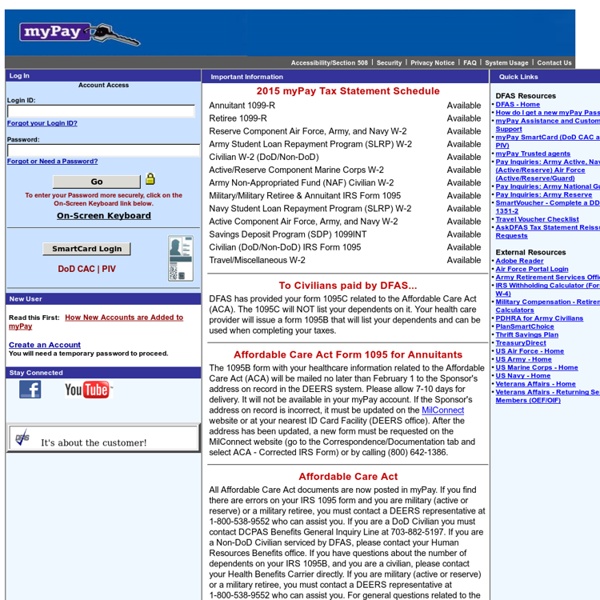

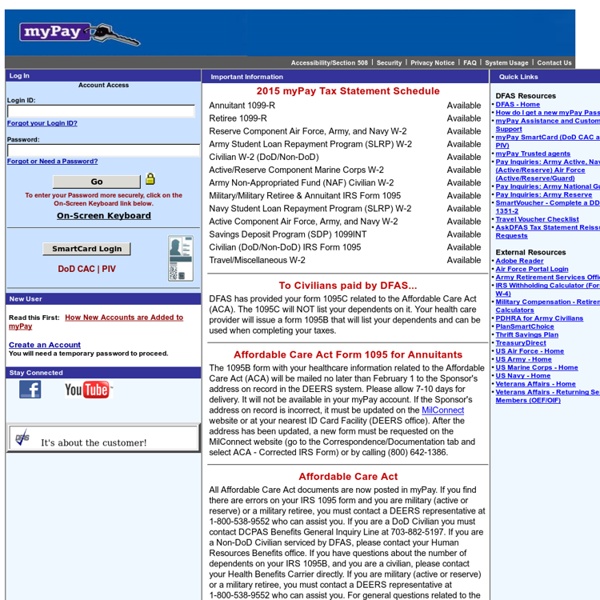

MyPay Web Site

The Online Encyclopaedia of Tanks & Military Vehicles

Military College Loan Repayment Program (Page 2)

Taxes The College Loan Repayment Program is taxable income, and 28 percent of the payment is withheld and sent to the IRS. (Example: Authorized payment of $100.00 - 28% tax withholdings = $72.00 paid to lender $28.00 paid to the individuals IRS account.) CLRP and the GI Bill Federal law prohibits the VA from paying benefits under the College Loan Repayment Program and the Montgomery GI Bill for the same enlistment period for active duty personnel. The above provisions do not apply for members of the Reserves and National Guard. Interest As it stands right now, the College Loan Repayment Program only pays on the unpaid principle balance. Member Responsibilities Member must remain on enlisted active duty while enrolled in the program Member's loans must be in good standing (Note: Loans in default status, delinquent in payments, interest, or associated charges will not receive payment. College Loan Deferments

Related:

Related: