Building a Trading System: Where to Start. Anatomy of a Trading Plan. Trading Plan: What, Why, and How? Using Previous Day’s High/Low for Intraday Bias. The Precedence of Price – An Altcoin Trader's Blog. AD: Before I begin this post, I’d like to briefly mention Bitcoin.Live, who are sponsoring my blog.

Bitcoin.Live offers regular, detailed content on their free-to-access blog, created by a panel of analysts (including Peter Brandt), and covering all manner of market-related topics. I found both the video material and the blog posts to be genuinely insightful, with many differing analytical perspectives available for viewers and readers. The platform also offers premium content for paying subscribers who find value in the free material, with daily videos, alerts and support provided. Check it out and bookmark the blog. I’d like to preface this post by mentioning that this, unlike the vast majority of blog posts I publish, is expressly aimed at newer speculators, with little to no familiarity with markets.

The price paid for any asset is the single most important aspect of speculation, and one that largely determines the profitability of said speculation. RDM - Roquettes De Marché (le système) - E-Devenir Trader. Roquettes des marchés (RDM) - Plan de trading - E-Devenir Trader. .Ma méthode pour savoir si un titre à du potentiel à la hausse ou à la baisse.Comment se concentrer sur les 2% des actions exceptionnelles qui drivent le marché, et ne pas faire l’erreur de trader un titre parmi les 98% restant.L’indicateur qui vous permet de choisir la crème de la crème parmi les actions exceptionnelles.Les explications étape par étape pour savoir si un titre est sur le point de s’envoler dans les séances à venir.Les 2 configurations techniques qu’il faut absolument trader avec constance.Comment éviter les pièges du « bruit du marché » et obtenir le niveau précis pour entrer sur l’action.Le tutoriel en images pour créer en moins de 5 minutes l’indicateur RDM, et sans rien y connaitre en programmation.La recette explosive pour utiliser l’effet de levier lorsqu’une action est dans une situation bien précise.Les pièges et les configurations dans lesquels tombent la majorité des traders et qu’il faut impérativement fuir.

Group paid services in CT. ‘Toshimoku’s Trading Tips & Tricks. Parabola case study. The Importance Of Using A Stop Loss - The Wolf of All Streets. You should never experience a big loss. What Is an OCO Order? Note: We highly recommend reading our guides on limit and stop-limit orders prior to continuing.

An OCO, or “One Cancels the Other” order allows you to place two orders at the same time. It combines a limit order, with a stop-limit order, but only one of the two can be executed. In other words, as soon as one of the orders get partially or fully filled, the remaining one will be canceled automatically. Note that canceling one of the orders will also cancel the other one. When trading on the Binance Exchange, you can use OCO orders as a basic form of trade automation. How to use OCO orders? After logging in to your Binance account, go to the Basic Exchange interface and find the trading area as illustrated below. Don’t ever net short. Hedge short, but never net short.

Charting. Indicators. Apps trading. DeFi - Yield Farming. #StaySAFU. Crypto. #TA101 Simplify your trading. Start off by building a solid foundation. You don't win the game because you do better trades. You win because you have a better process.

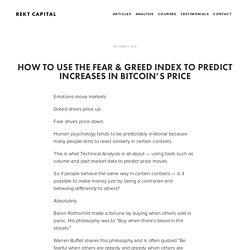

Use an inverted chart to help eliminate bias. Inversion is useful for wooly problems like happiness. Instead of asking "How do I become happy?" Ask, "How do I become depressed?" 1. Poor sleep 2. Shit diet 3. Meaningless work 4. No exercise 5. Boring friends Avoid those 5 and you've figured out 95% of. Trading 101. How to Use the Fear & Greed Index to Predict Increases in Bitcoin’s Price — REKT CAPITAL. As we can see from the graph, fear can quickly gain momentum and spiral out of control.

But every time the Fear and Greed Index reaches close to or below the 10 mark (i.e. green area) — the value of the Index reverses to the upside. Data talks. So what is it saying? Every time high levels of fear have crept into the minds of traders and investors — opportunists such as “bargain hunters” have used this dreadful market climate to their advantage. In the spirit of savvy investors like Warren Buffet, Baron Rothschild, or John Templeton — the “bargain hunters” were greedy when others were fearful. [Pinned] Directory of #TA resources: Candlestick Charts Risk Management Order Flow Trendlines Horizontals Fibonacci RSI Ichimoku. Cred's Study Guide. Cryptoquant #btc indicators. PrimeXBT. A Quick Guide to Binance Dual Savings.

If you’ve been involved in the world of crypto for a while, you’ll know that crypto assets can be extremely volatile.

The total value of your portfolio can experience large swings, leaving you holding on to dear life in the front seat of a wild roller coaster. Binance Dual Savings is a great way to earn passive income no matter which direction the market goes. If you’re looking to earn yield while minimizing the risk of price exposure, Binance Dual Savings is for you. Introduction What can you do to protect yourself from volatility but still generate yield? You can also use stablecoins, such as BUSD or USDT, but Binance Dual Savings takes this concept to the next level.