Who's afraid of the euro crisis? After two major bailouts and a change in government, Greece is still struggling to reduce its debt mountain.

But how might the crisis in Greece spread out across Europe and what are the main fears for each economy? Greece Prime Minister Antonis Samaras Took office: June 2012 Big fear: Running out of money After a second parliamentary election in as many months, Greece's centre right New Democracy party has managed to cobble together a grand coalition with former arch opponents Pasok as well as the anti-austerity Democratic Left. New Prime Minister Antonis Samaras' big fear is the government will either fall apart, or run out of money (or both) before Christmas, which could precipitate an exit from the euro. The coalition parties make strange bedfellows, and have agreed to push for softer terms - including slower spending cuts - from Greece's bailout lenders. Portugal Prime Minister Pedro Passos Coelho Took office: 21 June 2011 Big fear: Bank run But his work could be for nothing.

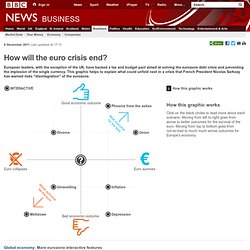

Ireland Spain Italy. The truth about Greek Porsche owners. Eurozone crisis: The possible resolutions. How will the euro crisis end? (BBC News) 9 December 2011Last updated at 17:11.

Eurozone debt web: Who owes what to whom? The circle below shows the gross external, or foreign, debt of some of the main players in the eurozone as well as other big world economies.

The arrows show how much money is owed by each country to banks in other nations. The arrows point from the debtor to the creditor and are proportional to the money owed as of the end of June 2011. The colours attributed to countries are a rough guide to how much trouble each economy is in. Click on a country name to see who they owe Europe is struggling to find a way out of the eurozone crisis amid mounting debts, stalling growth and widespread market jitters. But, with global financial systems so interconnected, this is not just a eurozone problem and the repercussions extend beyond its borders. While lending between nations presents little problem during boom years, when a country can no longer handle its debts, those overseas banks and financial institutions that lent it money are exposed to losses. GDP: €1.8 tn Foreign debt: €4.2 tn. Unicredit shares fall on rights issue concerns - BBC News.

4 January 2012Last updated at 18:04 Unicredit has to raise funds to meet new banking regulations Italian bank Unicredit fell sharply on the Milan stock exchange after it announced the details of a 7.5bn euro ($9.8bn; £6.3bn) sale of new shares.

Trading was briefly halted after it emerged only 24% of shareholders had taken up the offer despite being priced 69% below Tuesday's closing price. Shares were down 13.8% by the close of trading on Wednesday. The bank wants to triple its number of shares to help it meet European demands to bolster its financial resilience.

The European Banking Authority (EBA) said Unicredit was sitting on a 7.97bn euro shortfall in its capital - its buffer against potential future losses. What really caused the eurozone crisis? - BBC News. Banks May Flock to ‘Free Money’ as ECB Awards 3-Year Loans. Baum: Summit to Save Euro, Part 5, Debuts in Brussels. On Feb. 15, 1999, Alan Greenspan, Robert Rubin and Larry Summers were featured on the cover of Time magazine as “The Committee to Save the World.”

Greenspan, then Federal Reserve chairman, and Rubin, the Treasury secretary, were smiling. And why not? This “free-market Politburo on economic matters,” as Time described the troika, had steered the U.S. economy through the Asian financial crisis in 1997 and Russia’s default and the near-collapse of hedge fund Long-Term Capital Management in 1998 seemingly unscathed. Now it’s Angela Merkel’s and Nicolas Sarkozy’s turn. Earlier this week, the chancellor of Germany and the president of France laid the groundwork for today’s European Union Summit to Save the Euro, the fifth such gathering in 19 months, by agreeing to greater central control over individual countries’ budgets. No wonder some analysts are skeptical that the summit can succeed where previous ones have failed.

It may not have the authority of a prenup. More Perfect Union. European CEOs Move Cash to Germany. Grupo Gowex (GOW), a Spanish provider of Wi-Fi wireless services, is moving funds to Germany because it expects Spain to exit the euro.

German machinery maker GEA Group AG is setting maximum amounts held at any one bank. “I don’t trust Spain will remain in the euro zone,” said Jenaro Garcia, founder and chief executive officer of Madrid- based Grupo Gowex, which provides Wi-Fi access in 15 countries. “We moved our cash and deposits to Germany because Spain will come back to the peseta.” European companies spent billions preparing for the euro when it was introduced in 2000 by 11 countries.

Contingency planning for an unraveling of the currency involves cutting investment, moving money to Germany, transferring headquarters to northern Europe from southern, and even going out of business, according to interviews with more than 20 executives.