10 Mental Barriers to Paying Off Debt: Not Making Debt Payoff the Top Priority. At the start of The Debt Movement, we introduced the topic of mental barriers that prevent us from paying off debt.

Why? Because even the best-laid plans can fail and, when that happens, we’re left to wonder what to do about it. The fact is, good intentions and solid planning are important but they won’t move us forward without self-awareness. So for the rest of The Debt Movement, we’re going to talk about each mental barrier that prevents us from paying off debt so they can be conquered once and for all.

Remember, there’s a lot more to securing a solid financial future than simply crunching numbers in an Excel spreadsheet! Mental Barrier Number Two: Not Making Debt Payoff the Top Priority Have you ever thought to yourself, “Sure, I want to get out of debt, but there are more important things to worry about right now”? Do any of these sound familiar? The Belief that Debt Isn’t Really a Problem Now look at how much you’re paying in interest each month.

Escalating Delinquency Rates Make Student Loans Look Like the New Subprime. Now that student loans are undeniably in bubble territory, the officialdom is starting to wake up and take notice.

Evidence that students were taking on so much debt as a group that it was undermining their ability to be Good American Consumers wasn’t enough. A recent New York Fed study found that 94% of recent graduates had borrowed to help pay for their education, and average debt levels among student borrowers is $23,000. Remember, that average includes seasoned borrowers, who presumably borrowed less and also in many cases reduced the principal amount of their loans, so the average amount borrowed by recent grads is certain to be higher. Student debt is senior to all other consumer debt; unlike, say, credit card balances, Social Security payments can be garnished to pay delinquencies.

As a result, it has contributed to the fall in the homeownership rate, since many young people who want to buy a house can’t because their level of student debt prevents them from getting a mortgage. Student debt repayment assistant. Before you start, it will be helpful to have a list of your loans, as well as the required monthly payment amounts.

If you don’t have this information, don’t worry. While we can’t give you advice for your exact situation, we hope it can point you in the right direction and help you learn about some of your options. Federal, Private (non-federal), or both? Delinquency and Default - FedLoan Servicing. About delinquency and default.

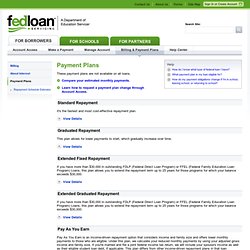

Untitled. These payment plans are not available on all loans.

Compare your estimated monthly payments. Learn how to request a payment plan change throughAccount Access. Standard Repayment It's the fastest and most cost-effective repayment plan. View Details Graduated Repayment This plan allows for lower payments to start, which gradually increase over time. Extended Fixed Repayment. Stafford Loan Consolidation < Stafford Loans Repayment. National Student Loan Data System for Students. Student Loan Consolidation Calculator - Calculate Your Savings Today. Looking to find out how much you can save by consolidating your loans?

We can help. Our student loan consolidation calculator will show you how much you can save on your monthly payments. To use this consolidation calculator, all you need are your loan amounts, interest rates, and your credit rating. Student Loans : News, Updates and Blog Posts. I was chatting with a friend this past evening, and the topic of grad school came up.

(As it tends to at my current age) We both agreed that grad school was a great idea – a somewhat necessary tool to advance in ones career. I’ve been rather excited about the prospect of going back to school for some time now, but my friend had some hesitation in his voice. Not because of the application process, or getting back into the swing of class life – but more so over the issue of payment. How do you pay for the normally pricey grad school courses? Many students still have remaining debt from their undergraduate program, and the thought of taking out more student loans can be rather daunting. First and foremost, if you haven’t already, consolidate your federal student loans from your undergrad program. Student Loans : News, Updates and Blog Posts. The US House of Representatives voted last Wednesday to cut the interest rate on future federal student loans.

The bill will gradually reduce interest rates for only federally subsidized loans. If this bill is passed by both the House and the Senate, interest rates on the subsidized Stafford Loan will be cut beginning this July. These rate cuts will be phased in over the course of five years. So, this year, the interest rate will be cut from 6.8 percent to 6.12 percent.

This cut will help lower the monthly cost of repaying student loans for millions of low-income students. The bill currently awaits Senate and presidential approval. Student Loan Consolidation - Get Help with Federal, Private and Direct Loan Consolidation. Borrower Services - Should I Consolidate? Deferment and Forbearance.