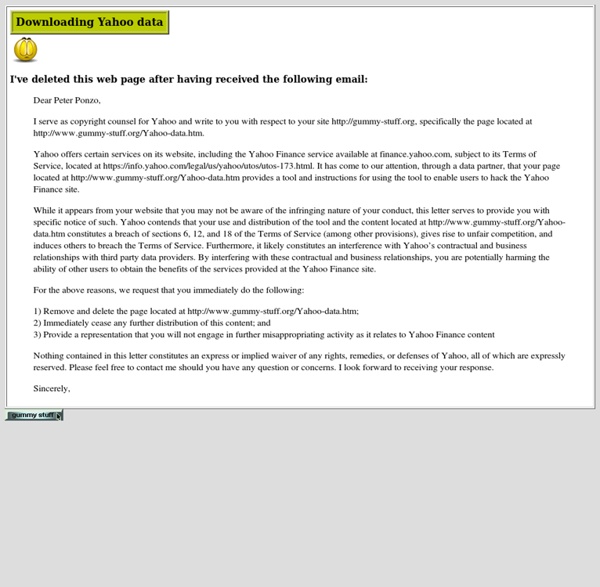

Yahoo data download

Dear Peter Ponzo, I serve as copyright counsel for Yahoo and write to you with respect to your site specifically the page located at Yahoo offers certain services on its website, including the Yahoo Finance service available at finance.yahoo.com, subject to its Terms of Service, located at While it appears from your website that you may not be aware of the infringing nature of your conduct, this letter serves to provide you with specific notice of such. For the above reasons, we request that you immediately do the following: 1) Remove and delete the page located at 2) Immediately cease any further distribution of this content; and 3) Provide a representation that you will not engage in further misappropriating activity as it relates to Yahoo Finance content Sincerely,

Finance RSS Feeds

Yahoo! Finance provides a variety of RSS feeds on various finance news topics including top stories, most viewed stories, stories by industry and sector, as well as dynamic feeds for company and industry news based on company ticker symbol. All the Finance Columnists also have feeds available. You can find the complete listing of all Yahoo! Yahoo! Overview In addition to basic RSS feeds Yahoo! Company News RSS Feed provides news headlines for a given company, by company ticker symbol. For More Information For more information on all the Yahoo! Acceptable Use

Yahoo Download Stock Data

Almost everyone knows that Yahoo has API to retrieve financial data.We will write a client that will consume Yahoo API to retrieve history stock data. Let's start to develop set of classes that will handle required functionality. First we define an Enum that holds different period types. The name of the class "PeriodType". The main class that uses Yahoo API is class that named "YahooHistoryDownloader". string stockName - ticker name of the stock . In order to test I created a console application that will print the downloaded data to console. private static void GetDataFromStock(string stockName,PeriodType periodType) { YahooHistoryDownloader historyDown = new YahooHistoryDownloader(); List<Bar> listBar = historyDown.GetBarHistory(stockName,periodType, DateTime.Now.AddMonths(-6), DateTime.Now); foreach (Bar bar in listBar) Console.WriteLine(bar); } In order to use it string stockName = "GOOG"; GetDataFromStock(stockName, PeriodType.Weekly ); Here is UML

java - Yahoo Finance API

Alternative to google finance api

Related:

Related: