everystockphoto - searching free photos Educator Toolkit Topics - National Financial Capability Challenge Here are three points to consider as you decide which lessons you might wish to use in the classroom: First, the Educator Toolkit offers you a carefully selected menu of lessons from which you can choose what you judge as best for you and your students. There are almost certainly more lessons here than you can use. Second, these lessons have been developed by independent, not-for-profit organizations. As a result, the formats differ from lesson to lesson. Finally, the lessons have been assigned letters for the Educator Toolkit as indicated in the far left column to make the list easier to follow. Lesson Options Lesson Title Lesson Description Publisher ONLINE Lesson: Participants solve word puzzles with varying degrees of knowledge. Federal Reserve Bank of St. Lesson: Participants compute the gross pay for a fictional character named John Dough given his hourly wage and the number of hours worked. Lesson: Family Economics and Financial Education Junior Achievement Money SKILL Mission 3. Lesson:

Lesson finder EconEdLink is the leading source of online economic & personal finance lessons & resources for educators and students. Browse by Keyword, Grade, Concept, Author or Standard. Further enhance results by searching for economics or personal finance standards in your state, or by alignment to the Common Core State Standards. Rating Grade9-12 View this lesson By Robotic technology is increasingly infiltrating our everyday world, and as robots become more capable of human labor, people will likely have to develop new skills for new jobs. Key concepts Human Capital Investment, Human Resources, Incentive, Innovation, Inventors, Productivity, Standard of Living View this lesson Just 113,000 new jobs were added in January, according to the Labor Department’s monthly employment report. Discouraged Workers, Economic Growth, Employment Rate, Labor Force, Unemployment View this lesson Human Capital, Human Capital Investment, Human Resources, Labor Market, Standard of Living View this lesson View this lesson

Frost Middle School Throughout the 20 week course each student will complete the following assignments. 4) Career Research MLA Style Typed Paper- For this assignment you will be researching a career and writing about it in MLA style using Microsoft Word! Click on this link to show you a sample and a step by step on how to set-up your page. 5) Game Show Power Point- For this assignment you will be creating some review questions for any one of your classes (English, History, Math, or Science) to insert in a game template for "Who Wants to be a Millionaire". Remember, the first questions should be easy, then should get harder as they go along. 6) Graph Assignment- This assignment will show you how to create a graph based on a survey by using Microsoft Excell. 8) Create Logos using MS Paint- For this assignment you will create several logos using MS Paint. 10) Word Search- Create a word search using MS Excell.

High School Financial Literacy Curriculum: Building Your Future The Actuarial Foundation has released to U.S. high school teachers Building Your Future, an engaging and relevant financial literacy curriculum, to help teens master the foundational elements of personal finance and to prepare for life on their own. Building Your Future helps students easily grasp the essentials of personal finance, gives them multiple opportunities to practice core skills and showcases the real-world impact of the financial decisions they make. All four of the Building Your Future books are classroom ready with a Teacher's Guide including handouts, answer keys, instruction and assessment suggestions, definitions and resources that align with National Council of Teacher of Mathematics and JumpStart. The 2013 update addresses developing trends, such as the use of smart phones in banking and the increasing risk of identity theft, and to reflect the current tax and interest rate environment. Get Your Free Individual Set of Materials - Just Ask! Download the Materials

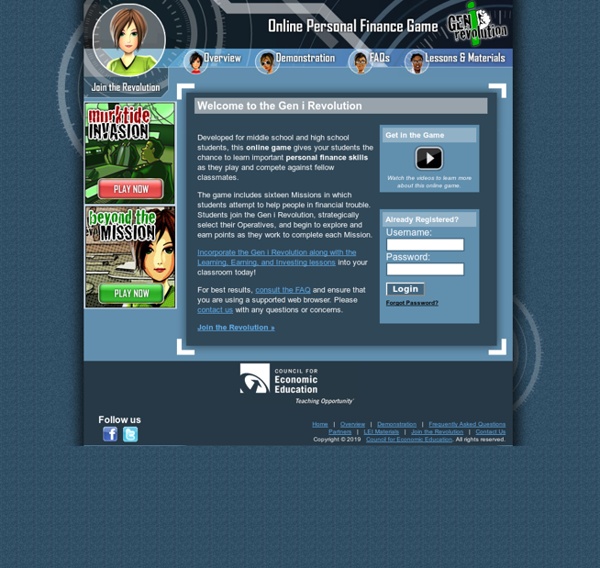

The most comprehensive personal finance curriculum for grades K-12 | FFFL - Financial Fitness For Life Little Bird Tales - Home Home | Teaching Financial Literacy Gen i Revolution - Mission 1: Building Wealth Over the Long Term This interactive tool is a part of the online personal finance game, Gen i Revolution. This is one of the fifteen "Missions" available within the online game. This Mission takes about 30 minutes to complete. To sign up to play the game, you'll need to register for an account on the Gen i Revolution web site. In Mission 1, students must convince Angela to invest in a 401(k) plan now to build wealth over the long term. This mission is from the Gen i Revolution created by the Council for Economic Education. Key Concepts A Penny Saved Students will read the comic book, "A Penny Saved" published by the New York Federal Reserve Bank. Grades 9-12 Opportunity Cost Consumers are faced with tough choices because so many innovative and exciting products and services are available. Calculating Simple Interest How do banks calculate the amount of interest paid on a loan? Grades 6-8, 9-12 How Global is Your Portfolio? Grades 3-5, 6-8 Big Banks, Piggy Banks Grades K-2, 3-5

Life in the Tech Lab: Spreadsheet Magic! Introduction Spreadsheets are very powerful tools that allow you to accomplish many tasks easily. They can do massively huge math problems quicker than you can blink your eyes (actually they can do thousands of math problems quicker than you can blink your eyes), help you organize your life, create and format lists that can be used in a number of ways and they help you understand huge amounts of data. Parts of a Spreadsheet Before you can start using a spreadsheet, there are just a few key things you need to learn. Click here to study the PARTS OF A SPREADSHEET! Enter Data Now that you understand the parts of a spreadsheet and can find them on the screen, we'll start entering data in a spreadsheet you create. First, watch the video that explains how to enter data in a spreadsheet. Now that you know all about entering data, it it time for you to create your first spreadsheet! Formatting Data Entering data in a spreadsheet is pretty easy if you had a plan to start with. Formulas and Functions

Compare Credit Cards, Home Loans, Car Insurance and more | RateCity.com.au Why Work Now? Tell the students that teachers tell them to do homework, but ask them why they have to do it now? Ask the students if they are going to spend the rest of their life working? Tell the students that in this lesson they will learn something about education or training that may encourage them to take your school work seriously. Tell the students that they will find out how education and training are related to the amount of money people earn on their jobs. Stanley Czyzyk, Hurricane Hunter: This website features an interview with Stanley Czyzyk, a hurricane hunter. Tell the students that they probably know that Productive Resources are natural resources, human resources, and capital resources. Tell the student that what they may not know is that workers "sell" their labor and employers "buy" that labor. Have the students complete the interactive activity that describes situations in which they assume that they are an employer. 1) Who would you pay a higher wage to? Please select an option