Pension Scheme PMVVY for Senior Citizens - 8% Return. Months after Prime Minister Narendra Modi announced a pension scheme exclusively for senior citizens, Finance Minister Arun Jaitley today formally launched the same, titled as Pradhan Mantri Vaya Vandana Yojana (PMVVY). The scheme, which will apply to the senior citizens who are 60 years and above, aims to deliver a guaranteed 8% interest rate for 10 years.

If financial experts are to be believed, the pension scheme would provide more opportunities for senior citizens to generate a steady flow of income. The move assumes enormous significance at the face of rapidly falling interest rates. And what’s more the scheme is out of the purview of Goods and Services Tax (GST). You can purchase the scheme either online or offline through Life Insurance Corporation of India (LIC). What About the Investment Amount? Based on the chosen frequency, the amount of investment in PMVVY scheme would vary.

Is There a Possibility of Increasing the Personal Loan Tenure? The tenure plays an important role in every loan, including a personal loan, which you can take for a maximum of 5 years.

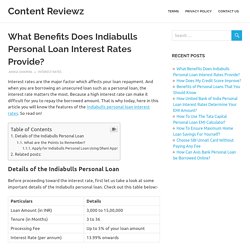

State Bank of India (SBI) and a couple more lenders can offer you more time to pay a personal loan. Ideally, one should choose an optimized personal loan tenure, which should be neither too short nor too long. This ensures a substantial reduction in the overall interest outgo. But things may not go as you plan. Uncertainties could come in your way and make it tough for you to pay off the personal loan EMI on time. What Benefits Does Indiabulls Personal Loan Interest Rates Provide? - Content Reviewz.

Interest rates are the major factor which affects your loan repayment.

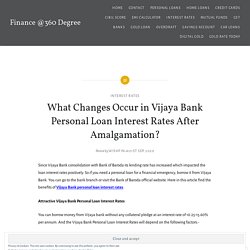

And when you are borrowing an unsecured loan such as a personal loan, the interest rate matters the most. Because a high interest rate can make it difficult for you to repay the borrowed amount. That is why today, here in this article you will know the features of the Indiabulls personal loan interest rates. So read on! What Changes Occur in Vijaya Bank Personal Loan Interest Rates After Amalgamation? Since Vijaya Bank consolidation with Bank of Baroda its lending rate has increased which impacted the loan interest rates positively.

So if you need a personal loan for a financial emergency, borrow it from Vijaya Bank. You can go to the bank branch or visit the Bank of Baroda official website. Here in this article find the benefits of Vijaya Bank personal loan interest rates. Attractive Vijaya Bank Personal Loan Interest Rates You can borrow money from Vijaya bank without any collateral pledge at an interest rate of 10.25-15.60% per annum.

Minimum Income: Your gross monthly income should be less than INR 75,000 to borrow a personal loan from Vijaya Bank. Mega Merger of PSU Banks. In a major move that is set to redefine India’s banking space, Finance Minister Nirmala Sitharaman announced the merger of 10 public sector banks into four.

The announcement of merger has now got the cabinet approval. The merger will take effect from April 1, 2020. The amalgamation scheme includes the merger of Allahabad Bank with Indian BankOriental Bank of Commerce (OBC) and United Bank of India with Punjab National Bank (PNB)Syndicate Bank with Canara BankCorporation Bank and Andhra Bank with Union Bank of India Free CIBIL Score Check What’s also noteworthy is the fact that the government has announced capital infusion worth more than 55,000 crore into public sector banks (PSBs). Top 5 Best Credit Cards with No Annual Fee in India Sep 2020. When having a cash crunch, the biggest rescue you can have is through credit cards. Having a credit card in wallet gives you the power of shopping your favourite stuff as the plastic money enables a number of things for you.

While choosing credit cards, the focus remains very much on the annual fees. Do you know, there are some credit cards that do not charge any annual fees from the cardholders? Top lenders like ICICI Bank, Axis Bank and others are busy offering such cards to add to the growing list of the credit card customers. Apply Credit Card for People with no Credit History. Shopping via credit cards are increasingly becoming the go-to-do-thing in today’s world of credit-hungry people.

Doesn’t matter if it is about paying the petty expenses of mobile recharges to a purchase of as big as iPhone, it’s credit cards that make all these happen with ease. A world of discounts, reward points, cashback, surcharge waiver and much more adds to the excitement and, thus a flurry of credit card applications visit the desk of banks on a regular basis. The banks, in turn, check the credit history, income, residence and age of an individual before saying ‘Yes’ to the application.

Of these, credit history is something not integral to everyone, right! Listening to this, you could question, whether people with no credit history stand a chance to get credit cards. Does Home Loan Prepayment Post Covid Make Sense. The Covid-19 Coronavirus pandemic has an opportunity in store for home loan borrowers to cash in.

Wondering how? Well, the pandemic could result in lower offtake of home loans because of the poor demand for buying homes. The poor demand will result from the lesser than expected annual increments for employees. Companies are losing business volumes sharply because of Coronavirus led slowdown, and will most likely come with a flat appraisal this time around. This will most likely make lenders cut their home loan rates to make some grounds for the fall in their business. Repo Rate vs MCLR - Is Repo Linked Rate Better than MCLR based Home Loans. The Reserve Bank of India (RBI) has cut the repo rate by more than 100 basis points in the Calendar Year 2019 in a bid to propel the economy that is facing slowdown.

The low inflationary scenario prevailing for most of the year helped the central bank continue with its rate cut marathon. However, for the last two monetary policy meetings, the RBI didn’t make any changes. As a result, the repo-linked lending rate of most banks remained still. The increasing inflation for the last 3-4 months made the RBI hold on to the repo rate, the rate at which the apex bank lends to commercial banks for their short-term obligations. Does a Top-up Personal Loan Require Documents and Verification? A top-up personal loan is an amount given over and above the running personal loan to meet your additional funding needs.

You can apply for the same at the lender where your personal loan is running. You can also get a top-up amount on doing a balance transfer to the new lender. But the question remains, do you need to submit documents to get a top-up personal loan? Reasons Why a Home Loan Balance Transfer Can be Rejected. If done at the right time, a home loan balance transfer could yield massive savings for borrowers.

It is a process by which you can transfer your existing home loan balance to another lender at a lower rate of interest. Not only that, you can also apply for a top-up (additional loan amount) on the transferred balance. The utility of a balance transfer is immense in terms of savings and flexibility. How to Check CIBIL Score Online - Free CIBIL Score Check Online. The need to check the CIBIL score arises when a person applies for a credit card or a loan.

An applicant with a good credit or CIBIL score is considered suitable for most of the credit facilities and also for the best ones. People who have credit history know the impact of their payment behavior on the credit score but many are still unaware of simple things such as checking the credit score. In this article, we have provided an amalgamation of the procedure to check CIBIL score online and how this score is generated by the credit information companies such as CIBIL along with some other valuable information on the same. How Does My Credit Score Improve? - Content Reviewz. Your credit score will decide your loan interest rates, and when you have a poor score the one thing which you should do first is to check your credit report. What is a credit report? If you are new to this and don’t know much about the credit score and credit report, it is the borrower credit profile which encompasses your loan and credit card details.

Your credit score will start building when you buy a credit card or borrow a loan. Read this article here and find out how to improve the credit score with your credit report. PMAY CLSS Calculator - Apply Online at Reduced Rates. In the recently concluded Press Conference, Nirmala Sitharaman announced the extension in the last date of Pradhan Mantri Awas Yojana (PMAY) Credit-Linked Subsidy Scheme (CLSS) for the individuals both in category MIG-I and MIG-II. Before today, the last date for anyone who wants to enjoy the benefits of PMAY CLSS scheme was March 31, 2020.

After the extension, you can avail the benefits till March 31, 2021. However, the date will be March 31, 2022 for the LIG/EWS category. The main objective behind this extension is to make sure that people coming from the lower strata of the middle class families can be benefited more. According to the estimation, more than 2.5 lakh families from the middle class background will be able to enjoy the benefits from this extension of the date.

Overdraft Facility from Banks - OD against Salary/FD/Property, Interest Rates. In all walks of life, you never know when financial emergency strikes its chords leaving you in despair giving you no time to arrange your funds from your own deposit or savings but you need the money anyhow. What to do now? There comes an overdraft facility from banks which is very well accessible to protect you from distressful situations. In general, certain credit facility can also come to your mind like availing bank loans or using a credit card but interest rates tend to be quite high making you feel restless. Two Wheeler Bike Loan - Apply Bike Loan at Low Interest Rate 2020, EMI. Interest for TDS payment delay and non payment of tax. A person is liable to pay interest for various delays/defaults like interest under section 234A for delay in filing the return of income, interest under section 234B for default in payment of advance tax, interest under section 234C for deferment of payment of individual installment or installments of advance tax, interest under section 234D for excess refund granted to the taxpayer, interest under section 201(1A) for failure to deduct tax at source/delay in payment of tax deducted at source and interest under section 206C(7) is levied for failure to collect tax at source/delay in payment of tax collected at source.

Through this blog, we have explained the important provisions relating to: Credit Cards for Bad Credit in India 2020 - Apply Online. Be it travelling to an exotic location or fulfilling the immediate cash requirements, we, most of the time, apply for a loan, don’t we? Systematic Withdrawal Plan from SBI Mutual Fund. Are you planning to take a sabbatical from work or want to take retirement? Do you find the need for regular cash flow returns in such times?

Whichever your goals are, you obviously require immediate cash in your own hands. But you have parked away your entire funds in an existing mutual fund for a particular purpose, what to do now? You cannot withdraw it right now until it’s maturity but you need it badly as your immediate need is knocking your doors. Apply Credit Card for People with no Credit History. What will be the Eligible Home Loan Amount for you? The eligible home loan amount usually tends to change from one individual to another. Also, it depends on a lot of important factors. Want to Make Home Loan Part Payment? Know When to Do It. A 20-year home loan of ₹50 lakh at an interest rate of 8.50% per annum will mean interest obligations of ₹54,13,879, more than the principal amount. Can You Transfer Your Existing Home Loan to Another Individual- Wishfin. Yes, it’s possible. If a property owner does not want to repay the loan any further, he/she can transfer the debt to someone else.

Is It Compulsory to Take Insurance for a Home Loan. Enjoy More Savings on Buying Homes Costing Upto 45 Lakh. Benefits of Fixed Deposits - Stable Returns, Liquidity Facility, Tax Saver FD. If you want to invest your hard-earned money in a financial instrument where there is no risk and assured interest is provided, a Fixed Deposit (FD) can be a good choice for you. Benefits of Fixed Deposits - Stable Returns, Liquidity Facility, Tax Saver FD. Benefits Of Personal Loans That You Should Know - Content Reviewz. Minimum Credit Score Required for Credit Cards. Best Credit Cards for Pensioners in India Sep 2020 - Apply Online. IDFC Bank Loan Against Property Details. Dena Bank Loan Against Property Eligibility. Credit Linked Subsidy Scheme - CLSS Scheme Eligibility.

Tax Benefits Await You on Your Home Loan. Prepay Home Loan or Mutual Fund SIP - Which Option to Use ? When Should You Transfer Your Home Loan. Union Budget 2019 - Extra Tax Break of ₹1.5 Lakh on Home Loan Interest. Shall You Read Home Loan Agreement Clauses. Six Things About Gold Loans You May Not Know. Times When a Home Loan Prepayment Can be Avoided. How United Bank Of India Personal Loan Interest Rates Determine Your EMI Amount? - Content Reviewz. RBL Bank Personal Loan Rejection Reasons And How To Avoid Them. Life Without Credit Cards - How to Make it Work. When comfort meets Convenience, You get a Credit Card.

7 Best Reasons to get a Credit Card. Worried about Interest Rate on a Personal Loan? Take a Look. Is Personal Loan Document Free Possible? Answer Demystified ! Reasons Behind Home Loan Rejection & Tips to Avoid It. Joint Home Loan Tax Benefit with Spouse. Can Contractual Employees Get a Home Loan in India. Floating vs Fixed Rate - Which Should You Opt for Home Loan. SBI Home Loan for Government Employees - Rates Sep 2020, Apply. Problems to Have with a Bad Credit Score. What Can Happen in Personal Loan Defaults? How To Use The Tata Capital Personal Loan EMI Calculator? - Content Reviewz. Reasons To Choose Kotak Credit Cards. Why To Borrow Kotak Personal Loan? Importance of Home Loan EMI Calculator. Can students get credit cards in India? Why Credit Cards offer Cashback? Here's Why!

IDFC First Bank Home Loan: Interest Rate 2020, Eligibility, Apply Online. Piramal Housing Finance Home Loan - PCHF Interest Rate 2020, Apply, Eligibility. Advantages of Home Loan Top Up Over Personal Loan. Apply for Home Loan on WhatsApp - Rates Sep 2020, Eligibility. What is the Best Option When Taking a Personal Loan? What are the 3 types of Mortgage Loans? How To Ensure Maximum Home Loan Savings For Yourself? - Content Reviewz. Choose HDFC Home Loan Interest Rates To Have Pocket-Friendly EMIs. Home Loan Tax: Is Home Loan Tax Deductible? Revelation : Why Credit cards are Bad? Does a Personal Loan Hurt your Credit Score. Who Needs Personal Loan ? Know the complete Bank Eligibility. Should college students have credit cards ? Difference Between Home Loan and Loan Against Property. Apply Reliance Home Finance Home Loan Sep 2020 with Low Interest Rates - Check Eligibility.

List of Bank Home Loan Providers PAN Numbers. Home Loan Tips for First Time Home Buyer - Reduce Interest Rates, EMI. Book Your Dream Home on This Women's Day 2020. Is No Credit Worse Than Bad Credit? Benefits of a Good Credit Score that You Should Know. Choose SBI Unnati Card Without Paying Any Fee - Content Reviewz. When Do I Use The IndusInd Bank Personal Loan? How Does Home Loan Balance Transfer Facility Help People in Saving Money? 10 Commandments To Know Before Taking A Home Loan. HSBC Bank Home Loan - Eligibility, Interest Rates Sep 2020, Apply. Home Loan or Rent - Which Helps You Save More? Can you opt for Multiple Personal Loans in India? Pre Approved Personal Loan - Zero Documentation, Offers, Apply Online. Sukanya Samriddhi Yojana Scheme - Eligibility, Min Deposit, Tax Benefits, Rates.

How Does the EMI Work in Different Loans? Benefits of Making Loan Payments Before the Actual Tenure. What are the Cheaper Alternatives to an Education Loan in India? Will it Help My CIBIL Score Rise If I Pay the Written-off Amount? How to Choose the Right Personal Loan Tenure? Reasons Why Lenders Can Reject Your Loan Application. When Does Your Credit Score Decrease - Check the Instances That Can. How Can Axis Bank Personal Loan Be Borrowed Online? - Content Reviewz. Why SBI Home Loan For Government Employees is The Best Choice? What is Loan Overdue - Effects of Loan Overdue on Your Credit Score. Prepayment Facility of Different Loans in India.