China's State Development & Investment Corp (SDIC) Drops Coal. No More Capacity to Absorb New Fossil Fuel Plants. The world has so many existing fossil fuel projects that it cannot afford to build any more polluting infrastructure without busting international climate change goals, the global energy watchdog has warned.

The International Energy Agency said almost all of the world’s carbon budget up to 2040 – the amount that can be emitted without causing dangerous warming – would be eaten up by today’s power stations, vehicles and industrial facilities. Fatih Birol, the executive director of the Paris-based group, told the Guardian: “We have no room to build anything that emits CO2 emissions.” The economist said to limit temperature rises to 2C, let alone the 1.5C as scientists recommend, either all new energy projects would have to be low carbon, which was unlikely, or existing infrastructure would need to be cleaned up.

That could include incentives for dirty power plants to be retired early or installing carbon capture and storage technologies, Birol said. Bitcoin Mining Annually Uses as much CO₂ as 1m Transatlantic Flights. Bitcoin’s electricity usage is enormous.

In November, the power consumed by the entire bitcoin network was estimated to be higher than that of the Republic of Ireland. Since then, its demands have only grown. It’s now on pace to use just over 42TWh of electricity in a year, placing it ahead of New Zealand and Hungary and just behind Peru, according to estimates from Digiconomist. That’s commensurate with CO2 emissions of 20 megatonnes – or roughly 1m transatlantic flights. That fact should be a grave notion to anyone who hopes for the cryptocurrency to grow further in stature and enter widespread usage. Power Worth Less Than Zero Spreads as Green Energy Floods Grids. World Passes 1,000GW of Wind & Solar, on an Exponential Curve. Solar + Storage Installs Treble YoY. Aus. Solar & Storage Beats Grid Prices for Households.

At RenewEconomy’s Energy Disruption conference in Sydney this week there were lots of talk, lots of slides, lots of ideas about the future of the country’s energy system.

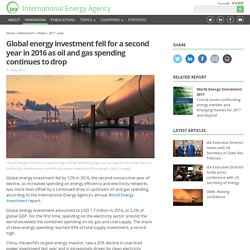

German Power Prices go Negative. Global Energy Investment Falls for 2nd Year in 2016. 11 July 2017 The oil and gas industry is transforming itself by delivering large cost savings and focusing more on technology development and efficient project execution (Photograph: Getty Images) Global energy investment fell by 12% in 2016, the second consecutive year of decline, as increased spending on energy efficiency and electricity networks was more than offset by a continued drop in upstream oil and gas spending, according to the International Energy Agency’s annual World Energy Investment report.

Global energy investment amounted to USD 1.7 trillion in 2016, or 2.2% of global GDP. For the first time, spending on the electricity sector around the world exceeded the combined spending on oil, gas and coal supply. The share of clean-energy spending reached 43% of total supply investment, a record high. Dr Birol added: “The good news is that in spite of low energy prices, energy efficiency spending is rising thanks to strong government policies in key markets.” 25% Australian Homes Now Have Solar. One Step Off The Grid New data has confirmed the effects of a second rooftop solar boom taking place around Australia – driven by falling technology costs and increasingly volatile electricity prices – with nearly one quarter of all Australian households found to have invested in solar panels.

The survey, published by Roy Morgan on Thursday, shows that on average almost one in four Australian households (23.2 per cent) own a “Home Solar Electric Panel”, as at March 2017. Uptake is shown to be strongest in South Australia, at 32.8 per cent; then Queensland, at 30.2 per cent; and Western Australia, at 26.6 per cent. China Successfully Mines Flammable Ice. After nearly two decades of research and exploration, China has successfully mined so-called “flammable ice” in what authorities qualify as a major breakthrough that may lead to a global energy revolution.

The element, a kind of natural gas hydrate, was discovered in the area in 2007, but this is the first time the country is able to successfully extract combustible ice from the seabed, in a single, continuous operation on a floating production platform in the Shenhu area of the South China Sea, about 300km southeast of Hong Kong, state-run Xinhua news agency reports. Methane hydrate global sources are estimated to exceed the combined energy content of all other fossil fuels. Methane hydrates, where molecules of methane gas are trapped in a lattice of ice crystals, exist in conditions of low temperature and high pressure. According to Xinhua’s report, one cubic metre of flammable ice is equal to 164 cubic metres of natural regular gas. Big Solar Passes 100GW Global Milestone. Global installed capacity of utility-scale solar power stations has passed the milestone 100 gigawatt mark, according to the latest data from wiki-solar.org, which has put the global total at just above 101GW, as at the end of March, 2017.

The Wiki-Solar report, released late last week, said that more than 70 countries around the world had now installed at least some capacity of utility-scale solar plant, with 13 countries – led by China –accounting for almost 95GW of that global total. 1st US Offshore Wind Farm Helps Close Diesel Plant. Indian Solar Prices Hit New Low; Undercut Fossil Fuels. By Michael Safi, The Guardian Wholesale solar power prices have reached another record low in India, faster than analysts predicted and further undercutting the price of fossil fuel-generated power in the country.

‘Permanent' Oil Price Collapse - Fossil Fuel's Done. Jillian Ambrose, Postmedia Network “I usually put a £5 bet on the oil price — and I’m collecting,” smiles Professor Dieter Helm.

It’s not difficult to imagine his tally of modest wagers adding up. The highly regarded Oxford University economics professor is a long-time industry observer. Today, he is in central London after taking meetings with major oil executives. Canadian Power 66% Renewable. Canada produced about 66 per cent of its electricity from renewable sources, according to a new report.

The country is the second biggest producer of hydro electricity in the world, accounting for 10 per cent of the entire world’s generation. About 60 per cent of Canada’s electricity in 2015 was produced by hydro with the remaining amount coming from wind, solar and biomass, according to the National Energy Board (NEB) report. Westinghouse Bankruptcy: The End of Nuclear Power? An age of innovation may be coming to an end for nuclear giant Westinghouse. On Wednesday, the company that designed those conical AP1000s that have become emblematic of U.S. nuclear plants is seeking Chapter 11 bankruptcy protection.

The move was approved by its parent corporation, Toshiba Corp., as part of an effort to ensure Westinghouse’s financial problems would not endanger the Japanese electronics manufacturer. In its 109-page filing, the company said that requirements put in place by the Nuclear Regulatory Commission following the September 11 attacks resulted in unforeseen design specifications and licensing costs. “These new requirements and safety measures created additional, unanticipated engineering challenges that resulted in increased costs and delays on the U.S. AP1000 projects and other AP1000 projects worldwide,” Westinghouse wrote in its bankruptcy filing.

Record Number of O&G Bankruptcies Driven by Renewables Revolution. A record number of oil and gas companies became insolvent last year, according to a new study which environmentalists said highlighted the need for the UK to prepare for the move to a low-carbon economy. They warned that the loss of jobs in the sector when it becomes clear that fossil fuels can no longer be burned because of the effect on global warming would lead to “desolate communities” unless people were retrained to work in the “new industries of the 21st century”.

The study by accountancy firm Moore Stephens found 16 oil and gas companies went insolvent last year, compared to none at all in 2012. First commercial flight powered by renewable energy takes to skies After oil prices fell from about $120 a barrel to under $50 for most of the past year, smaller firms in the sector were unable to cope, Moore Stephens found. Jeremy Willmont, who carried out the research, said: “The collapse of the price of oil has stretched many UK independents to breaking point. Tesla’s Battery Revolution Reaches Critical Mass. Tesla Motors Inc. is making a huge bet that millions of small batteries can be strung together to help kick fossil fuels off the grid. The idea is a powerful one—one that’s been used to help justify the company’s $5 billion factory near Reno, Nev.

—but batteries have so far only appeared in a handful of true, grid-scale pilot projects. That changes this week. Abu Dhabi Sets New Record Low Solar Price. The price of solar power – in the very sunniest locations in particular – is plunging faster than I expected. I’ve been talking for years now about the exponential decline of solar power prices. Shell Brings World's Deepest Offshore Oilfield Into Production. US Solar PV Prices Hit "All-Time Low" World’s Largest Coal Miner Signs Agreement for Solar Power. World’s largest coal mining company – Coal India Limited – has announced a major step towards implementation of its ambitious solar power goals. According to a communication made by Coal India Limited to the Bombay Stock Exchange, the company has signed agreements with the Solar Energy Corporation of India for implementation of 200 MW solar power projects in the state of Madhya Pradesh.

Solar Delivers Cheapest Electricity Ever, By Any Technology. Solar Delivers Cheapest Electricity ‘Ever, Anywhere, By Any Technology’ China Installed 20GW of Solar in First-Half; Triple Previous Year's. Australia Installs 1st Commercial EV Fast-Charge Stations. Oil Price Plummets on Oversupply & Weak Demand. Oil may be a precious and dwindling resource but at the moment, at least, it looks like we just have too much of it. Crude-oil prices are now at their lowest since early April, hit by continued oversupply, concerns about global demand and negative price sentiment by oil-market participants. And that situation looks likely to continue in the near future. The US crude oil benchmark price, West Texas Intermediate traded at the New York Mercantile Exchange, closed at $39.51 a barrel on Tuesday, the first time since 6 April. The global Brent crude oil benchmark closed at $41.50 on Tuesday, a three-and-a-half month low. As of midday Wednesday, prices were just above those levels.