How To Calculate EMI On Your Home Loan?-Wishfin. Which Loan Against Security Option Should You Go for. At a time when a financial emergency can crop up anytime, you could feel for instant cash, such as a personal loan.

But if you have had a poor repayment record or don’t have any credit history, the loan can be denied. Don’t lose hope! There’s a lifeline for you i.e. a loan against security, which can be anything from fixed deposit, mutual fund or a life insurance policy. But, which security should you pledge to avail of the loan? If you have a lot of securities, you have a choice to make!

Loan Against Fixed Deposit Having a loan against a fixed deposit is perhaps the easiest route an individual can opt for. Loan Against Mutual Fund You’ll be surprised to know this, but it’s a truth and a good one. Loan Against Shares As shares are considered riskier just like equity funds, one can get a maximum of 50% loan on the market value of the said security. Loan Against Bonds Loans can even be granted against bonds that are issued for 10, 20 and 30 years. Paying Multiple Personal Loan EMIs? Switch All into One & Save. At a time when there are multiple needs to fulfill, people often resort to multiple personal loans.

What’s interesting is that they take loans from different lenders having different EMI dates. All that makes it puzzling and rather cumbersome for borrowers to deal with. Different dates mean you simply can’t afford any uncertainty, which is like fighting against the basic nature of life. Differences between Liquid Funds and Arbitrage Funds? There are many investors who want to park their hard-earned money for the short term.

But there are so many options around us that we are bound to get confused. Fixed Deposits and Savings Bank Accounts have always been a choice for most. But if you want to capitalize more, you can trust on any of these two mutual funds – arbitrage fund and liquid fund, arguably the best short-term investment options. Liquidity, return on investment, risk factor, tax benefits are some factors on which you can differentiate liquid funds and arbitrage funds. The article will differentiate these two to help you choose the right option. Capital Float Business Loan EMI Calculator 2020. As Capital Float give you an option to calculate EMI manually or through calculator.

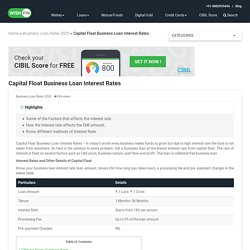

Even both the way gives you the same result. So before taking a business loan you should know the EMI amount. So you can calculate EMI amount in a few seconds through business loan EMI calculator. Required information that is loan amount, interest rate and tenure period. The results include monthly EMI amount, total amount with interest, flat rate per month and per annum, total amount and yearly interest amount. Capital Float Business Loan Interest Rates Oct 2020. Capital Float Business Loan Interest Rates – In today’s world every business needs funds to grow but due to high interest rate the fund is not taken from anywhere.

So here is the solution to every problem. Get a business loan at the lowest interest rate from capital float. The rate of interest is fixed on several factors such as Cibil score, business nature, cash flow and profit. This loan is collateral free business loan. Interest Rates and Other Details of Capital Float. How Financial Planning for Millennials can the Economy & Them. Slowly and Sadly, the Gen X (people who raised millennials), are taking a back seat in the Indian economy.

Millennials are taking over the steering wheel to drive the Indian economy. By 2022, India is expected to become the youngest country with an average age of 29. They contribute 46% of the Indian workforce. So, millennials are the people who are going to build the future Indian economy. But, they lack some financial management skills, which their parents learnt early-on in their lives due to the responsibilities that were passed on to them by their parents (or baby boomers). What are Millennials Spending Habits Like?

Millennials are individuals who are in the age group of 18-34 years (born between 1980 and 2000). While growing up, they have witnessed globalisation hitting India, as a result of which, they saw their parents emphasizing on savings and education. So, How Should Millennials Make Financial Plans? Life will be smooth until a point. Invest: Money lying idle is of no use. Best Personal Loan Deals to Choose from. As lenders have ramped up television, digital and print ads regarding best personal loan deals, you must be getting confused as to which to pick.

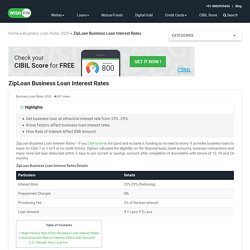

While some emphasize on the lowest interest rate offers, others come with zero processing fee and attractive balance transfer options. To make it easy for you, we have jotted down some of the best personal loan offers available right now. So, read and have your pick. ZipLoan Business Loan Interest Rates Oct 2020. ZipLoan Business Loan Interest Rates – If you Cibil score is not good and no bank is funding so no need to worry.

It provides business loans to loans for Cibil -1 or 1 to 5 or no credit history. Ziploan calculate the eligibility on the financial basic, bank accounts, business transactions and many more.Get loan disbursed within 3 days to our current or savings account after completion of documents with tenure of 12, 18 and 24 months. ZipLoan Business Loan Interest Rates Details Main Factors that Affect Business Loan Interest Rates Nature of Business – The nature of business should be positive. Business Vintage – Business vintage plays an important role. Business Annual Turnover – The lender always calculates the eligibility based on the turnover of your business.

Collateral – As all banks and financial institutions provide collateral free loans. How Does the Rate of Interest Affect EMI Amount? You can see how the rate of interest fluctuates in the EMI amount from the table below. Is it Possible to Take a Loan Against Shares from a Bank? Getting an unsecured loan from any lender can be difficult for individuals having a poor credit score (considered a score below 650).

Lenders also like to charge higher interest rates when such individuals want a loan. Such individuals, therefore, go for a Secured Loan where lenders don’t check credit scores to assess eligibility. Before going for a secured loan, the most common question that people often ask – ‘Is it possible to take a Loan against Shares from a bank’ – as Share is one of the most popular investment products among customers. The answer to this question is YES, you can get a Loan Against Shares from a lender! Several top banks like State Bank of India (SBI), HDFC Bank, ICICI Bank, IDBI Bank, Standard Chartered Bank provide the option of Loan Against Securities. Affordable interest rate is one of the benefits of Loan Against Shares provided by banks. Benefits of Loans Against Shares. Can I Get Another Loan After Clearing My CIBIL? Yes, you can!

Once your CIBIL Score goes past 750, a gold standard in credit scores, lenders will start offering you new loans based on your income and repayment potential. CIBIL assigns credit scores in the range of 300 to 900 in India. Scores around 750 and above are considered good, while scores below 650 are seen badly by lenders. A good credit score will lead to high loan amounts at attractive interest rates, helping you fulfill your financial needs. So, you should work on your CIBIL flaws instead of letting those mount worries for you. Free CIBIL Score Check Loans That You Can Get After Your CIBIL Score Becomes Good You will be eligible for unsecured loans such as personal loans when your CIBIL Score goes past 750. Which Is The Popular Kotak Credit Card? - Content Reviewz. Kotak Mahindra Bank gives a variety of credit cards to its customers.

The kotak credit card is designed to give you benefits like rewards, cashback, discount, fee waivers, and more. Here in this article today you will know the top Kotak Mahindra Credit Card. Read more to know about the features and benefits of each kotak credit card. Kotak Royale Signature Credit Card A kotak credit card with premium features that helps you make the most from your travel and shopping. Charge an annual fee of INR 9994X reward points on every INR 150 spend on special categories2X reward points on every INR 150 spend across all categoriesComplimentary airport lounge access (Under Visa Lounge Access Program)Priority service from Kotak Mahindra BankFuel surcharge waiver of maximum INR 3,500 per calendar yearMilestone benefits 10,000 bonus points on INR 4 lakh spending and 30,000 bonus points on INR 8 lakh spending in a year.

Opt For Kotak Personal Loan Against Credit Card To Fulfill Your Needs. Kotak Mahindra Bank is one of the leading banks in the country that provides different types of credit cards to customers. These credit cards range across different categories such as Travel, Entertainment, Shopping, etc. But do you know that you can get a Kotak Personal Loan against one of your credit cards? Well, don’t be surprised because you certainly can! Kotak Mahindra offers a credit card loan to its customers with which they can fulfill their urgent needs without any security. So, what is this loan against a credit card that you can get? Well, everybody faces a situation when they need urgent money for some financial needs. In this post, we will talk about the features of this loan facility, who can get this loan, the loan amount, and other things. Borrow An HDFC Personal Loan to Meet Your Medical Emergency.

Central Bank of India Business Loan EMI Calculator Oct 2020. Searching for a bank that offers business loans without collateral and processing fees. So there is no need to search more, Central Bank of India offers you both facilities. So you can easily calculate the monthly EMI through the calculator in just a few minutes, just put the value in the calculator which is the principal amount, interest rate and time period in which you are taking the loan. After completing all the details, you can see the monthly installments paid. Best ELSS Funds to Invest in & Save Tax Upto ₹46,800. Want to invest in an instrument that can help you save tax? Equity-linked Savings Scheme (ELSS), a type of equity mutual fund that invests predominantly in the high return proposition of equity and equity-related instruments, is one of the options you can contemplate on. And, if you want to invest for long and have a high risk appetite, there’s probably none better than ELSS!

Punjab & Sind Bank Business Loan EMI Calculator Oct 2020. If you want to take a business loan from Punjab & Sind Bank then, first of all, you have to check the EMI payable. With the calculator, you can easily know the total amount to be paid till the end of the tenure period, including the principal amount and the interest amount. If you enter all the information, the calculator will show you the EMI. Factors that Helps to Calculate EMI These are the three common factors that help to calculate the EMI of your approved loan amount. Principal Amount – The principal amount is basically a loan taken by the borrower to expand his business. IDBI Bank Business Loan EMI Calculator Oct 2020. Punjab National Bank Business Loan EMI Calculator Oct 2020. Yes Bank Business Loan Interest Rates Oct 2020.

What is the Interest Rate on Credit Card EMIs? Personal Loan Deals According to Different Customer Profiles. Different Union Bank Gold Loan Repayment Methods That You Should Know - Content Reviewz. Top ICICI Credit Card Offers Available for Customers. How Does HDFC Credit Card Provide The Option of SmartEMI Facility? HDFC Bank is one of the leading private banks of India that provides a different range of credit cards to customers. ICICI Bank Business Loan Interest Rates Oct 2020. Best Tax Saving Schemes - Interest Rate, Lock-in Period. Principal Launches a Mid Cap Fund with Attractive Features. Check Out Unconventional Methods to Improve Your Credit Score. Now, NEFT is availaible to you 24x7 all throughout the year! Know about top-rated Arbitrage Funds that you should invest in! Citibank Credit Card Customer Care - 24x7 Toll Free Number. Oriental Bank Of Commerce Credit Card Customer Care - 24x7 Toll Free Number.

Bank Of Baroda Credit Card Customer Care - 24x7 Toll Free Number. Dhanlaxmi Bank Credit Card Customer Care - 24x7 Toll Free Number. Union Bank of India Credit Card Customer Care - 24x7 Toll Free Number. Canara Bank credit card customer care - 24x7 Toll Free Number. DCB Bank Credit Card Customer Care - 24x7 Toll Free Number. What is the Interest Rate on Credit Card Loans? How To Apply For An SBI Credit Card In An Easy Way? - Content Reviewz.

What is The Bank of Baroda Home Loan Advantage Scheme? Buy Bank of India Credit Card & Let it Manage Your Monthly Expense! - WISHFIN. Andhra Bank Credit Card Customer Care - 24x7 Toll Free Number. Vijaya Bank Credit Card Customer Care - 24x7 Toll Free Number. Indian Bank Credit Card Customer Care - 24x7 Toll Free Number. Save upto ₹46,800 by investing in highest-rated ELSS Funds! How to Swap Credit Card Outstanding with a Personal Loan. RBL Bank Business Loan Interest Rates Oct 2020. Kotak Mahindra Bank Business Loan Interest Rates Oct 2020. How to Recharge FASTag through HDFC Bank 2020. RBL Bank Credit Card Payment through NEFT 2020, Steps. Fullerton India Business Loan Interest Rates Oct 2020, Fee & Charges. YES BANK Credit Card Payment through Billdesk 2020. YES BANK Credit Card Payment Through NEFT 2020.

How do Loans Help us Save Income Tax in India? - Tax Benefits. What is the Concept of EMI - Loan EMI, Credit Card EMI. Best Credit Card In India With No Annual Fees - Content Reviewz. Choose First Citizen Citibank Credit Card To Have a Perfect Shopping Partner! Factors That Affect Your Home Loan Interest Rates in a Big Way. Borrow Home Credit Personal Loan And Say Goodbye to Your Worries! - WISHFIN.

Allahabad Bank Credit Card Customer Care - 24x7 Toll Free Number. Tata Capital Business Loan Interest Rates Oct 2020, Fee & Charges. Bajaj Finserv Business Loan Interest Rates Oct 2020, Fee & Charges. HDFC Bank Business Loan Interest Rates Oct 2020, Fee & Charges. Retirement Planning for Women is a Must. Best Arbitrage Funds You Should Invest in. Best Banks in India 2020 - List of PSU and Private Banks in India. Tax Saving Products Millennials Must Consider.

YES BANK Credit Card Payment - Option, Methods Oct 2020. SIP vs Lump Sum - Which Should You Choose to Invest in ELSS. HDFC Bank Credit Card Payment - Options, Method Oct 2020. What is the Minimum Personal Loan Amount I Can Take? Canara Bank Loan Restructuring Scheme - Eligibility, Benefits, How to Apply. Apply For Axis Bank Home Loan To Buy, Constructor Renovate Homes - Content Reviewz.

Factors That Decide IDFC Bank Personal Loan Interest Rates. How ICICI Home Loan EMI Calculator Helps You Choose Suitable Interest Rates? ICICI Bank Credit Card Payment - Options, Methods Oct 2020. Is ELSS Better Than its Competing Tax-saving Products? THE IDEAL INVESTMENT MIX - LIQUID? LOCKED IN? BOTH?? Latest Mutual Fund e-KYC Guidelines by SEBI for Investors.

Which Mutual Funds Have Given the Best Lump Sum Returns. List of Equity Mutual Funds with High SIP Returns. Large & Midcap Fund vs Multi-cap Fund - Which Should You Go for. HDFC Bank Business Loan EMI Calculator Oct 2020. ICICI Bank Business Loan EMI Calculator Oct 2020. Business Loan EMI Calculator Oct 2020. Correct Your Financial Mistakes This Diwali with These Strategies. Best Banks for Business Loan in India 2020. Is It Good to Invest in Banking & PSU Debt Mutual Funds. Can I Take 3 Personal Loans at the Same Time? Gold Loan DCB Bank Gives You Financial Support - Content Reviewz. Borrow DCB Bank Personal Loan To Get Free From Your Financial Burden! Choose American Express Credit Card To Enjoy a Host of Privileges. Pros & Cons of Investing in a Focused Equity Mutual Fund. Documents Required for Working Capital Loan 2020.

Documents Required for Business Loan 2020. How to Get a Loan from Bank for Business. Bajaj Finserv Working Capital Loan - Eligibility, Rates 2020. Utkarsh Small Finance Bank Business Loan - Eligibility, Rates. Can I Hide My Loan History in My CIBIL Report?