https://www.miraeassetmf.co.in/calculators/sip-top-up-calculator

Related: kalpeshnairAll You Need to Know on Hybrid Mutual Funds Online at Mirae Asset What are hybrid funds? Hybrid funds are mutual fund schemes that are characterized by diversification within two or more asset classes. The term ‘hybrid’ itself indicates that the portfolio invests in multiple asset classes. As these funds typically invest in a mix of equity, debt and other products, they are also known as asset allocation funds. As hybrid funds invest in a mix of assets, it offers investors a diversified portfolio. Therefore, through a single fund, the investors have an option for investing in multiple asset classes. Know Everything on Debt Funds Online For Regular Returns at Mirae Asset Government securities (G-Secs) are also known as Gilts. Like any other bond, Gilts also have fixed maturities, during which they pay interest and principal on maturity. Since they are issued by the Government, Gilts have no credit risk at all.

Exchange Traded Funds (ETF) What is ETF? An ETF is a basket of stocks that reflects the composition of an Index, like the Sensex or the Nifty. ETF prices reflect the net asset value of basket of stocks in which it is investing. In many ways, it is similar to mutual funds. Know All on Exchange Traded Fund (ETF Fund) at Mirae Asset What is ETF? An ETF is a basket of stocks that reflects the composition of an Index, like the Sensex or the Nifty. ETF prices reflect the net asset value of basket of stocks in which it is investing. In many ways, it is similar to mutual funds. Exchange Traded Funds (ETFs) are actually Index Funds that are listed and traded on exchanges like stocks and are passively managed. Mutual funds aim to generate alpha by outperforming a market benchmark, whereas ETFs aim to track the relevant index and replicate it returns.

Know All on Exchange Traded Fund (ETF Fund) at Mirae Asset What is ETF? An ETF is a basket of stocks that reflects the composition of an Index, like the Sensex or the Nifty. ETF prices reflect the net asset value of basket of stocks in which it is investing.

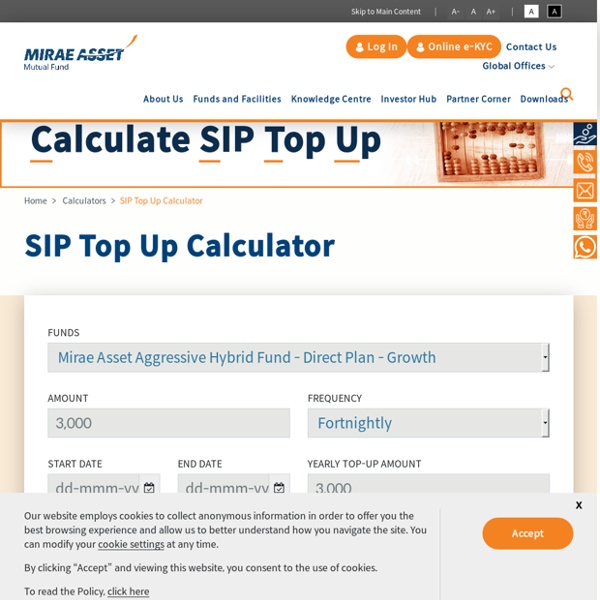

How to Invest in SIP online Mutual Fund SIP is a simple tool that helps you to invest regularly in mutual fund schemes of your choice. You can start a SIP with a frequency of your choice: daily, weekly, monthly or quarterly. However, you must check with the AMC in whose scheme you want to start a SIP as all AMCs may not offer all the frequencies mentioned herein. As per SEBI regulations, you should be KYC compliant to invest in mutual funds.

Know All on Goal Based Investment Through Mutual Funds at Mirae Asset Good investment advisors are increasingly endeavouring that their investors do not make random investments in mutual funds and instead map these with their various financial goals. Most Indian investors do not have a structured approach to savings and investments. Most people do not have saving targets as the amount of money they save depends on their spending habits. Know About ELSS vs PPF Difference and More at Mirae Asset Public Provident Fund (PPF) is one of the popular traditional 80C tax savings options in India. There are several reasons for PPF’s popularity among tax payers. The average retail investor is usually risk averse and capital safety is assured by the Government in PPF. What Are Exchange Traded Funds: Know How ETF Works at Mirae Asset While awareness about Exchange Traded Funds (ETFs) is quite low in India, these funds are gaining traction amongst investors over the last few years. In the last 5 years, the mutual fund industry assets under management (AUM) in ETFs have grown at a CAGR of more than 100%. In the developed markets, ETFs and index funds are hugely popular with investors.

Asset Diversification: Types of Asset Allocation Strategies at Mirae Asset Asset allocation is a strategy to balance risk and returns by investing in different asset classes. Historical price movements of different asset classes like equity, fixed income or debt and gold show low or negative correlation among these asset classes. Hence diversification across asset classes can greatly reduce risk and generate potential superior returns in the long term. Financial planners suggest that right asset allocation strategy is critical in achieving your financial goals. Different types of asset allocation strategies

Credit Risk: Know the Types of Credit Risk at Mirae Asset Fixed income securities make interest payments at regular intervals and principal payment on maturity. Credit risk of fixed income instruments refers to the issuers’ failure of meeting their interest and / or principal payment obligations, exposing the investor to potential loss of income and / or capital. If the issuer defaults on interest and principal payments then the price of the instrument will be written down permanently and the investor may have to suffer a loss.

Fd Vs Mutual Fund: Know the Difference at Mirae Asset Fixed Deposits are the traditional investment choice for most Indian households. As per RBI research released in June 2020, 53% of average household financial assets are invested in Bank FDs (as on March 2020). Though mutual funds have a long history in India with setting up of Unit Trust of India in 1963, popularity of mutual funds among retail investors have grown only in the last 20 – 25 years.