portfolio. Your Guide To Retire Rich With Mutual Funds. Personalized Financial Planning, Weath Planning Services Online - PersonalFN. Money Simplified Guide - 10 Steps to Select Winning Mutual Funds. What are Equity Mutual Funds? Types of Equity Funds & All You Need To Know. Due to the massive gains over the past few years, the attractiveness of equity mutual funds has increased.

There is no doubt that mutual fund investors are flooding the market. The quantum of growth in new investments becomes clear when looking at the increase in mutual fund folios over the past year. Mutual Funds recorded an addition of 1.6 crore investor accounts in FY2017-18, taking the total tally to over 7 crore. This is more than double the addition of over 67 lakh folios in FY2016-17 and 59 lakh in FY2015-16. Retail investor accounts grew by over 1.5 crore to 5.94 crore during FY2017-18. The Mutual Fund “Sahi Hai” catchphrase seems to have encouraged a new wave of investors. Are the new flocks of investors acquainted with the volatility in the market? If you are a newbie investor, don’t get lured by the performance of equity mutual funds over the past few years. Thus, PersonalFN has put together this guide to answer all questions, both basic and advanced on Equity Mutual Funds. 1.

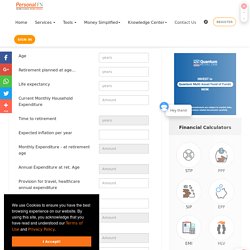

SIP: A Rewarding Strategy Everything You Need To Know. DSP Mutual Fund - DSP Fund Investment Plans in India. About Axis Mutual Fund Axis Mutual Fund has been constituted as a trust on June 27, 2009 in accordance with the provisions of the Indian Trusts Act, 1882 (2 of 1882) with Axis Bank Limited, as the Sponsor and Axis Mutual Fund Trustee Limited as the Trustee to the Mutual Fund.

The Deed of Trust has been registered under the Indian Registration Act, 1908. The Mutual Fund was registered with SEBI on September 04, 2009 under Registration Code MF-/061/09/02. The head office of the Mutual Fund is at Axis House, 1st Floor, C-2, Wadia International Centre, Pandurang Budhkar Marg, Worli, Mumbai – 400025. SBI Blue Chip Fund - Growth - Direct Plan - Mutual Fund Overview. Looking for the Best Liquid Funds of 2020 to Address Your Liquidity Needs. In an endeavour to generate decent returns with minimum risk, most of us park our hard-earned money in savings account or bank fixed deposits.

But effectively these are not viable options if you are looking to invest to address your short-term and/or for emergency needs; a Liquid Fund is worthy sub-category to consider amongst the debt mutual fund schemes. Liquid funds, on the other hand, generate 200 to 300 basis points higher returns than what your savings bank account fetches you. A basis point is a hundredth of a per cent.

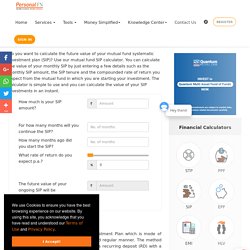

You can withdraw within a month. In other words, liquid funds offer you almost the same liquidity as your savings bank account does, but help you generate better returns. (Image Source: Business photo created by freepik) SIP Calculator – Systematic Investment Plan (SIP) Calculator. What is SIP?

Simply put, a SIP refers to Systematic Investment Plan which is mode of investing in mutual funds in a systematic and regular manner. The method of investing is similar to your investment in a recurring deposit (RD) with a bank, where you deposit a fixed sum of money (into your recurring deposit account), but the only difference here is, your money is deployed in a mutual fund scheme (equity schemes and / or debt schemes) and not in a bank deposit, and hence your investments (in mutual funds) are subject to market risk. A SIP enforces a disciplined approach towards investing, and infuses regular saving habits which we all probably learnt during our childhood days when we used to maintain a piggy bank. Yes, those good old days where our parents provided us with some pocket money, which after expenditure we deposited in our piggy banks and at the end of particular tenure we saw that every penny saved became a large amount.

Benefits of SIP. Tax Planning - Learn How to Save Tax Efficiently. Step 1: Compute the Gross Total Income The process of tax planning begins with computation of your Gross Total Income (GTI).

This step enables you to ascertain the total income earned by you during a financial year, from various under-mentioned sources of income, and helps you to judge where you stand. Income from salary Income from house property Profits and gains from business & profession Capital gains (short term and long term); and Income from other sources. Hence, GTI is the total income earned by an individual before availing any deductions under the Income Tax Act, 1961. To undertake your tax planning effectively use the relevant provisions of the Income Tax Act applicable to the various sources of income, as well as by availing deductions to GTI.

Now, one may ask – “how do I undertake this activity if I’m a novice?” Well, the answer is pretty simple! It is vital to know at least those provisions of the Income Tax Act, which directly have an impact on your personal finances. Looking for the Best Large Cap Funds of 2020? Find Out Here. The equity market continued to witness higher volatility in 2019 with the deepening of liquidity crisis in NBFCs, weak consumption growth, lower industrial and agricultural output, and global factors such as the US-China trade war.

Has the volatility in equity markets made you wary about your mutual fund investment? Don't worry. Photo created by freepik - www.freepik.com If you invest in large cap funds, it can provide the much needed stability to tide over turbulent market conditions. During the last one year when the S&P BSE Mid-cap index and the S&P BSE Small-cap index were down 0.3% and 5.4% respectively, the frontline index S&P BSE Sensex rose 13.4% while Nifty 50 rose 11.5%. Looking for the Best Large Cap Funds of 2020? Find Out Here. Best ELSS for Tax Planning in 2020. The New Year is just around the corner.

If one of your goals for the New Year is to protect your wealth from taxes, have you considered investing in Equity-Linked Saving Scheme (ELSS), an equity-oriented tax saving mutual fund? Photo created by Waewkidja - www.freepik.com ELSS, like all other equity mutual fund schemes, are managed by professional fund managers. They invest with an aim to make higher gains for their investors. So if you invest in the right schemes, you can gain much higher returns than you can probably expect from a tax saver bank fixed deposit, PPF account, NSC or any other tax-saving schemes.

Find out the best ELSS for Tax Planning in 2020. Mutual Fund Calculator – Calculate Your Returns. Mutual Fund Calculator Mutual Fund Calculator is a dedicated tool to calculate the return on your lump-sum mutual fund investment. It accessible and convenient platform which empowers investors by calculating complex calculation within no time. It generates accurate and quick result of the future value of current investment. Mutual Fund Calculator – Calculate Your Returns.

Everything You Need To Know About Financial Planning. Many may wonder - "Do I really need a financial plan? " Some feel that saving regularly in bank recurring deposits or Systematic Investment Plans (SIPs) in mutual funds is financial planning. But allocating savings and investments in ad hoc manner is not enough to achieve your life goals.

And such investments lead to inefficient utilisation of your financial resources. To become rich or to achieve all your goals such as buying a house, car, dream vacation, child's education and so on you need to make money work for you. Besides salary or business income might not be sufficient enough. Everything You Need To Know About Financial Planning. Looking for Best Small Cap Funds to Invest in 2020? Looks like small cap stocks will finally see brighter days going forward. In the last one month, the S&P BSE Sensex Smallcap - TRI index gained 10.1% after underperforming its large cap peer for nearly two years. The frontline index S&P BSE Sensex - TRI gained 2.4% during the same period. This could provide a valuable opportunity to raise exposure in small cap stocks through well-managed small cap funds for your long term goals.

Graph: Are small caps set for rally? Data as on January 16, 2020 (Source: ACE MF) Looking for Best Small Cap Funds to Invest in 2020? Best Mutual Funds for SIP in 2020. Are you among the many people who have resolved to make smart money practices to lead a healthy financial life and create wealth in this New Year? If yes, then, you would agree that a disciplined approach to investing will take you far ahead in this journey. Building a portfolio of the best mutual funds and investing through the SIP mode is one of the most efficient ways to do it. photo created by freepik - www.freepik.com Many times, investing a lump sum in mutual funds becomes a risky proposition.

This is where Systematic Investment Plan (SIP) comes to the rescue. SIP has made life easy -- it's lighter on the wallet, you don't need to time the market to generate wealth, you inculcate the habit of investing regularly, and it is an effective medium to accomplish vital financial goals such as, buying a dream home, children's education needs, their marriage, and your retirement, among others.

As it's said, "little drops of water make a mighty ocean"; SIP just does that. Qualitative Parameters. Untitled. Best Mutual Funds for SIP in 2020. Axis Long Term Equity Fund - Growth. Axis Long Term Equity Fund - Growth - Regular Plan. Top 10 Liquid Funds to Invest 2019. Many of us have money idling away in a savings bank account generating meagre returns. Why not invest in Liquid funds instead? Liquid Funds is a worthwhile investment alternative to park your short-term needs and contingency funds.

Barring a few banks, most others pay an interest of 3.5%-4.0% on balance in the savings bank account. Liquid funds, on the other hand, generate 200 to 300 basis points higher returns than what your savings bank account fetches you. A basis point is a hundredth of a per cent. You can withdraw within a month. Top 10 Liquid Funds to Invest 2019. How to Invest in Direct Mutual Funds Online & Offline - PersonalFn. How to Invest in Direct Mutual Funds Online & Offline - PersonalFN. Mutual Fund direct plans are the first choice of do-it-yourself investors. The reason is simple, direct mutual fund investment eliminates the need of a distributor. Hence, it not only saves on transaction costs if any, mutual fund direct plans come with lower fees.

While the difference in costs may seem negligible at first, but over time—thanks to the magic of compounding—the difference in value terms works out to lakhs of rupees. HDFC Balanced Fund - Growth - Regular Plan. HDFC Balanced Fund - Growth. HDFC Bank Ltd. Collateralised Borrowing & Lending Obligation Infosys Ltd. Housing Development Finance Corporation Ltd.$ ITC Ltd. Larsen & Toubro Ltd. ICICI Bank Ltd. Axis Bank Ltd.

HDFC Balanced Fund - Growth. HDFC Balanced Fund - Growth. HDFC Balanced Fund - Growth. Looking for Best Small Cap Funds to Invest in 2020?