The high cost of switching college majors. As more and more students, parents and state legislators learn that college may take more time and tuition than they thought, institutions are turning their attention to this.

“There are institutional measures that we have from the federal government, from the state, from our board of directors. They’re going to look at a dashboard and want to say, ‘How are we doing?’ One of those measures of effectiveness is your four-year graduation rate,” said Kevin Hearn, vice president of enrollment management at Chestnut Hill, which costs about $58,000 a year in tuition, fees, room, board, books and other expenses. Giving this more urgency, said Complete College America vice president for strategy Dhanfu Elston, is that “families are now asking, ‘What’s your on-time graduation rate?’ They want to know how quickly can I get to that end goal.” But fixing this problem is complicated. “Exploration is great. Solutions like Chestnut Hill’s remain rare, however, Elston said. Not everyone does. The best websites to find cheap textbooks. Technology is making college a little more affordable.

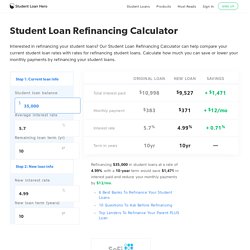

There is one thing all students have in common. They all need multiple text books and that costs money. VPC Can you smell the pencil shavings and new notebooks? PA Slip Internship Program - workforcesolutions. Time for Payback. How America Pays for College. Student Loan Refinancing Calculator - Should you refinance? Student Loan Refinancing Calculator FAQs 1.

Does this calculator tell me what refinancing rates I’m eligible for? No. This calculator simply provides savings estimates based on the refinancing rates you input into the calculator. To see what rates are available and check your eligibility, see our top partners for refinancing student loans here. 2. See our top partners for refinancing student loans here to view available rates and terms. 3. If you have multiple student loans, use our Weighted Average Interest Rate calculator to find your average interest rate. 4. That depends on several different factors. Interested in refinancing student loans? Here are the top 6 lenders of 2017! Advertiser Disclosure. 18 Sources For Free Money For College (Grants) For Any Age, Income or Grade Point Average. Compare financial aid and college cost. Office of Extended Studies.

Terp Young Scholars: July 10-29, 2016 In this demanding pre-college program, high school students pursue academic interests, discover career opportunities, earn three university credits, and explore university life.

Terp Discovery: July 17-29, 2016 Middle school students discover academic and career opportunities, learn about campus life, and engage with experts in innovative classes. Terp Young Scholars and Terp Discovery provide a great introduction to the University of Maryland, ranked 19th among national public universities in America’s Best Colleges 2013, U.S. News & World Report. Situated on over 1,250 tree-lined acres, the University is located just nine miles from the nation’s capital, Washington, DC. As the state of Maryland’s flagship university, the University provides an academic environment that prepares students for success, educating the most talented students from Maryland and beyond.

30 four-year schools with high graduation rates and low costs. PSU_HN_Fall_2015_GENERIC_all.pdf. Occupation employment, job openings and worker characteristics. Four Financial Tips Every High School Senior and College Freshman Should Know. Photo credit: 401kcalculator.org by Afoma Okoye Financial planning is important for students seeking post-secondary education.

Poor financial planning is one of the major reasons why students drop out of college. College is an investment. Studies point out that acquiring a degree increases lifetime happiness and earnings. Fill out the FASFA The first step all students need to take during their senior year is to apply for FASFA. The National Center for Fair & Open Testing. Search.

BrowseTrending.

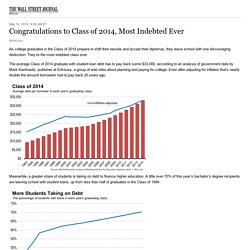

ByPhil Izzo As college graduates in the Class of 2014 prepare to shift their tassels and accept their diplomas, they leave school with one discouraging distinction: They’re the most indebted class ever.

The average Class of 2014 graduate with student-loan debt has to pay back some $33,000, according to an analysis of government data by Mark Kantrowitz, publisher at Edvisors, a group of web sites about planning and paying for college. Even after adjusting for inflation that’s nearly double the amount borrowers had to pay back 20 years ago. Meanwhile, a greater share of students is taking on debt to finance higher education. A little over 70% of this year’s bachelor’s degree recipients are leaving school with student loans, up from less than half of graduates in the Class of 1994. The good news for the Class of 2014 is that they likely won’t hold the title of “Most Indebted Ever” very long. Zuma Press. For Students. The Teacher’s Guide To Open Educational Resources. You’ve probably heard about Open Educational Resources and maybe even used some in your classroom. But the world of OERs is growing constantly, with more quality resources available every day.

If you aren’t taking advantage of them yet, now is a great time to take a closer look. News, Breaking News and More: The Delaware County Daily Times. 5 Student Loan Forgiveness Programs for Nurses, Teachers, Military, and Others. Higher Education: The Facts, Risks, and True Cost. Skyrocketing college costs make higher education seem like a pipe dream for many.

In this article, we discuss the evolving facts and risks associated with getting a higher degree – and the true costs of going to college that no one is talking about. New FAFSA Rules As of January 1, 2014, the U.S. Department of Education laid down some new laws for parents who want to help their students with the Free Application for Federal Student Aid (FAFSA). Although the changes have been around for a year, many people still don’t know about them. Two unmarried parents who live together must file jointly. Tougher Parent PLUS Loan Requirements. Compare New and Used Textbook Prices. PrepFactory.com - The best SAT + ACT prep money could buy... if we didn't give it away for free! How Technology is Changing the Way Colleges Recruit. Technology has transformed the way colleges run — from classrooms to learning management systems to handing in homework.

It’s also changed the way colleges recruit students. Most colleges now only accept paperless applications and students normally interact with a college digitally before they even visit or apply. Admissions offices are not only taking advantage of the new ways in which they can get students excited about their school, but entrepreneurs are looking at how they can help students in their college search. YouVisit, a website that takes prospective students on virtual tours, was created by international students who were frustrated at the lack of materials they were given over the web. The website now has over 1,000 virtual tours of college campuses students can visit without spending all the money on a plane ticket and hotel room.

College Prep for POCS (Parents of College-bound Students) The Death of Textbooks? Artificially intelligent software is reshaping traditional teaching materials—but it's unclear what the new technology will take away from the learning experience.

At a recent sit-down with executives representing one of the biggest players in the textbook industry, my colleague and I felt surprisingly out of touch. The executives spent most of the meeting touting the evolving market, namely how their newfound allegiance to digital learning materials—rather than old-school physical textbooks—would place them at the forefront of the new wave of education technology. Rhetoric describing the company’s unmatched innovation pervaded the hour-long meeting; they raved about the company’s across-the-board shift to digital, how its new state-of-the-art materials comprise a "single roadmap" that is expected to make its generic, stodgy textbooks obsolete. These executives certainly seem to have popular opinion on their side. CampusBooks.com - Buy Textbooks, Sell Textbooks, Rent Textbooks. Your College Textbook Headquarters.

Putting a Dent in College Costs With Open-Source Textbooks. College students could save an average of $128 a course if traditional textbooks were replaced with free or low-cost “open-source” electronic versions, a new report finds. The Student Public Interest Research Groups, state-based advocacy groups that promote affordable textbook options, analyzed open-source pilot programs at five colleges and found that the savings for students can be significant. While the price of textbooks at four-year schools pales in comparison to the cost of tuition, the cost still can weigh heavily on students with tight budgets. Home. Find Top Colleges, Tutors, Schools by Education Path Finder.

7 Common Myths about Financial Aid. College application deadlines are fast approaching and you may be wondering if you can even afford to go to college. What you might not know is that the federal government provides almost $150 billion a year to help students just like you pay for college. Financial Aid Errors No College Student Should Make. One of the worst mistakes you can make with college financial aid is simply failing to file the all-important Free Application for Federal Student Aid. The U.S. MEFA - Massachusetts Educational Financing Authority. Niche: Reviews of K-12 Schools, Colleges, and Neighborhoods. Free Scholarships web : Fellowship Financial Aid University College, Master PHD.

Encouraging Trends Seen in New Reports on College Pricing and Debt - College Bound.