‘Piketty bedrijft geen wetenschap’ Het boek Kapitaal in de 21ste eeuw van de Franse econoom Thomas Piketty verschijnt morgen.

What the 1% Don't Want You to Know. Un dialogue Piketty-Graeber : comment sortir de la dette. Il existe quatre méthodes principales pour réduire significativement une dette publique : la répudiation, l’impôt sur le capital, l’inflation et l’austérité.

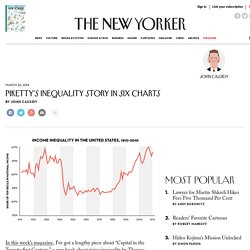

Thomas Piketty - Home. Piketty's Inequality Story in Six Charts. In this week’s magazine, I’ve got a lengthy piece about “Capital in the Twenty-first Century,” a new book about rising inequality by Thomas Piketty, a French economist, that is sparking a lot of comment and debate.

(Brad DeLong has a useful summary of some early reviews.) I’ll go further into that discussion in future posts, but first I thought it might be useful to portray the gist of Piketty’s story in a series of charts. The charts aren’t merely illustrative: they are an essential part of Piketty’s contribution. Fifteen or twenty years ago, debates about inequality tended to be cast in terms of clever but complicated statistics, such as the Gini coefficient and the Theil entropy index, which attempted to reduce the entire income distribution to a single number.

One thing that Piketty and his colleagues Emmanuel Saez and Anthony Atkinson have done is to popularize the use of simple charts that are easier to understand. The Piketty group didn’t invent this way of looking at things. Capital in the Twenty-First Century. Capitalism vs. Democracy. Thomas Piketty’s new book, “Capital in the Twenty-First Century,” described by one French newspaper as a “a political and theoretical bulldozer,” defies left and right orthodoxy by arguing that worsening inequality is an inevitable outcome of free market capitalism.

Piketty, a professor at the Paris School of Economics, does not stop there. He contends that capitalism’s inherent dynamic propels powerful forces that threaten democratic societies. Capitalism, according to Piketty, confronts both modern and modernizing countries with a dilemma: entrepreneurs become increasingly dominant over those who own only their own labor.

In Piketty’s view, while emerging economies can defeat this logic in the near term, in the long run, “when pay setters set their own pay, there’s no limit,” unless “confiscatory tax rates” are imposed. Photo. PikettyZucman2013DatabookLinks. The return of \patrimonial capitalism":review of Thomas Piketty's Capital inthe 21st centuryBranko Milanovic. Thomas Piketty: Al onze theorieën over het kapitalisme weerlegd in één grafiek. De revolutie is voorbij, Napoleon verpietert al een paar jaar op Sint-Helena en de nieuwe koning zit stevig op de troon. ‘Alle mensen zijn gelijk,’ hadden de revolutionairen nog geroepen, maar nu is sociale status weer een kwestie van afkomst en rijkdom. We bevinden ons in het Parijs van 1819. Het is deze stad waarin Eugène de Rastignac, een jonge rechtenstudent, zich omhoog probeert te werken. Hij heeft maar één doel voor ogen: rijk worden.

En snel ook. Kapital for the Twenty-First Century? Kapital for the Twenty-First Century?

Thomas Piketty, 2011 (Parti Socialiste du Loiret/Flickr) Capital in the Twenty-First Century by Thomas Piketty, trans. Arthur Goldhammer Belknap Press, 2014, 671 pp. What is “capital”? To Karl Marx, it was a social, political, and legal category—the means of control of the means of production by the dominant class. Early in the last century, neoclassical economics dumped this social and political analysis for a mechanical one. Symbolic mathematics begets quantification. Detail nieuws. Thomas Piketty: Dynamics of Inequality. Why We’re in a New Gilded Age by Paul Krugman. Capital in the Twenty-First Century by Thomas Piketty, translated from the French by Arthur Goldhammer Belknap Press/Harvard University Press, 685 pp., $39.95 Thomas Piketty, professor at the Paris School of Economics, isn’t a household name, although that may change with the English-language publication of his magnificent, sweeping meditation on inequality, Capital in the Twenty-First Century.

Yet his influence runs deep. It has become a commonplace to say that we are living in a second Gilded Age—or, as Piketty likes to put it, a second Belle Époque—defined by the incredible rise of the “one percent.” The result has been a revolution in our understanding of long-term trends in inequality. It therefore came as a revelation when Piketty and his colleagues showed that incomes of the now famous “one percent,” and of even narrower groups, are actually the big story in rising inequality.

Still, today’s economic elite is very different from that of the nineteenth century, isn’t it? Over Piketty’s race tussen kapitaal ii en arbeid ii. On Piketty and definitions. ‘Financial capital’ is not the same thing as ‘physical capital’ (two graphs) The discussion about Piketty is getting messed up.

The vagueness of economic parlance allows people to accuse him of mistakes he doesn’t make. The meaning of the word ‘capital’ is a case in point. Financial capital (like bonds, cash, receivables (which are included in the estimates of financial wealth in the national accounts and which have the same magnitude as cash, deposit money and money in savings account combined)) are not the same thing as physical capital (houses, cars, buildings, machinery and the like). Financial capital is to quite some extent owned by old, retired women.

Can-an-Economists-Theory-Apply-to-Art. Photo Thomas Piketty is a name on a lot of people’s lips at the moment.

The French economist’s new book, “Capital in the Twenty-First Century,” is a historic survey of wealth concentration that has quickly become a go-to text for the gathering debate on income inequality. In his book, published in English last month, Mr. Piketty argues that the rich are only going to get richer as a result of free-market capitalism. The reason, according to Mr. First Thoughts on Piketty. I have been reading Thomas Piketty's "Capital in the 21st Century.

" It is truly an impressive work, and I am much enjoying it. I have recently organized a session at the upcoming AEA meeting (January in Boston), where David Weil, Alan Auerbach, and I will be discussing the book, followed by a response from Professor Piketty. Let me offer a few immediate reactions. The book has three main elements: A history of inequality and wealth. Point 2 is highly conjectural. What Piketty’s Conservative Critics Get Wrong. With his book Capital in the Twenty-First Century, Thomas Piketty has lobbed a truth bomb that has blown up several decades’ worth of received opinion about the way the economy works in capitalist societies.

He makes a powerful, meticulously-argued, data-driven case that inequality is a feature of capitalist economies, not a bug. Let to its own devices, wealth tends to become highly concentrated. The only events likely to prevent our society from plunging into a dystopian spiral of inequity are, on the one hand, certain rarely occurring catastrophes, such as war or depression; or, on the other, dramatic government intervention in the economy, in the form of steep taxes on the wealthy. You can see why conservatives are going to be enraged by this book. Piketty – in French it’s worse.

Thomas Piketty’s now much lauded book, Capital in the 21st century, was actually published in French last summer. But it did not receive the overwhelming plaudits that American and British mainstream and leftist economists have given it (see Indeed, several French critics commented that Piketty’s data on the inequality of wealth in modern capitalist economies was good to have, but so what? Surely, everybody knows that capitalism generates inequality – what’s new about that. Some Americans reckon the French attitude is because Piketty is seen as too ‘meritocratic’, which is frowned on in France!

( Thanks to some readers for pointing to some French critics who have come up with several perceptive critiques of Piketty’s book that make many of the points that I have made in my review for Historical Materialism (submitted, but not yet accepted – see my post ( and often better than I have. Over Piketty’s race tussen kapitaal en arbeid i - wonkish - See more. Thomas Piketty: ‘Ongelijkheid is gevaarlijk’ Hoe de rijken steeds rijker worden - Economie. Ongelijkheid 1. Ongelijkheid 2. Nederland blijft echter vooralsnog gevrijwaard van het meetkundige geweld. Er is dan ook weinig reden tot zorg: Nederland is een van de platste, gelijkste landen ter wereld als we het Centraal Bureau voor de Statistiek (CBS) mogen geloven.

Zelden vraagt iemand zich echter af wat we nu eigenlijk meten. Is Thomas Piketty de nieuwe Marx? - Mathijs Bouman en Bas Jacobs - 30-4-2014. De Nederlandse Publieke Omroep maakt gebruik van cookies. Doorbraak in de sociologie: inkomensongelijkheid correleert sterk met zichzelf - Stuk Rood Vlees. Afgunst, door links opgepoetst tot deugd - Opinie. Piketty blitz. Piketty findings undercut by errors. ©Getty Economist and author Thomas Piketty Thomas Piketty’s book, ‘Capital in the Twenty-First Century’, has been the publishing sensation of the year. Its thesis of rising inequality tapped into the zeitgeist and electrified the post-financial crisis public policy debate. But according to a Financial Times investigation, the rock-star French economist appears to have got his sums wrong. Inequality: A Piketty problem? THIS morning, the Financial Times leads with a striking allegation: "Capital in the Twenty-First Century", the bestselling analysis of inequality by economist Thomas Piketty, is fundamentally flawed thanks to errors in the data backing the book.

The story is based on work done by Chris Giles, economics editor of the paper. He writes that his interest in the data's veracity was piqued by an apparent large disparity in the figure for the concentration of wealth ownership in Britain used by Mr Piketty and that reported by Britain's Office for National Statistics. In a companion blog post, Mr Giles lays out the charges and concludes, "The conclusions of Capital in the 21st century do not appear to be backed by the book’s own sources. " Went1955: My week on Twitter: Piketty ... Piketty; de nieuwe Marx? Hij wordt al de nieuwe Marx genoemd. Piketty, de nuttige idioot - Ewald Engelen @ewaldeng. Waarom de inkomensongelijkheid in Nederland groter is dan we denken. Welles, zei Roemer. Nietes, zei Rutte.

Het was een wat merkwaardig tafereel tijdens de Algemene Politieke Beschouwingen. Een verslag van de Algemene Politieke Beschouwingen kun je hier teruglezen. Een verslag van de Algemene Politieke Beschouwingen kun je hier teruglezen. tijdens de Algemene Politieke Beschouwingen. De inkomensongelijkheid in Nederland is veel groter dan we dachten! als je inkomen uit eigen bedrijf meeneemt #CBS. ( mirror ) Piketty march 2020 Slides Short Version capital & ideology.