TSVCM Consultation Document. Tropical Rainforest Trees Carbon Sequestration. The new normal: 1,000 companies are now setting science-based climate targets. The new normal: 1,000 companies are now setting science-based climate targets. RPT 2020 09 10134550. CO₂ and Greenhouse Gas Emissions. How to price carbon to reach net zero emissions in the UK. Delivering Client Success. Microsoft’s carbon fee supports global low carbon sustainable development Since Microsoft launched its carbon fee and achieved carbon neutrality in 2012, we have partnered with the company to evolve its carbon offset programme, ensuring it aligns with multiple business priorities through a portfolio of more than 60 projects in 29 countries.

From selecting key customer and data centre locations, to delivering sustainable energy for underserved populations, to supporting citizenship goals and using technology to enhance project success, the Microsoft carbon offset portfolio delivers deeper business value, in addition to meeting its carbon neutral target. Watch the video to learn more about Microsoft's carbon fee. Read Microsoft's latest carbon fee white paper which explores how the programme is now evolving to "beyond carbon neutral". Learn about Microsoft’s Senior Director of Sustainability, TJ DiCaprio's, project visit experience. Investors Managing $16 Trillion Establish Net Zero Framework. Global investors representing more than $16 trillion in assets released a blueprint to help the investment community worldwide contribute to achieving net zero emissions by 2050.

Over 70 investors worked on the new Net Zero Investment Framework through the Institutional Investors Group on Climate Change (IIGCC). The framework provides a set of actions, metrics, and methodologies that enable asset owners and asset managers to become “net zero investors,” according to the group. The Net Zero Investment Framework offers an investment strategy-led approach supported by concrete targets set at the portfolio and asset level, the group explained. When combined with smart capital allocation plus engagement and advocacy activity, the framework should ensure that investors maximize their role in driving decarbonization, IIGCC said. “The willingness is there, but until now the investment sector has lacked a framework enabling it to deliver on this ambition,” said IIGCC CEO Stephanie Pfeifer. Investors Managing $16 Trillion Establish Net Zero Framework. 2018 2019 Carbon Pricing Leadership Report. We Need True Net Zero, and It Needs Early Adopters.

Fending off damaging climate change is like a timed game of chess humanity can’t afford to lose.

Our odds of avoiding checkmate improve significantly if we keep cumulative carbon dioxide (CO2) emissions under 350 gigatons between now and 2050. The problem is that if nothing changes, we will already deplete this CO2 “budget”—based on the Paris Agreement—by 2030. A strategy known as “net zero,” which many companies, institutions, and governments are considering, buys the world time to transition to low-carbon technologies and for behavioral changes to take hold. The basic concept behind net zero is simple: reduce emissions aggressively and balance out the remaining CO2 with removals.

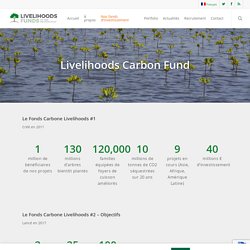

But there is a catch. The best course of action is a strategy of “true net zero” that combines highly aggressive emissions cuts with permanent removals. Fortunately, a small set of companies is already uniquely positioned with the incentives and resources to commit to true net zero. GCP CarbonBudget 2019. Puits de carbone : vidéo Marine de Bazelaire. Impact of the financial crisis on carbon economics Version 21. WEF The Net Zero Challenge. LCF- Les fonds Carbone Livelihoods – Livelihoods. 25% de la population mondiale dépend directement des écosystèmes forestiers pour assurer leur subsistance.

Pourtant, une surface de forêt équivalente à 50 terrains de football disparait à chaque minute. De plus, les communautés rurales démunies dans les pays en développement sont les premières à souffrir du changement climatique. Elles manquent également d’accès au savoir-faire, à la technologie et à des préfinancements pour leur permettre de devenir les acteurs de leur propre développement. Les Fonds Carbone Livelihoods utilisent l’économie du carbone pour financer différents projets – restauration des écosystèmes, agroforesterie et énergie rurale – destinés à améliorer la sécurité alimentaire des communautés rurales et accroître les revenus des agriculteurs. Les Fonds préfinancent des ONG pour la mise en œuvre et la maintenance de projets de grande ampleur. The carbon offset market that hogged so much of the attention at COP25 Madrid once looked like it might be growing to substantial size. But after Copenhagen it stagnated and then shrank. Excellent report by @AnnaSophieGross @lesliehook @TanyaPowley.

Carbon offsets, the popular climate change mitigation tactic, explained. Amazon.

JetBlue. Delta Airlines. Elton John. Dave Matthews Band. Justin Trudeau. This odd mélange of companies, celebrities, cities, countries, and organizations have all made commitments to curb their contributions to climate change, if not eliminate them entirely. For companies like Amazon and Delta aiming to be carbon-neutral, offsets help provide the “net” in their “net-zero emissions” goals. Boom times are back for carbon offsetting industry.