Services in London Ontario - Landscaping & Lawn Maintenance. London St. Thomas Association of Realtors. Welcome to MPAC. Windsor-Essex County Association of REALTORS® The Body Dryer. Thank You for all the support during the campaign.

Visit www.getbodydryer.com for more information and your chance to order the Body Dryer Today! Thank You for All the Media Support! Short Summary Hello, my name is Tyler Overk and I have been working with the Body Dryer Team on this project for over 2 years. We created this product to replace bacteria filled and environmentally harmful bathroom towels. We are looking to raise $50,000 to put this invention into a full production line. Contributing to this project is really a contribution to our dream of bringing the body dryer to market, and doing our part to help improve the world we live in. What We Need & What You Get The funding of this project is going into an initial production minimum we need to meet with the manufacturer we have identified as being the best. The Perks At the top of our reward level we have an actual body dryer. Early Adopters Reward $125 (limited to 150): An actual numbered Body Dryer off the production line. Q. Dyson Airblade™ hand dryers — Official Site.

Not Allowed - Bad Crawler. Selling a house? Beware the costs. If you're thinking of selling your house to make a little money before rising interest rates squeeze the real estate market, there's good news and bad news.

The good news is you're almost certainly making money because home prices in Canada have been rising for the past few decades, particularly in the greater Vancouver area, as shown in the chart below, which is from a BMO Capital Markets report published this week. The bad news is: It's not as much money as you'd like. We recently sold our income property, and I was aghast at some of the costs associated with closing. Here are some of the biggies to keep in mind, if you're going that route: - Paying the agent. . - Paying the lawyer. . - Paying the bank. . - Paying utilities and property taxes. . - Paying the government. Here's a handy-dandy checklist that you can use. Land Transfer Tax. When you buy land or an interest in land in Ontario, you pay Ontario's land transfer tax.

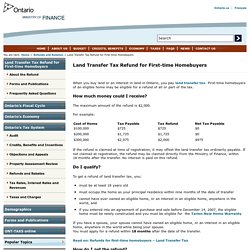

Land includes any buildings, buildings to be constructed, and fixtures (such as light fixtures, built-in appliances and cabinetry). Who pays land transfer tax? When you acquire a property or land, you pay land transfer tax to the province when the transaction closes. Land transfer tax is normally based on the amount paid for the land, in addition to the amount remaining on any mortgage or debt assumed as part of the arrangement to buy the land. In some cases, land transfer tax is based on the fair market value of the land, for example, where: the transfer of a lease with a remaining term that can exceed 50 years the transfer of land is from a corporation to one of its shareholders, or the transfer of land is to a corporation, if shares of the corporation are issued. First-time homebuyers. Land Transfer Tax Refund for First-time Homebuyers. When you buy land or an interest in land in Ontario, you pay land transfer tax.

First-time homebuyers of an eligible home may be eligible for a refund of all or part of the tax. How much money could I receive? The maximum amount of the refund is $2,000. For example: If the refund is claimed at time of registration, it may offset the land transfer tax ordinarily payable. Do I qualify? To get a refund of land transfer tax, you: must be at least 18 years old must occupy the home as your principal residence within nine months of the date of transfer cannot have ever owned an eligible home, or an interest in an eligible home, anywhere in the world, and if you entered into an agreement of purchase and sale before December 14, 2007, the eligible home must be newly constructed and you must be eligible for the Tarion New Home Warranty. If you have a spouse, your spouse cannot have owned an eligible home, or an interest in an eligible home, anywhere in the world while being your spouse.