Zeitgeist - The Movie: Federal Reserve (Part 5 of 5) House of Rothschild. Gold standard. All references to "dollars" in this article refer to the United States dollar, unless otherwise stated.

Under a gold standard, paper notes are convertible into preset, fixed quantities of gold. A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. Federal Reserve Act. Federal Reserve The Federal Reserve Act (ch. 6, 38 Stat. 251, enacted December 23, 1913, 12 U.S.C. ch. 3) is an Act of Congress that created and set up the Federal Reserve System, the central banking system of the United States of America, and granted it the legal authority to issue Federal Reserve Notes, now commonly known as the U.S.

Dollar, and Federal Reserve Bank Notes as legal tender. The Act was signed into law by President Woodrow Wilson. Woodrow Wilson. In his first term as President, Wilson persuaded a Democratic Congress to pass a legislative agenda that few presidents have equaled, remaining unmatched up until the New Deal in 1933.[2] This agenda included the Federal Reserve Act, Federal Trade Commission Act, the Clayton Antitrust Act, the Federal Farm Loan Act and an income tax.

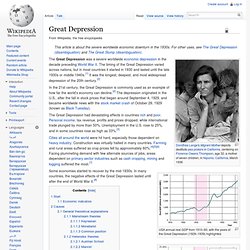

Child labor was curtailed by the Keating–Owen Act of 1916, but the U.S. Supreme Court declared it unconstitutional in 1918. Wilson also had Congress pass the Adamson Act, which imposed an 8-hour workday for railroads.[3] Although considered a modern liberal visionary giant as President, Wilson was "deeply racist in his thoughts and politics" and his administration racially segregated federal employees and the Navy.[4][5] According to Wilson biographer A. Great Depression. USA annual real GDP from 1910–60, with the years of the Great Depression (1929–1939) highlighted.

The unemployment rate in the US 1910–1960, with the years of the Great Depression (1929–1939) highlighted. In the 21st century, the Great Depression is commonly used as an example of how far the world's economy can decline.[2] The depression originated in the U.S., after the fall in stock prices that began around September 4, 1929, and became worldwide news with the stock market crash of October 29, 1929 (known as Black Tuesday). The Great Depression had devastating effects in countries rich and poor. Personal income, tax revenue, profits and prices dropped, while international trade plunged by more than 50%. Unemployment in the U.S. rose to 25%, and in some countries rose as high as 33%.[3] Cities all around the world were hit hard, especially those dependent on heavy industry.

J. P. Morgan. John Pierpont "J.

P. " Morgan (April 17, 1837 – March 31, 1913) was an American financier, banker, philanthropist and art collector who dominated corporate finance and industrial consolidation during his time. In 1892 Morgan arranged the merger of Edison General Electric and Thomson-Houston Electric Company to form General Electric. Central Banks. Central bank. The primary function of a central bank is to manage the nation's money supply (monetary policy), through active duties such as managing interest rates, setting the reserve requirement, and acting as a lender of last resort to the banking sector during times of bank insolvency or financial crisis.

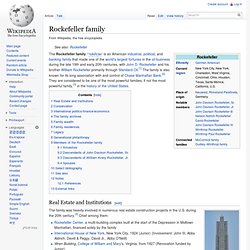

Central banks usually also have supervisory powers, intended to prevent bank runs and to reduce the risk that commercial banks and other financial institutions engage in reckless or fraudulent behavior. Central banks in most developed nations are institutionally designed to be independent from political interference.[4][5] Still, limited control by the executive and legislative bodies usually exists.[6][7] THE FED : The Federal Reserve. The Fed. Rockefeller family. The Rockefeller family /ˈrɒkɨfɛlər/ is an American industrial, political, and banking family that made one of the world's largest fortunes in the oil business during the late 19th and early 20th centuries, with John D.

Rockefeller and his brother William Rockefeller primarily through Standard Oil.[1] The family is also known for its long association with and control of Chase Manhattan Bank.[2] They are considered to be one of the most powerful families, if not the most powerful family,[3] in the history of the United States. Real Estate and Institutions[edit] The Rockefellers (Full) The Rockefeller File (1976) by Gary Allen. The Evolution Of Banking. With the exception of the extremely wealthy, very few people buy their homes in all-cash transactions.

Most of us need a mortgage, or some form of credit, to make such a large purchase. In fact, many people use credit in the form of credit cards to pay for everyday items. The world as we know it wouldn't run smoothly without credit and banks to issue it. In this article we'll, explore the birth of these two now-flourishing industries. Tutorial: Introduction To Banking And Saving Divine DepositsBanks have been around since the first currencies were minted, perhaps even before that, in some form or another. Central Banking Explained (satan's monetary control) Part 1 of 2. Reflections And Warnings - An Interview With Aaron Russo {Full Film} AMERICA — From Freedom To Fascism (Full Length Documentary) Exposing the Fed: What is the Federal Reserve? Part 3. Editor Note: For those of you who are not familiar with Marilyn MacGruder Barnewall, she is the woman who wrote the definitive book on Ambassador Lee Wanta, Wanta!

Black Swan, White Hat. I listened to several interviews with Marilyn that were conducted by Teri Ambach and the team at Global News and Views on Facebook. Federal Reserve Whistleblower Tells America The REAL Reason For Quantitative Easing. A banker named Andrew Huszar that helped manage the Federal Reserve's quantitative easing program during 2009 and 2010 is publicly apologizing for what he has done.

Who owns American Debt? House of Cards: Season 3(image by YouTube) I came across this chart from an article at Global Economic Intersection (where I am also a sometimes contributor): According to statistics from US Treasury Department, China cut US treasury holdings in 2014 by $25.8 billion. Despite all this, China remains US biggest foreign creditor. (image by Global Economic Intersection) A couple of things stand out:1. From November 2013 through January 2014 Belgium with a GDP of $480 billion purchased $141.2 billion of US Treasury bonds. Are Private Banks Unconstitutional? Ellen BrownRINF Alternative News The movement to break away from Wall Street and form publicly-owned banks continues to gain momentum. But enthusiasts are deterred by claims that a state-owned bank would violate constitutional prohibitions against “lending the credit of the state.”

California’s constitution is typical. It states in Section 17: “The State shall not in any manner loan its credit, nor shall it subscribe to, or be interested in the stock of any company, association, or corporation . . . .” The language sounds prohibitive, but what does it mean? The Federal Reserve Explained in 7 Minutes. Have you ever caught yourself wondering how nearly every country on earth can be in debt to outside sources? In my world, if I owe a friend $10 and he owes me $5 then I simply give him $5 and we call it “even.” But that’s not how the world of international banking works. If you have a minute, Wikipedia tries to keep an updated National Debt List.

Looking at the chart is very eye-opening. Why This Harvard Economist Is Pulling All His Money From Bank Of America. A classicial economist... and Harvard professor... preaching to the world that one's money is not safe in the US banking system due to Ben Bernanke's actions? And putting his withdrawal slip where his mouth is and pulling $1 million out of Bank America? Say it isn't so... From Terry Burnham, former Harvard economics professor, author of “Mean Genes” and “Mean Markets and Lizard Brains,” provocative poster on this page and long-time critic of the Federal Reserve, argues that the Fed’s efforts to strengthen America’s banks have perversely weakened them.

First posted in PBS. JFK Vs The Federal Reserve. Chart Of The Day: Fed Interventions Since 2008. The chart below, via Stone McCarthy, shows the months with Fed intervention since December 2008. That in the past 42 or so months, less than one third have been intervention-free, should close any open questions about whether the stock "market" is anything but a policy vehicle used by the Fed to perpetuate a broke(n) status quo now entirely dependent on every market up (and down) tick.

Gold. New World Order. Bankers dishonest by training, not by nature, Swiss study finds. Updated A Swiss study has set out to establish once and for all whether bankers are scheming, untrustworthy scoundrels. Secret Fed Loans Gave Banks Undisclosed $13B. Exposing the Fed: What is the Federal Reserve? Part 3. IRS Agent Whistleblowers. Shelley L. Et tu, Britain? United Kingdom to join China in the anti-dollar alliance. March 13, 2015Willemstad, Curacao.

How the Banksters Steal Your Wealth Using the Modern Banking System.