Detroit’s pension problems, in one chart

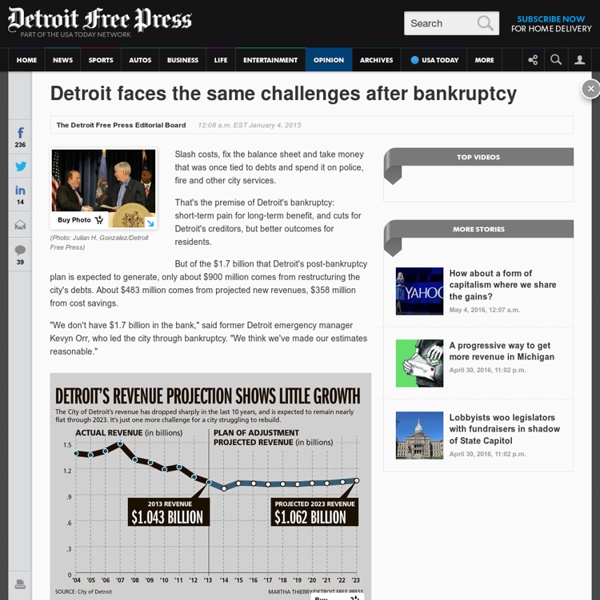

By Brad Plumer By Brad Plumer July 19, 2013 The Detroit Free Press has a long, detailed breakdown of Detroit's pension woes. Here's the key chart: Detroit currently owes $3.5 billion on its pension funds and writes checks to about 21,000 retired city employees and their widows, most of whom get around $1,600 per month. As you can see from the chart above, pensions are far from the only problem with Detroit's finances. Still, as the Free Press lays out, those pension obligations have become unsustainable, not least since there are now more retirees than workers paying into the system: "The city can’t pay what it owes the funds this year, much less make up its arrearage." So how did Detroit reach this point? There wasn’t any one thing that brought Detroit’s pension funds to this low point. By 2005, the city was forced to borrow $1.4 billion to plug a hole in its pension fund, and everything really collapsed with the financial crisis in 2008. Wonkbook newsletter Further reading:

The Michigan Daily

In the last 20 years, the population of Detroit has shrunk dramatically, causing concern among many cities about gentrification, which is the process by which higher income individuals occupy low-income urban areas, raising prices forcing residents to leave their homes and relocate. Wednesday night at Weill Hall, a panel of urban planning experts and a city official discussed the definition of gentrification and the effects it has on Detroit. About 60 students and faculty attended the event, sponsored by the Detroit Partnership, a student organization advocating education and service in the city. State Rep. John Olumba spoke at the panel and discussed his experiences representing Detroit. Olumba said the traditional definition of gentrification sometimes overlooks the social factors involved in such movements. “It’s OK to have a hard and fast definition of (gentrification),” Olumba said. “You introduce plight into a neighborhood,” Dewar said in the panel.

Detroit To Officially Exit Historic Bankruptcy

DETROIT, Dec 10 (Reuters) - Detroit will officially exit the biggest-ever U.S. municipal bankruptcy later on Wednesday, officials said, allowing Michigan’s largest city to start a new chapter with a lighter debt load. The city, which filed for bankruptcy in July 2013, will shed about $7 billion of its $18 billion of debt and obligations. “We’re going to start fresh tomorrow and do the best we can to deliver the kind of services people deserve,” said Mayor Mike Duggan. Once a symbol of U.S. industrial might, Detroit fell on hard times after decades of population loss, rampant debt and financial mismanagement left it struggling to provide basic services to residents. Later on Wednesday, payments to city creditors will be triggered under a debt adjustment plan confirmed by a U.S. Most of the settlements with major creditors, including Detroit’s pension funds and bondholders, will be paid with a distribution of about $720 million of bonds.

Detroit's Abandoned Building Problem Is An Actual 'Blight Emergency,' Says City Manager

Detroit is now undergoing an official “blight emergency,” according to an order signed by the city’s emergency manager last month. One-fifth of the city’s housing stock, approximately 78,000 homes, are vacant. If emergency sounds too strong, consider the case of Bill Wade, a 61-year-old Detroiter with multiple sclerosis who is paralyzed from the waist down. When he talked to WXYZ-TV, Wade said he lives in fear that the structure will go up in flames and set his house on fire. “I worry about that house [next door] because if I’m not here and I’m running an errand and that house goes up [in flames], he’s stuck,” Wade’s wife Linda explained to the local news station. According to Reuters, 60 percent of the city’s annual 12,000 fires involve blighted and abandoned buildings. Empty since 2005, the house next to Wade’s has been hit by scrappers, and is now a home for rodents and small wild animals, WXYZ reports. For many young women, blight can represent a different kind of danger. Getty Images

Most Detroit Families Can't Afford Their Basic Needs: Report

Two-thirds of Detroiters can’t afford basic needs like housing and health care, even when family members are employed, according to a new report. On Sunday, the United Way released a study that found 40 percent of Michigan households, and 67 percent of Detroit families, are either under the poverty line or what it identifies as “ALICE” — asset-limited, income-constrained, employed. Yes, Detroit’s poverty rate is 38 percent, but the United Way study looks at the cost of living — factoring in housing, child care, food, transportation and health care — compared to income by county to identify families that are above the federal poverty line but still struggling. “There’s this whole other group of people — could be you or me — (who are) one failed transmission away from going over the cliff to poverty,” Nancy Rosso, executive director of the Livingston County United Way, told the Livingston Daily. Read the full report here. Most Stressful Jobs Of 2014 10. Getty Images

Detroit's population loss slows; some suburbs see gains

Detroit continues to lose residents, but the population loss appears to be slowing, with about 1% moving out between 2013 and 2014, according to estimates released today by the U.S. Census Bureau. In the tri-county area, the Oakland County suburbs of Lyon and Oakland townships and Sylvan Lake, as well as Macomb and Washington townships in Macomb County grew the fastest, according to the estimates. The census makes the estimates annually based on a review of birth and death records, as well as migration. Demographer Kurt Metzger said Detroit's population loss appears to be easing. "It continues to average about 1% loss per year," said Metzger, now mayor of Pleasant Ridge. By the city's estimates, Detroit lost about 1,000 residents per month in 2013; that slowed to 500 in 2014, and the number is even lower in 2015. "We have seen a significant slowing of people leaving the neighborhoods, and it will continue to improve," Mayor Mike Duggan said.

Why isn't everyone buying cheap houses in Detroit as an investment? - Quora

Detroit, suburbs reach water deal

It's official: Detroit and the suburbs have struck a water deal. Leaders voted today to let Detroit lease its massive, crumbling water and sewer system to a new, regional board called the Great Lakes Water Authority. The deal was originally cooked up as part of Detroit’s bankruptcy, as a way for the city to fix its water system – which is in serious need of expensive improvements – and for the Detroit Water and Sewerage Department to pay down what it owes the city’s retirees. The deal: Detroit gets money, and the counties get more influence For years the surrounding counties – Wayne, Oakland, and Macomb – have been buying their water from the city. This deal will, at least in theory, give suburbanites more direct power over the system, and (they hope) lower rates in the long run. "Unlike all other communities, Detroit will only pay the authority what they collect from their residents. In exchange, the authority will pay Detroit $50 million a year in lease payments. But that didn’t happen.