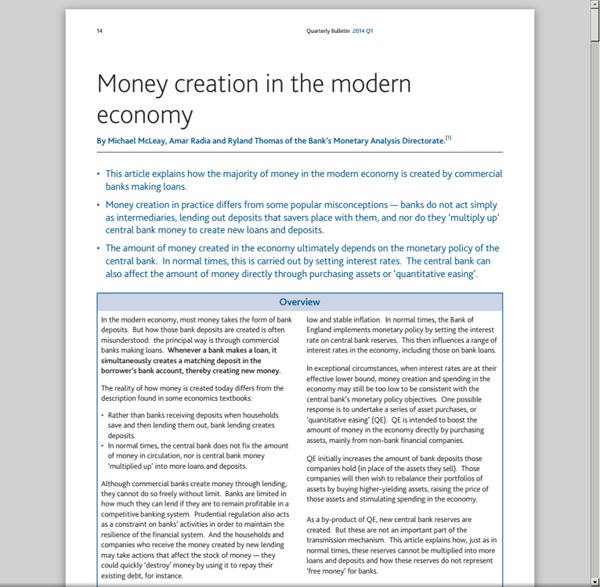

The truth is out: money is just an IOU, and the banks are rolling in it | David Graeber Back in the 1930s, Henry Ford is supposed to have remarked that it was a good thing that most Americans didn't know how banking really works, because if they did, "there'd be a revolution before tomorrow morning". Last week, something remarkable happened. The Bank of England let the cat out of the bag. In a paper called "Money Creation in the Modern Economy", co-authored by three economists from the Bank's Monetary Analysis Directorate, they stated outright that most common assumptions of how banking works are simply wrong, and that the kind of populist, heterodox positions more ordinarily associated with groups such as Occupy Wall Street are correct. In doing so, they have effectively thrown the entire theoretical basis for austerity out of the window. To get a sense of how radical the Bank's new position is, consider the conventional view, which continues to be the basis of all respectable debate on public policy. The central bank can print as much money as it wishes.

News Reports: JPMorgan Chase Agrees to $13 Billion Settlement NEW YORK (TheStreet) -- JP Morgan Chase has agreed to pay a $13 billion fine to settle federal and state lawsuits over the bank's residential mortgage-backed securities business, according to news reports. General terms of the tentative agreement between the bank and the Justice Department were reached Friday night in a phone conversation involving Attorney General Eric Holder, his deputy Tony West, J.P. Morgan CEO James Dimon and the bank's general counsel, Stephen Cutler, The Wall Street Journal reported, citing an unidentified person familiar with the deal. The agreement does not require the Justice Department to drop a criminal investigation focusing on the same issues, Reuters reported, also citing an unidentified person with knowledge of the deal. Stock quotes in this article: JPM

Druckenmiller: Fed shifting money to rich from poor The big debate Economists and academics are divided on whether the Fed's policies have truly helped the rich at the expense of the rest of America. Many point out that the policies have lowered interest rates for all Americans, which have helped boost housing sales and values. They also say unemployment and the economy would be a lot worse if the central bank didn't continue its huge monthly bond purchases. Yet others say the policies have mainly juiced asset prices—and the wealthy hold most of the assets. (Read more: Druckenmiller: Fed just lost chance for a 'freebie' ) By contrast, the number of millionaires—households worth $1 million or more, including homes—hit an all-time record in 2010, according to Wolff. The top 1 percent of Americans hold 35 percent of the nation's wealth—up slightly since 2007. 1 percent gets 95 percent A stream of new data on inequality also suggest that the gap between the wealthy and the nonwealthy is growing, largely becaue of rising stock markets.

The Biggest Price-Fixing Scandal Ever | Politics News Conspiracy theorists of the world, believers in the hidden hands of the Rothschilds and the Masons and the Illuminati, we skeptics owe you an apology. You were right. The players may be a little different, but your basic premise is correct: The world is a rigged game. We found this out in recent months, when a series of related corruption stories spilled out of the financial sector, suggesting the world's largest banks may be fixing the prices of, well, just about everything. You may have heard of the Libor scandal, in which at least three – and perhaps as many as 16 – of the name-brand too-big-to-fail banks have been manipulating global interest rates, in the process messing around with the prices of upward of $500 trillion (that's trillion, with a "t") worth of financial instruments. That was bad enough, but now Libor may have a twin brother. The Scam Wall Street Learned From the Mafia Why? The bad news didn't stop with swaps and interest rates. "You name it," says Frenk.

Can the Internet Replace Big Banks? Nervous Cypriots hit cash machines 16 March 2013 Lines formed at many ATMs as people scrambled to pull their money out after word that the 10 billion euro (£8.6bn) rescue package Cyprus agreed with its euro area partners and the International Monetary Fund included one-off levy on deposit, an unprecedented step in the eurozone crisis. The levy is expected to raise 5.8 billion euro. European officials said people with less than 100,000 euro in their accounts will have to pay a one-time tax of 6.75%, those owning more money will lose 9.9%. Cypriot bank officials said that depositors can access all their money except the amount set by the levy. But that hardly assuaged people who continued to withdraw cash from ATMs until the machines ran out, unsure what or how much would be taxed. The country's co-operative banks also shut their doors after depositors scurried in hopes of protecting their savings.

Derivatives - The Unregulated Global Casino for Banks Note the little man standing in front of white house. The little worm next to lastfootball field is a truck with $2 billion dollars. There is no government in the world that has this kind of money. This is roughly 3 times the entire world economy. The unregulated market presents a massive financial risk. If you don't want to bank with these banks, but want to have access to free ATM's anywhere-- most Credit Unions in USA are in the CO-OP ATM network, where all ATM's are free to any COOP CU member and most support depositing checks. Keep an eye out in the news for "derivative crisis", as the crisis is inevitable with current falling value of most real assets.

Germany's Bundesbank reveals plan to bring gold reserves home | Europe FRANKFURT— Germany’s Bundesbank plans to bring home some of its gold reserves stored in the United States’ and French central banks, bowing to government pressure to unwind a Cold War-era ploy that secured the national treasure. Germany amassed gold reserves in the post-war era thanks to rapid economic expansion that saw growing exports to the United States, where its dollar claims were turned into gold under the Bretton Woods agreement that Germany joined in 1952. As the Cold War set in, Germany kept its gold reserves put, keeping them out of reach of the Soviet empire. But government officials have grown uneasy about the storage set-up and have called for the Bundesbank to inspect the bars. The Bundesbank now wants to change the arrangement too, even though it has said it does not see a need to count the bars or check their gold content itself and considers written assurances from the other central banks as sufficient. "To hold gold as a central bank creates confidence," Mr Thiele said.

Two bombshell documents that Citigroup's lawyers try to suppress, describing in detail the rule of the first 1% "Are they real?" That's the question people usually ask when they hear for the first time of the "Citigroup Plutonomy Memos." The sad truth is: Yes, they are real, and instead of being discussed on mainstream media outlets all over America and beyond, Citigroup was surprisingly successful so far in suppressing these memos, using their lawyers to issue takedown-notices whenever these memos were being made available for download on the internet. So what are we talking about? So Citigroup did their duty and published two explosive memos, which should have become mainstream news, but eventually did not. Screenshot: The second memo is dated March 5, 2006 (18 pages) and is titled: "Revisiting Plutonomy: The Rich Getting Richer" A few years ago, two copies of these memos were leaked and were published on the internet. Examples of the reports deleted from "scribd.com" after Citigroup demanded their takedown (here and here): Little of this note should tally with conventional thinking. Quote: Quote:

Banks pay $8.5bn to settle home foreclosure review 7 January 2013Last updated at 16:51 ET Many people lost their home in the financial crisis, and they may get compensation Ten of the biggest banks have agreed to pay $8.5bn (£5.2bn) to settle a review of home foreclosures by US regulators. Banks and mortgage lenders including Bank of America, Citigroup and JP Morgan Chase will pay $3.3bn directly to eligible homeowners, regulators said. The lenders will also pay $5.2bn to modify and forgive loans. The investigation began in 2011, and looked into whether borrowers had unlawfully had their homes repossessed. The regulators were the Office of the Comptroller of the Currency (OCC), which is an independent bureau of the Department of the Treasury, and the US central bank, the Federal Reserve. The US mortgage market boomed in the middle of the last decade. The housing bubble collapsed in 2008, making many of the homes worthless and causing the loans and their derivatives to become toxic. 'Roadkill'

FactCheck Q&A: Where will Barclays’ fines go? “Under the previous government’s regime, fines paid to the FSA (Financial Services Authority) are used to reduce the annual levy other financial institutions are asked to pay…We are considering ammendments to the Financial Services Bill that will ensure that fines of this nature go to paying the taxpaying public, not the financial industry.” - Chancellor George Osborne, House of Commons, 28 June 2012 Barclays Bank has been ordered by US and British authorities to pay a record-breaking £290m in fines this week. Of that, the Financial Services Authority demanded £59.5m – the biggest fine it’s ever imposed in its 10-year history. But the sense of relief that Barclays has been brought to book will be shortlived when ordinary taxpayers learn that under current rules, they won’t see a penny. FactCheck’s been looking at how the financial services industry benefits when one of their own messes up. So what actually happens when the FSA fines one of their members? Not for that particular year.