Board of Governors of the Federal Reserve System. Ben Bernanke #OpESR. Home Page - FederalReporting.gov. Currency Futures Trading Commission. Open Market Operations. Open market operations (OMOs)--the purchase and sale of securities in the open market by a central bank--are a key tool used by the Federal Reserve in the implementation of monetary policy.

The short-term objective for open market operations is specified by the Federal Open Market Committee (FOMC). Historically, the Federal Reserve has used OMOs to adjust the supply of reserve balances so as to keep the federal funds rate--the interest rate at which depository institutions lend reserve balances to other depository institutions overnight--around the target established by the FOMC. The Federal Reserve's approach to the implementation of monetary policy has evolved considerably since the financial crisis, and particularly so since late 2008 when the FOMC established a near-zero target range for the federal funds rate.

For additional information, see: The Federal Reserve Bank of New York publishes a detailed explanation of OMOs each year in its Annual Report . Back to year navigation. Federal Reserve Act - Wiki. Federal Reserve The Federal Reserve Act (ch. 6, 38 Stat. 251, enacted December 23, 1913, 12 U.S.C. ch. 3) is an Act of Congress that created and set up the Federal Reserve System, the central banking system of the United States of America, and granted it the legal authority to issue Federal Reserve Notes, now commonly known as the U.S.

Dollar, and Federal Reserve Bank Notes as legal tender. The Act was signed into law by President Woodrow Wilson. The Act[edit] The Federal Reserve Act created a system of private and public entities; there were to be at least eight, and no more than 12, private regional Federal Reserve banks. With the passing of the Federal Reserve Act, Congress required that all nationally chartered banks become members of the Federal Reserve System. Background[edit] Federal Reserve - Echelon 2. Federal Reserve Bank (Inc.) A Murderous History. The Fed. Who owns the Fed?

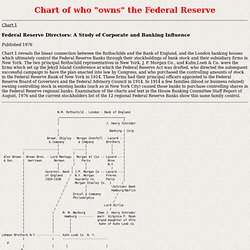

Chart 1 Federal Reserve Directors: A Study of Corporate and Banking Influence Published 1976 Chart 1 reveals the linear connection between the Rothschilds and the Bank of England, and the London banking houses which ultimately control the Federal Reserve Banks through their stockholdings of bank stock and their subsidiary firms in New York.

The two principal Rothschild representatives in New York, J. P. N.M. Chart 2 - Published 1983. Who owns and controls the Federal Reserve. Is the Federal Reserve System secretly owned and covertly controlled by powerful foreign banking interests?

If so, how? These claims, made chiefly by authors Eustace Mullins (1983) and Gary Kah (1991) and repeated by many others, are quite serious because the Fed is the United States central bank and controls U.S. monetary policy. By changing the supply of money in circulation, the Fed influences interest rates, affecting the mortgage payments of millions of families, causing the financial markets to boom or collapse, and prompting the economy to expand or to stumble into recession. Such awesome power presumably would be used to benefit the U.S. economy. Who Owns The Federal Reserve? This article was first published by Global Research in October 2008 “Some people think that the Federal Reserve Banks are United States Government institutions.

They are private monopolies which prey upon the people of these United States for the benefit of themselves and their foreign customers; foreign and domestic speculators and swindlers; and rich and predatory money lenders.” – The Honorable Louis McFadden, Chairman of the House Banking and Currency Committee in the 1930s The Federal Reserve (or Fed) has assumed sweeping new powers in the last year. In an unprecedented move in March 2008, the New York Fed advanced the funds for JPMorgan Chase Bank to buy investment bank Bear Stearns for pennies on the dollar.

“The Treasury Department, for the first time in its history, said it would begin selling bonds for the Federal Reserve in an effort to help the central bank deal with its unprecedented borrowing needs.”2 This is extraordinary. “The U.S. Not Private and Not for Profit? Federal Reserve Act. Site Map. Board of Governors of the Federal Reserve System.