How to Respond - Tax Attorney Newport Beach CA. IRS Form 9297, titled "Summary of Taxpayer Contact," is a written request to a taxpayer from an IRS Revenue Officer (collections officer) for information, documents, and certain actions.

The request comes after the Revenue Officer is assigned your case to pursue potential compliance or enforcement options. It may request bank statements and other financial documents, a completed IRS Form 433 financial statement, or delinquent returns among other things. A PDF example of an IRS Form 9297 can be found here. What Do I Fill Out on IRS Form 9297? The principal document to be filled out in response to an IRS Form 9297, if you are an individual, is the IRS Form 433-A. Dual Determination Definition: What is a Dual Determination? - Tax Attorney Newport Beach CA. Dual Determination: The Liability Provisions for a Responsible Person under California and Federal Tax Law What is a Dual Determination?

A “dual determination” is defined as a finding by a state taxing authority or a federal entity that a business entity’s liability may be assessed personally against an owner, officer, or other responsible employee of the business entity. A dual determination results in two mirroring assessments of the same liability, the net effect of the right to satisfy the liability from any of the person, the business, or a combination thereof.

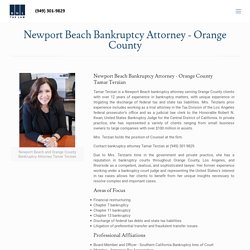

Tax Attorney Orange County. Newport Beach Bankruptcy Attorney - Orange County - Abogado Bancarroto - Tax Attorney Orange County. Newport Beach Bankruptcy Attorney - Orange CountyTamar Terzian Tamar Terzian is a Newport Beach bankruptcy attorney serving Orange County clients with over 12 years of experience in bankruptcy matters, with unique experience in litigating the discharge of federal tax and state tax liabilities.

Mrs. CSED - IRS Collection Statute Expiration Date - Tax Attorney Orange County. CSED (IRS)- Understanding the IRS Collection Statute Expiration Date.

What is CSED (IRS)? CSED is the IRS acronym for Collection Statute Expiration Date as it appears in many IRS internal computer transcripts of taxpayer accounts, which tells the IRS collections officer what the IRS system has computed as the statutory expiration date for collection of the tax. Although the computer’s CSED date is sometimes inaccurate, it is still generally relied on by IRS employees in practice.

Almost any time the IRS is prevented from collecting by law, time is added to extend the IRS’s statute of limitations period (the allowed time per law) to collect. Is a Tax LLM a Good Idea? Part 3.1: Ranking the Top Tax LLM Programs. - Tax Attorney Orange County. Currently, there are a few places that you may find rankings of the master of laws in taxation programs.

One of the obvious places to look would be US News and World Report, but, while they have a “tax law” ranking of law schools, it does not actually rank LLM programs. While it does somehow seem to matter that a school has an LLM program, which would explain why University of San Diego ranked so high on the list, it also includes top schools that have no tax LLM program at all. It is hard to say which is worse: that USNWR’s ranking gives the impression you might be better off getting a JD at University of Miami than Harvard if you are interested in tax or that it gives the impression that Harvard has a tax LLM. In any event, if you are looking at LLM programs, this USNWR ranking should be disregarded. The TaxProf Blog, always an excellent resource for tax news, has done good breakdowns of the rankings, and has extracted only those schools from the list that have LLM programs. Foregone Interest - Definition and Examples - Tax Attorney Orange County.

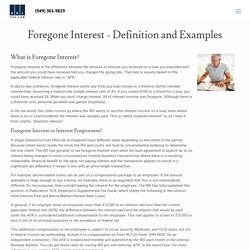

What is Foregone Interest?

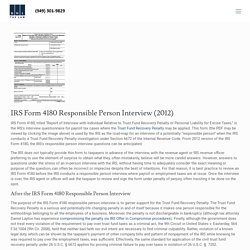

Foregone interest is the difference between the amount of interest you received on a loan you extended and the amount you could have received had you charged the going rate. That rate is usually based on the applicable federal interest rate or "AFR. " IRS Form 4180 Responsible Person Interview (2012) - Tax Attorney Orange County. IRS Form 4180, titled “Report of Interview with Individual Relative to Trust Fund Recovery Penalty or Personal Liability for Excise Taxes,” is the IRS’s interview questionnaire for payroll tax cases where the Trust Fund Recovery Penalty may be applied.

This form (the PDF may be viewed by clicking the image above) is used by the IRS as the road-map for an interview of a potentially “responsible person” when the IRS conducts a Trust Fund Recovery Penalty investigation under Section 6672 of the Internal Revenue Code. From 2012 version of the IRS Form 4180, the IRS’s responsible person interview questions can be anticipated. The IRS does not typically provide this form to taxpayers in advance of the interview, with the revenue agent or IRS revenue officer preferring to use the element of surprise to obtain what they, often mistakenly, believe will be more candid answers.

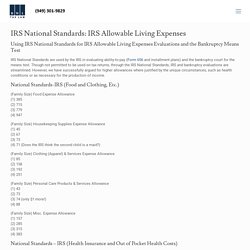

IRS National Standards: IRS & Bankruptcy Means Test - Tax Attorney Orange County. Using IRS National Standards for IRS Allowable Living Expenses Evaluations and the Bankruptcy Means Test IRS National Standards are used by the IRS in evaluating ability-to-pay (Form 656 and installment plans) and the bankruptcy court for the means test.

Though not permitted to be used on tax returns, through the IRS National Standards, IRS and bankruptcy evaluations are streamlined. Form 656 IRS Booklet PDF - Tax Attorney Orange County. Form 656 is the IRS Offer in Compromise form.

This particular PDF form is the Form 656-B, the more common Offer-in-Compromise based on “doubt as to collectability”, which requires completion of the Form 433-A (OIC) and/or a Form 433-B (OIC) if you also have a business. The purpose of these forms is to allow the IRS to evaluate your ability to pay and qualification for fresh start relief. While your Form 656 Offer in Compromise or other Fresh Start relief is under consideration by the IRS, the IRS will cease levies and garnishments. Tax LLM Rankings: Top 10 Best LLM Programs [2020 Update] - Tax Attorney Orange County. Tax LLM Rankings: The Top 10 Best LLM Programs (Including Online Executive Tax LLM Programs) I first posted about the top 10 best LLM programs, (Master of Laws in Taxation programs) and the various tax LLM rankings, about five years ago.

![Tax LLM Rankings: Top 10 Best LLM Programs [2020 Update] - Tax Attorney Orange County](http://cdn.pearltrees.com/s/pic/th/rankings-programs-attorney-218578007)

Last year, I said that not much can change in that time, except the methodologies of those who are ranking the “best” LLM programs. With recent world events, however, we have a new important consideration – ranking the best online programs would be more valuable. I would note that several of the traditional top programs already have “Executive” tax LLM programs, with NYU and Golden Gate University (MST) being years ahead on it, but Georgetown having one as well. Ex-IRS Tax Blog - Tax Attorney Orange County. What are the reasons for certified mail from the IRS? The reasons for certified mail from the IRS are because the mailing starts the clock ticking on when important action by the IRS may be commenced, usually after a taxpayer's appeal right has lapsed, and the IRS wants the certainty-of-proof a certified mail receipt offers. These same letters are sometimes statutorily required to be sent by certified mail (or registered mail) to advise you of your rights.

For the IRS's purposes, it typically will not matter that you don't sign for the mail (proof of delivery to your "last known address" will be enough - see Footnote 1 below). DWL Law Firm - Tax & Bankruptcy Attorneys, Pasadena CA. Tax Attorney Orange County.