Subprime mortgage crisis. The U.S. subprime mortgage crisis was a set of events and conditions that were significant aspects of a financial crisis and subsequent recession that became manifestly visible in 2008.

It was characterized by a rise in subprime mortgage delinquencies and foreclosures, and the resulting decline of securities backed by said mortgages. These mortgage-backed securities (MBS) and collateralized debt obligations (CDO) initially offered attractive rates of return due to the higher interest rates on the mortgages; however, the lower credit quality ultimately caused massive defaults.[1] While elements of the crisis first became more visible during 2007, several major financial institutions collapsed in September 2008, with significant disruption in the flow of credit to businesses and consumers and the onset of a severe global recession.[2] Delinquencies and Foreclosures Increase in Latest MBA National Delinquency Survey.

WASHINGTON, D.C.

(September 5, 2008) — The delinquency rate for mortgage loans on one-to-four-unit residential properties stood at 6.41 percent of all loans outstanding at the end of the second quarter of 2008, up six basis points from the first quarter of 2008, and up 129 basis points from one year ago on a seasonally adjusted basis, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans somewhere in the process of foreclosure. Declaration of the Summit on Financial Markets and the World Economy. For Immediate Release Office of the Press Secretary November 15, 2008 Declaration of the Summit on Financial Markets and the World Economy.

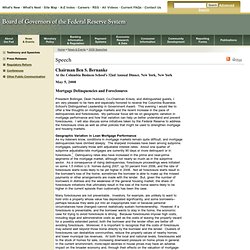

Bernanke, Mortgage Delinquencies and Foreclosures. Chairman Ben S.

Bernanke At the Columbia Business School's 32nd Annual Dinner, New York, New York May 5, 2008 Mortgage Delinquencies and Foreclosures President Bollinger, Dean Hubbard, Co-Chairman Kravis, and distinguished guests, I am very pleased to be here and especially honored to receive the Columbia Business School's Distinguished Leadership in Government Award. Geographic Variation in Loan Mortgage Performance As my listeners know, conditions in mortgage markets remain quite difficult, and mortgage delinquencies have climbed steeply. IMF loss estimates. To Cure the Economy - Joseph E. Stiglitz. Exit from comment view mode.

Click to hide this space NEW YORK – As the economic slump that began in 2007 persists, the question on everyone’s minds is obvious: Why? Unless we have a better understanding of the causes of the crisis, we can’t implement an effective recovery strategy. Op-Ed Columnist - Financial Reform 101. 2009-CDOmeltdown.pdf (Predmet application/pdf) Late-2000s financial crisis. Revenge of the Glut. Bernanke, Mortgage Delinquencies and Foreclosures.

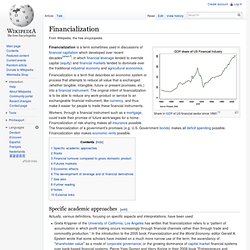

Financialization. Share in GDP of US financial sector since 1860.[1] Financialization is a term sometimes used in discussions of financial capitalism which developed over recent decades[when?]

, in which financial leverage tended to override capital (equity) and financial markets tended to dominate over the traditional industrial economy and agricultural economics. Financialization is a term that describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible, intangible, future or present promises, etc.) into a financial instrument. The original intent of financialization is to be able to reduce any work-product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments. Specific academic approaches[edit] Actually, various definitions, focusing on specific aspects and interpretations, have been used: Roots[edit] Shadow banking system. The shadow banking system is a term for the collection of non-bank financial intermediaries that provide services similar to traditional commercial banks.

Former Federal Reserve Chair Ben Bernanke provided a definition in April 2012: "Shadow banking, as usually defined, comprises a diverse set of institutions and markets that, collectively, carry out traditional banking functions--but do so outside, or in ways only loosely linked to, the traditional system of regulated depository institutions. Examples of important components of the shadow banking system include securitization vehicles, asset-backed commercial paper (ABCP) conduits, money market mutual funds, markets for repurchase agreements (repos), investment banks, and mortgage companies.

" Shadow banking has grown in importance to rival traditional depository banking and was a primary factor in the subprime mortgage crisis of 2007-2008 and global recession that followed.[1] [2] Overview[edit] Entities that make up the system[edit] Reducing Systemic Risk in a Dynamic Financial System. Since the summer of 2007, the major financial centers have experienced a very severe and complex financial crisis.

The fabric of confidence that is essential to the viability of individual institutions and to market functioning in the United States and in Europe proved exceptionally fragile. Money and funding markets became severely impaired, impeding the effective transmission of U.S. monetary policy to the economy. Central banks and governments, here and in other countries, have taken dramatic action to contain the risks to the broader economy.

Why was the system so fragile? U.S. current account deficit. On most dimensions the U.S. economy appears to be performing well.

Output growth has returned to healthy levels, the labor market is firming, and inflation appears to be well controlled. However, one aspect of U.S. economic performance still evokes concern among economists and policymakers: the nation's large and growing current account deficit. In 2004, the U.S. external deficit stood at $666 billion, or about 5-3/4 percent of the U.S. gross domestic product (GDP).

Corresponding to that deficit, U.S. citizens, businesses, and governments on net had to raise $666 billion on international capital markets.1 The current account deficit has been on a steep upward trajectory in recent years, rising from a relatively modest $120 billion (1.5 percent of GDP) in 1996 to $414 billion (4.2 percent of GDP) in 2000 on its way to its current level. Banks’ Hidden Junk Menaces $1 Trillion Purge: David Reilly.

March 25 (Bloomberg) -- The U.S. government wants to clear as much as $1 trillion in soured loans and securities from bank balance sheets with its latest bailout plan.

That might prove a short-term respite. No sooner might the Treasury Department mop up those assets than $1 trillion or more in new ones spring up to take their place. That is due to the potential return of assets held in so-called off-balance-sheet vehicles that banks may soon have to put back onto their books. The end result may be that banks are in no better shape to increase lending even after the government bailout. So investors betting for quick solutions to the financial crisis could be disappointed. Geithner's Plan For Derivatives - Forbes.com.