Crowdfunding per Imprese Innovative - WeAreStarting. Www.maximpact.com/asap/api/public/publication/bb9baaab-bbbb-4999-aa98-8888b99ab8b8/data.aspx. Crowdfunding: Equity Crowdfunding. Why due diligence matters in equity crowdfunding. This sponsored post is produced by MicroVentures.

VentureBeat recently reported that funding marketplace MicroVentures raised over $16 million for tech startups. Over the past 2 years, MicroVentures has reviewed over 2,000 companies and through its rigorous review process, filtered the prospective list to less than 40, which met the criteria to raise on the platform. This represents approximately 2 percent of the companies that initiated the process. Once the SEC issues the final rules around the JOBS Act, it will pave the way for funding portals to start equity-based crowdfunding, giving more startups an opportunity to find a place to raise capital.

Many of those 2,000 companies will now have another resource available to raise capital online. What does this mean for investors? It means that investors will likely spend more of their time searching multiple “Equity Crowdfunding” sites attempting to understand the risks associated with deals on any given platform. ▷ crowdfunding.ch – Online Fundraising » Blog Archive » Why due diligence matters in equity crowdfunding. May 31 VentureBeat recently reported that funding marketplace MicroVentures raised over $16 million for tech startups.

Over the past 2 years, MicroVentures has reviewed over 2,000 companies and through its rigorous review process, filtered the prospective list to less than 40, which met the criteria to raise on the platform. This represents approximately 2 percent of the companies that initiated the process. Once the SEC issues the final rules around the JOBS Act, it will pave the way for funding portals to start equity-based crowdfunding, giving more startups an opportunity to find a place to raise capital. How it works. 1000x1000. PeoplesVC becomes the 1st stock-based Crowdfunding Site to Open its Doors to Investors. Launch a project on MyMajorCompany. 1.

Creating my project You can pitch any innovative and original project on MMC provided you are more than 18 years old (or you are represented by a legal guardin if you are a minor) and that your project has not already been funded through another website. The first thing to do when you set up a project on MMC is to have a Member Account. If you don't have one yet, click here to register. Seedrs. English.gainonline.se/faq. Www.scideation.org/wp-content/uploads/2011/05/crowdfunding-post-table.pdf. Gene Massey - Soho Loft Crowdfunding Conference - New York, January 23, 2012. TenPages.com. Doorstart TenPages een feit Graag infomeren we u over de overeenstemming die we hebben bereikt met de curator van TenPages inzake de overname van bepaalde activa van TenPages.

Tekst en Uitleg BV is van plan het crowdfundingplatform TenPages in gewijzigde vorm voort te zetten. In dit kader verwijs ik naar de onderstaande berichtgeving. Mochten er vragen zijn dan kunt u contact opnemen met ondergetekende. Met vriendelijke groet, Tekst en Uitleg BV De Horst 21 9321 VH Peize. CrowdAboutNow. Crowd Funding - Geldvoorelkaar.nl. Aankoop beleggingspand Utrecht.

BriceAmery Capital - Crowd Investments. Innovestment - Invest in innovation! MyFootballClub.co.uk - The world's local football club. ASSOB. Description ASSOB assists small and medium sized business to sell equity (shares/stocks) in their business to friends, family, fans and followers of the business in a compliant and proven manner.

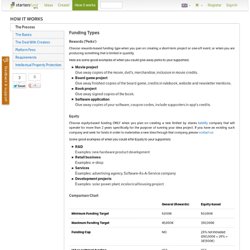

Over $120 million has been invested in matters funded through the ASSOB Capital Raising Platform. It is by far the most successful equity based crowdfunding platform in the world. Launch date March, 2006 Location Australia, ROBINA Company contact details Paul Niederer C.E.O - ASSOB Australian Small Scale Offerings Board “Passionately Facilitating Equity Funding for Small Business” paul@assob.com.au Phone: 1300 722 954 Fax: 1300 722 593 M: 0411 968 362 Office: Suite 14, "Riverwalk Place" 2 Waterfront Place ROBINA QLD 4226 AUSTRALIA Brief business history The founder has been pushing for more equity for small businesses in the fund raising space for 25 years. Success to date $120,015,443 raised to date. My Major Company UK. StartersFund. The Creator You have a great idea for a project and seek for funding?

You are at the right place! Take a look at our Requirements & Guidelines and get started! The Funder You're probably here either because your friend started a new project and asked for your support, or you want to discover and be part of the next big thing at the time when it’s bein born. Perks, equity or both! StartersFund is the only platform in the world that allows you to promise to your funders perks, equity over the company that will materialise the Idea, or both!

Build your profile. Venture capital. Crowdfunding for entrepreneurs (Crowd Investing investment rounds for startups) Crowdfunding platforms. Seedmatch. EarlyShares.com a Crowd Funding Platform - Crowdfunding. Cambridge's Wefunder builds startup crowdfunding site (but it's illegal for now) Step one: Build a site that lets anyone invest a small amount of money into a startup.

Step two: Build support for actually legalizing the site. That's the strategy at new Cambridge startup Wefunder.com, a project of local tech startup veterans Nicholas Tommarello and Nick Plante. Tommarello said the fundraising site would enable so-called crowdfunding for startups, with the idea that a large number of people investing small amounts into a startup can add up (filling a gap in early-stage fundraising). Currently only investors who meet the criteria for being "accredited" can put money into startup companies.

The fundraising site has been built over the past three weeks, but it's not live yet because it's "all illegal until that bill gets passed," Tommarello said. He's referring to a bill that's been before Congress for several months, which is being championed by Sen. Sprowd - serious crowdfunding. Symbid. Interview with Korstiaan Zandvliet, Managing Director Symbid. Symbid was first covered in the P2P-Banking blog two weeks ago.

I interviewed Korstiaan Zandvliet to get a deeper insight into the service. What is Symbid about? Symbid is the first online investment platform where the crowd directly invests in the equity of a start-up or existing company! Everybody can be an investor, each part has a nominal value of 20 EUR and you decide how many parts you would like to invest. The minimum is 20 EUR, the maximum is 2,500,000 EUR! How did you get the idea for Symbid? During my master degree in Entrepreneurship and new business venturing I noticed that many of my classmates did have an entrepreneurial dream but were reluctant to act upon it due to financial constrains.